Accounting for Royalties

Concept of

Royalty

Royalty is an amount payable

by one party/person in return for some special right or privilege conceded to

him by another party/person, such as the right to publish a book or to

manufacture and sell a patented article, or to work in a mine. It is the

compensation payable to a party/person in respect of the use of an asset

whether hired from such party/person, calculated with reference to and varying

with quantities produced or sold as a result of the use of such assets.

In simple words, the term

"Royalty" means a payment in the nature of rent, made by one person

to another person for using certain assets which belong to the latter. Another

words, it is a payment mace for having the privilege of using some right. This

may be any of the following types:

- Right to extract some mineral such as oil. Coal or stone, etc. from land:

- Right to use certain patents for the manufacture of articles for sale; and

- Right to publish and sell books under a copyright.

Importance words used in Accounting for Royalty

The following terms are used

in accounting for royalties:

- Lessee: a person or corporation who takes out the special rights of the assets from it owner on lease for a consideration of royalty, is called lessee. A lessee is also known as tenant, license, user or publisher.

- Landlord or lesser: a person or an organization who gives out some special right of own assets on lease for a consideration, is called landlord or lesser.

- Minimum rent; it is also termed as "Dead Rent" or "Rock Rent" or "Certain Rent" or "Flat Rent" or "Contract Rent". As the term suggests, minimum rent means the rent payable by the tenant to the landlord irrespective of the fact whether a person has derived any benefit or not, out of the property let out to him by the landlord. In other words, it is a guaranteed amount which the tenant has to pay irrespective of the output or sales on which the royalty is based. The amount is fixed up to avoid financial hardship to the landlord in the waiting period which must necessarily lapse before the production or sales cab begins on a commercial scale.

The following are the main

purposes of fixing a minimum rent:

- The landlord receives periodically at least a minimum rational amount.

- The lessee is indirectly inspired for the sake of his/her own interest to reach a minimum level of performance.

- In the absence of minimum rent, the lessee may acquire rights from different landlords to prevent compensation and deliberately may under utilize such rites.

Short working = Minimum rent – Royalty

5. Surplus: the excess of amount of royalty over minimum rent is

called surplus or excess workings. It is just opposite of short working. It can

be calculated as under:

6. Renouncement of short workings: usually in contracts where

there is provision for minimum rent, there is also a provision for renouncement of short-workings. It means that short workings allowed by the tenant to the

landlord will be recoverable by him/her from the landlord, during such periods

when the actual royalty is more that the minimum rent. In other words, recoupment

of short workings is the right of getting back from the landlord, excess

payment made by the tenant in the earlier years.

The right of recoupment of

short working may be either of: (a) fixed or (b) a floating type:

- Fixed right: in case of a fixed right of recoupment of short workings, the right is available only during a fixed period of lease commencement. In case the tenant is not a position to recoup the short working during this period, the balance amount will be a loss to him/ her which will be written off from the profit & loss account.

- Fluctuation right: in case of a fluctuation right of recoupment of shoert workings, the right is available only during a fixed period of showering. If the landlord promises to compensate the short workings with following year or two subsequent year or three subsequent right. In case the tenet is not a position to recoup the show working during this period, the balance amount will be a loss to him/her which will be written off from the profit & loss account.

1.

Short working not recouped: if the to recoup shoe

working time expires in respect of any portion of the short workings, it should

be written off to profit and loss account.

(Note: if the recoupable

shorthorns should be carried forward any they are shown in the balance sheet as

current assets, in the books of lessee.)

2.

Amount paid to landlords: if the amount of royalty is

less than minimum rent, the lessee must be paid minimum rent. In the case of

the calculated amount of royalty is equal to minimum rent, the lessee paid to

landlord that amount? If the amount of royalty is higher than minimum rent, the

amount paid to landlord is calculate by deducting short working recouped from

royalty.

3.

Strike and Lock out: in the event of strike or

lockout volume of production or sales decrease, so minimum rent can be reduced

if there is an agreement to the effect between landlord and lessee. The minimum

rent is reduced on the following way:

- A certain percentage of minimum rent is reduced.

- The minimum rent is reduced proportionately having regard to the length of the stoppage due to strike or lockout.

- The actual royalty discharge the entire rental obligation.

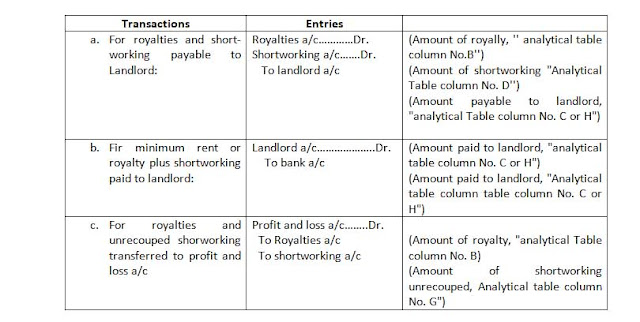

The following formula must

be used for recording royalty transactions.

The following analytical

table is prepared to record the transactions of royalties:

Accounting Treatment in the Books of Lessee

When the

Royalty is less than Minimum Rent:

Alternative 1:

Without Minimum Rent

Account:

Key point to Remember for Recording Royalty Transactions

- If the agreement of royalty does not contain a clause for minimum rent, the question of surplus, short-working and its recoupment doe not arise.

- Minimum rent account can be prepared when the royalty is less than minimum rent (I.e. in the case of short-workings arises.

- The landlord is always entitled to get either the minimum rent of the actual royalty whichever is more, subject to any adjustment of short-workings recouped.

- In the event of strike or lockout, the minimum rent can be reduced on the basis of agreement between the lessees and landlord.

- Recoverable short-working should be carried forward and shown in the balance sheet as a current asset of lessee.

- In any particular year, if a part or whole of the short-working lapse the landlord can get minimum rent only.

- Lapsed short-working or unrecorded short-working should be charged to profit and loss account.

- If the royalty is payable on the basis of sales, it should be charged to profit and loss account if the royalty is payable on the basis of production, it should be charged to manufacturing account.

Review of Theoretical Concept:

Write the meaning of

royalty.

Royalty is an amount payable

by one part/person in return for some special right or privilege conceded to

him by another party/person, such as the right to publish a book or to manufacture

and sell a patented article, or tow ok in a mine. It is the compensation

payable to a party/person in respect of the use of a assets whether hired from

such party/person, calculated with reference to and varying with quantities

produced or sold as a result of the use of such assets.

I similarly words, the

term' Royalty" means a payment in the nature of rent, made by one person

to another person for using certain assets which belong to the latter. In other

words, it is a payments mace for having the privilege of using some right.

Write the meaning of minimum rent.

I It is also termed as

"Dead rent", "Fixed Rent" or "Rock Rent" or

"Certain Rent" or "Flat Rent" or "Contract Rent".

As the term suggests, Minimum rent means the rent payable by the tenant to the

landlord irrespective of the fact whether a person has derived any benefit or

not, out of the property let out to him by the landlord. in other words, it is

a guaranteed amount which the tenant has to pay irrespective of the output or

sales on which the royalty is based. The amount is fixed up to avoid financial

hardship to the landlord in the waiting period which must necessarily laps

before the production or sales can

begins on a commercial scale.

Describe the purposed of fixing a minimum rent.

The following are the main

purposes of fixing a minimum rent:

- The landlord receives periodically at least a minimum rational amount.

- The lease is indirectly inspired for the sake of his/her own interest to reach a minimum level of performance.

- In the absence of minimum rent, the lessee may acquire rights from different landlords to prevent compensation and deliberately may under utilize such rites.

Describe about short workings.

It is the excess of minimum

rent over the actual royalties earned by the landlord. For example, if the

minimum rent is Rs. 10,000 p.a. and royally is @ 50 p. per tones, thee 20,000

tones must be produced before the minimum rent is covered. Is case the

production happens to be only 15,000 tones the short workings would amount to

Rs.2, 500 (i.e., excess of Rs 10,000 over Rs 7.500). Short working can be

determined by using the following formula:

Short working = Minimum rent – Royalty

Very nice post on Accounting for Royalties.

ReplyDeleteinvoicing software

Billing software India

retail software india

billing software for retail shop

Somewhere the content of the blog surrounded by little arguments. Yes it is healthy for readers. They can include this kind of language in their writing skill as well as while group discussion in college. secured business loans

ReplyDeleteIts a great concept.

ReplyDeleteHere is something for QuickBooks users:

QuickBooks Support Phone Number

QuickBooks Support

QuickBooks Support

QuickBooks Customer Service

Nice Blog. To the solution of the QuickBooks error, you can contact us at our Quickbooks Support Phone Number 1-800-986-4607. We have technical experts who have profound knowledge and experience in handling any sort of quickbooks issues.

ReplyDeleteQuickbooks Support Phone Number

ReplyDeleteQuickbooks Support Phone Number

Quickbooks Payroll Support Phone Number

ReplyDeleteQuickbooks Payroll Support Phone Number

Quickbooks Payroll Support Phone Number

Quickbooks Payroll Support Phone Number

Quickbooks Payroll Support Phone Number

Quickbooks Support Phone Number

Quickbooks Helpline Number

Quickbooks Proadvisor Support Phone Number

Quickbooks Proadvisor Support Phone Number

https://www.adpost.com/us/business_products_services/706397

ReplyDeletehttp://www.authorstream.com/Presentation/henry25-3961828-quickbooks-payroll-support-phone-number

https://www.localbusinesslisting.org/quickbooks-payroll-support-phone-number

https://www.expatriates.com/cls/43133201.html

https://www.expatriates.com/cls/43040697.html

We have a panel of Quickbooks Support Phone Number 800-986-4607 experts who can help you to solve your Quickbooks related issues. The solutions we deliver will take only few seconds of you. We have the availability 365 days a year and 24 hours a day!

ReplyDeleteHalo,I'm Helena Julio from Ecuador,I want to talk good about Le_Meridian Funding Investors on this topic.Le_Meridian Funding Investors gives me financial support when all bank in my city turned down my request to grant me a loan of 500,000.00 USD, I tried all i could to get a loan from my banks here in Ecuador but they all turned me down because my credit was low but with god grace I came to know about Le_Meridian so I decided to give a try to apply for the loan. with God willing they grant me loan of 500,000.00 USD the loan request that my banks here in Ecuador has turned me down for, it was really awesome doing business with them and my business is going well now. Here is Le_Meridian Funding Investment Email/WhatsApp Contact if you wish to apply loan from them.Email:lfdsloans@lemeridianfds.com / lfdsloans@outlook.comWhatsApp Contact:+1-989-394-3740.

ReplyDeletehttps://tinyurl.com/y5tc6t2z

ReplyDeletehttps://tinyurl.com/y5r6x2bz

https://tinyurl.com/y6gqrr9m

https://tinyurl.com/y5aaz6kx

https://tinyurl.com/y3nfurr8

https://tinyurl.com/y6ellwfo

https://tinyurl.com/y46sk9p9

https://tinyurl.com/y372c7x6

https://tinyurl.com/y59peyzt

https://tinyurl.com/y4acelx8

https://tinyurl.com/yy96srka

https://tinyurl.com/y28cceab

https://tinyurl.com/y4d8bghw

https://tinyurl.com/y5ox7f3f

QuickBooks Desktop Payroll Support Phone Number

ReplyDeleteQuickBooks Desktop Payroll Support Phone Number

QuickBooks Error Support Phone Number

QuickBooks For Mac Support Phone Number

QuickBooks Customer Care Number

QuickBooks Customer Care Number

QuickBooks Support Phone Number

QuickBooks Error Support Phone Number

QuickBooks Error 15215

QuickBooks Error 6123

Quickbooks Desktop Payroll Support Number

ReplyDeleteQuickbooks Desktop Payroll Support Number

Quickbooks Desktop Payroll Support Number

QuickBooks Error Support Phone Number

QuickBooks for Mac Support Phone Number

QuickBooks for Mac Support Phone Number

QuickBooks Customer Care Number

QuickBooks Customer Care Number

Quickbooks Support Phone Number

Quickbooks Desktop Payroll Support Number

Accouting Services

QuickBooks Error Support Phone Number

QuickBooks Error 15215

QuickBooks Support Phone Number

QuickBooks Error 1904

Quickbooks Customer Service Number

QuickBooks Toll Free Phone Number

QuickBooks Pos Support Phone Number

QuickBooks Payroll Support Phone Number

QuickBooks Support Phone nUmber

ReplyDeleteQuickbooks Proadvisor Support Phone Number

QuickBooks Helpline Number

QuickBooks Support Phone Number

ReplyDeleteQuickbooks Proadvisor Support Phone Number

QuickBooks Helpline Number

Quickbooks Proadvisor Support Phone Number

Quickbooks Proadvisor Support Phone Number

QuickBooks Error 15215

QuickBooks Toll Free Phone Number

QuickBooks 2020 Support Phone Number

ReplyDeleteQuickBooks 2020 Support Phone Number

QuickBooks 2020 Support Phone Number

QuickBooks 2020 Support Phone Number

Nice blog ! Really very helpful blog. QuickBooks software is a robust software, yet it is convenient to use. QuickBooks is used by businesses in their tasks like creating invoices, creating reports, payroll services. Although at times, QuickBooks may encounter several bugs and errors. Some of these errors are update errors. For instance, QuickBooks Error 15000. QuickBooks Error 15xxx is a payroll update error. In this article, I have tried to cover every aspect of QuickBooks Error 15000. But, if still you are not able to fix QuickBooks Error 15000, you can reach out to QuickBooks Enterprises Support at +1-888-485-0289. Our dedicated team of experts will help you in resolving all your issues. Call Now!

ReplyDeletenice blogger..

ReplyDeleteBook My Blogs is a one-stop destination for insightful content on Business and Finance, Food, Animation, Games, Entertainment, Automobiles, Sports, Gadgets, Fashion, and Beauty. Our expertly organized collection of blogs offers a wealth of information and inspiration in these diverse fields. We know you like to read and it's our duty to keep your interest alive.

ReplyDeleteBest Hotels In Santa Barbara

Certainly! A web development company is a business that specializes in creating and maintaining websites for clients. These companies typically offer services such as website design, development, hosting, and ongoing support. They may work with a variety of technologies and platforms to create custom websites tailored to their clients' needs. Additionally, some web development companies may offer additional services such as digital marketing, search engine optimization (SEO), and e-commerce solutions.

ReplyDeleteweb development company in USA

Hydraulic Torque Wrench are impressive! They offer precise torque control, making heavy-duty fastening tasks easier and more reliable. The build quality is robust, ensuring durability and long-term use. These wrenches are a must-have for any professional looking for efficiency and accuracy in industrial applications. Highly recommended!

ReplyDeleteHydraulic torque wrenchesare essential tools in various industrial applications for their precision, power, and efficiency. They are particularly useful in tasks requiring high torque levels, such as tightening or loosening large bolts in machinery, construction, and automotive settings. The ability to provide consistent and repeatable torque ensures safety and integrity in critical joints. Additionally, hydraulic torque wrenches minimize user fatigue and reduce the risk of operator error, making them invaluable in professional environments where precision and reliability are paramount. Their versatility and capability to handle heavy-duty tasks make them a must-have in any industrial toolkit

ReplyDelete