Accounting for package

or container

Concept

Nowadays, all most all

materials and commodities are sold in packet containers e.g., in bottles,

cartons, boxes bags, cans, case cylinders, drums, etc. these containers and

packages may be necessary for preservation of goods and commodities or for

processing, transportation and marketing purpose. These packing aids may be

called packages or containers. Usually, the packages or containers are made of

cotton, jute, paper, paper board, glass, plastic, plywood, aluminum, tin,

steel, etc. the seller of goods either purchases his packing materials form the

market or may produce/prepare them in his own factories. The seller directly or

indirectly charges the cost price thereof from the buyer of the goods. There

are two method of charging the price of packages from the costumers. Accounting

to first method the price of packages in not charges from the customer

separately, but the seller considers cost of empty containers and packages as a

part of production cost of goods and includes the cost of the packages while

fixing the selling price of the commodity. According to the second method the

price of packages is charges separately from the buyers in addition to the

price of goods/ commodity sold.

If the packing-aids are

durable in nature are can be refused then to the seller of goods/commodity may

considered to declare to policy from return of empty packages from his

customers thus, empty container or packages may be classified in to returnable

and no-returnable from the customers. The possibility of return by customers

depends upon the terms of agreement. Thus. There may be two satiation regarding

the return of packages by the buyer (i) the packages are not returned to the

seller of commodity by the buyer and (ii) the packages are returnable to the

seller by the buyer.

From the point of view of

accounting in the book of the seller of goods in packages, there may be

following fur situations in respect of packages:

- The price of packages is not separately charged and packages are no-returnable.

- The price of packages is not separately charged but packages are returnable;

- The price of packages is separately charged hut without the facility. Condition for return of packages and

- The price of packages is separately charged with the facility/condition for the return of the packages.

Objective of accounting for containers

Investment is made on

containers. Therefore, a separate accounting is needed for it. But in real

practice, it is not needed to prepare a separate account for non returnable

containers. Accounts are maintained only for returnable containers. Generally,

the following are the main objective of accounting for containers.

- To determine profit or loss from container.

- To determine the amount of investment on containers.

- To control the movement of containers.

- To determine the value of opening and closing stock of containers.

Importance terms of container

There are sum terms of

containers which are frequently used in accounting for containers.

a.

Containers sent out: when containers used in a

product is sent to the customers while selling the product, then such container

is called 'container sent out'.

b.

Containers returned: after using the product,

when a customer's returns empty container to the seller then such empty

container is called 'contained returned'. Here, such container should be

returned within the given due time.

c.

Returnable container: containers with customers at

the end of the accounting period are called 'returnable containers'. Such

containers are also known as closing stock with customers.

d.

Container returned by

customers; containers

not returned within the time or containers retained by the customers are called

'container retained by customers'. Such retained containers are treated as sold

containers.

e.

Cost price: purchasing or manufacturing

cost of the containers is known as 'cost price' of the container

f.

Charge out price: it is also known as invoice

or sent out price of the container. When the seller receivers the price of the

containers while selling goods then such price of containers is called 'charge

out price'.

g.

Returnable price: when a seller refunds sum

amount after returning container by a customer within during due time then such

refund amount is called 'returnable price'. Generally, the value of returnable

price is the less than charge out price.

h.

Hire charge: the difference value of

charge out price and returnable price is called 'hire charge'. Actually, a

seller receives only hire charge from returned containers.

Hire charge = charge out price – Returnable price

Calculation of Missing Terms of Container

a. Non-returnable containers:

1.

Closing stock units = opening stock units +

purchases units – consumed or sent out units

2.

Opening stock units = consumed or sent out units +

closing stock units – purchase units

3.

Purchase unit = consumed or sent out units +

closing stock units – opening stock units

4.

Consumed or sent out units =

opening

stock units + purchase units – closing stock units

1.

Closing stock units in hand = opening stock units in hand + purchase

units + Returned units by customers – sent out units – scrapped or condemned

units – destroyed units

2. Opening stock units in hand = sent out units + scrapped or condemned units + destroyed units + closing stock units in hand – purchase units – returned units by customers

3. Purchase units = sent out units + scrapped or condemned units + destroyed units + closing stock units in had – opening stock unit in hand – returned units by customers.

4. Returned units by customers = sent out units + scrapped or condemned units + destroyed units + closing stock units in hand – opening stock units in hand – purchase units

5. Closing stock units with customers = opening stock units with customers +sent out units – Returned units by customers – Retrained units by customers

6. Opening stock units with customers = returned units by customers + Retained units by customers + closing stock units with customers – sent out units

7. Sent out units = returned units by customers + retained units by customers + closing stock units with customers – opening stock units with customers

8. Returned units by customers = opening stock units with customers + sent out units – retained units by customers – closing stock with customers

9. Retried units by customers = opening stock units with customers + sent out units – retained units by customers –closing stock units with customers.

2. Opening stock units in hand = sent out units + scrapped or condemned units + destroyed units + closing stock units in hand – purchase units – returned units by customers

3. Purchase units = sent out units + scrapped or condemned units + destroyed units + closing stock units in had – opening stock unit in hand – returned units by customers.

4. Returned units by customers = sent out units + scrapped or condemned units + destroyed units + closing stock units in hand – opening stock units in hand – purchase units

5. Closing stock units with customers = opening stock units with customers +sent out units – Returned units by customers – Retrained units by customers

6. Opening stock units with customers = returned units by customers + Retained units by customers + closing stock units with customers – sent out units

7. Sent out units = returned units by customers + retained units by customers + closing stock units with customers – opening stock units with customers

8. Returned units by customers = opening stock units with customers + sent out units – retained units by customers – closing stock with customers

9. Retried units by customers = opening stock units with customers + sent out units – retained units by customers –closing stock units with customers.

1.

Hire charge per unit = charge out price per unit

– returnable price per unit

2.

Charge out per unit = returnable price per unit

+ Hire charge per unit

3.

Returnable price per unit = charge out per unit – hire

charge per unit

4.

Total hire charge = sent out units x hire charge

per unit

Note: in this chapter, Drum,

Crate, Bottle, Box, Jar, Bag, etc. words are used instead of package or

container.

As there are various types

of containers, their accounts are also kept using different methods.

- Non-returnable containers:

A separate

charge is not made

A separate

charge is made

- Returnable containers:

A separate

charge is not made

A separate

charge is made

After purchasing a product,

when package or container used in the product is not returned to the seller,

then such package or container is called non-returnable container. Examples of

non-returnable containers are wrapping and package materials of soap,

tooth-paste, medicine bottles, etc. such, non-returnable containers can be

classified into two parts:

a.

A separate charge is notmade: under

this, the price of packages is not charged separately in this saes voucher of

goods sold to the customers, rather it is considered while fixing the selling

price of the goods. The packages are also neither required nor permitted to

return to the seller by the customers. Since, the price of package is ot

separately charged from the by=user separately, the profit or loss on packages

cannot be ascertained. Under this method only 'packages stock account is

prepared. This account is debited with the value of opening stock of package

and with the cost price of packages purchase during the period. It is credited

with the value of closing stock of packages. The difference between the two

sides of this account represents the consumption of packages during the accounting

period. This amount i.e. cost of consumer packages is transferred to trading

and profit and loss account.

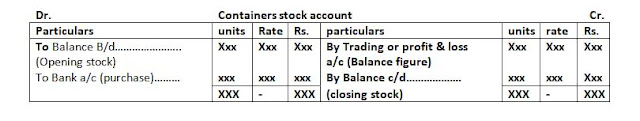

a.

Separate charge is made: under this arrangement, the

price of package is not included in this sale price of the goods, but is charge

separately in the sales voucher issued by seller of goods to its customers.

Under this situation, packages sent to customers are treated as final sale of packages

because the customers are not required to return the packages to the suppliers.

In this situation, a separate 'Contains Account' is prepared to record such

packages or containers. This account shows opening stock of packages or

containers and purchases of packages or containers on its debit side.

Similarly, its credit side shows amount receivable from containers and closing

stock of packages or containers account should be transferred to profit and

loss account. Generally, the following format is used to prepare a containers

account:

A separate charge is made: under this arrangement, the

price of packages is separately charged is sold goods to customers. Under this

method three method of accounting can be used for packages of containers:

a. With maintaining stock

training and reserve account

b. With maintaining stock and

reserve account

c.

With maintaining trading and reserve account

With Maintaining stock trading and reserve account method: under this method, the

following three accounts are prepared:

-

Containers stock account

-

Containers Trading account

-

Containers Reserve Account

Containers stock Account: this account shows units, rate and amount of

containers. All records are maintained on the basis of cost price or minimum

value of given stock. Its debit side shows opening stock I hand and with

customers as well as purchase of containers. Its credit side shows cost of

containers retained by customers, depreciation of containers, and cost of

containers scrapped cost of destroyed or lost containers as well as closing

stock of containers in hand and with customers.

Containers trading account: containers trading account to depict profit or loss

from returnable containers. This account begins with containers stock account

(cost of containers retained by customers) on debit side. Similarly

depreciation of containers, cost of containers scrapped and repair and

maintenance of containers are shown on it debit side. Its credit side shows

hire charge on containers, retaining f returnable price of containers, scrap

sold, etc. the balancing figure of this account either on debit or on credit is

called profit or loss and should be transferred to profit and loss account.

Containers Reserve Account: the credit side of this account shows opening stock

of containers with customers and containers sent to customers. It shows

retaining of side also shows returnable price of containers returned by

costumers and returnable price of closing stock with customers. This account is

also known as:

-

Containers deposited account

-

Container provision Account

-

Container Suspense Account

With maintaining stock and Reserve Account: under this method, a separate

containers Trading account is not prepared. The items of container Trading

Account are included in container stock account. Generally the following two

accounts are prepared under this method:

-

Containers stock account

-

Containers Reserve Account

Containers stock Account: this account shows opening

stock of containers in hand and with customers, purchase of containers and

repairs of containers on its debit side. Its credit side show hire charges on

containers, scrap sold loss of containers, returnable price of containers

retained by customers and closing stock of container in hand and with

customers. The balance figure of this account on debit or on credit side is

called profit or loss and such profit or loss should be transferred to profit

and loss account.

With maintaining stock and Reserve Account: under this method, a

separate containers Trading account is not prepared. The items of container

Trading Account are included in container stock account. Generally the

following two accounts are prepared under this method:

-

Containers stock account

-

Containers Reserve Account

Containers stock Account: this account shows opening

stock of containers in hand and with customers, purchase of containers and

repairs of containers on its debit side. Its credit side show hire charges on

containers, scrap sold loss of containers, returnable price of containers

retained by customers and closing stock of container in hand and with

customers. The balance figure of this account on debit or on credit side is

called profit or loss and such profit or loss should be transferred to profit

and loss account.

Containers Reserve Account: this account begins with

returnable price of opening stock with customers on its credit side. It also

shows returnable price of containers sent out on its credit side. Its debit

side shows returnable price of containers retained by customers, returnable

price of containers returned by customers and returnable price of closing stock

with customers.

With Maintaining Trading and Reserve Account: the following accounts are

prepared under this method:

-

Containers Trading Account

-

Containers Reserve Account

Containers Trading Account: under this method, a separate container stock account

is not prepared. Containers Trading Account included all the items of

containers stock account.

Containers Reserve Account: This account is prepared using the same principles

already discuses in fist method.

Annual Depreciation and Life Period Being Over

Containers are durable

assets therefore, depreciation should be charged on them. There are so many

methods of charging depreciation. But here, straight line method of

depreciation is used.

Opening and

closing stocks of containers are shown on cost price in container stock Account

or containers Trading Account. But depreciation in containers is shown on debit

side of these accounts. Generally, amount of deprecation is determined as

under:

Total annual Depreciation

=(closing stock in hand + Closing stock with

customers) x Annual depreciation per container

Accumulated

depreciation of obsolete containers is shown on the credit side of containers

stock account or containers Trading Account. The amount of accumulated

depreciation of obsolete containers is calculated as under:

Accumulated depreciation on scrapped, used life

being over

= No. of containers scrapped, useful life being over

x Annual depreciation per containers x Life in years

Review of Theoretical Concept

Write the accounting treatment of Non-returnable

container.

After

purchasing a product, when package or container used in the product is not

returned to the seller, then such package or container is called non-returnable

containers. Examples of non-returnable containers are wrapping and packing

materials of soap, tooth-paste, medicine bottles, etc. such, non-returnable

containers can be classified into two parts:

A separate charge is not made: under this, the price of

packages is not charged separately in this saes voucher of goods sold to the

customers, rather it is considered while fixing the selling price of the goods.

The packages are also neither required nor permitted to return to the seller by

the customers. Since, the price of package is ot separately charged from the

by=user separately, the profit or loss on packages cannot be ascertained. Under

this method only 'packages stock account is prepared. This account is debited

with the value of opening stock of package and with the cost price of packages

purchase during the period. It is credited with the value of closing stock of

packages. The difference between the two sides of this account represents the

consumption of packages during the accounting period. This amount i.e. cost of

consumer packages is transferred to trading and profit and loss account.

Separate charge is made: under this arrangement, the

price of package is not included in this sale price of the goods, but is charge

separately in the sales voucher issued by seller of goods to its customers.

Under this situation, packages sent to customers are treated as final sale of

packages because the customers are not required to return the packages to the

suppliers. In this situation, a separate 'Contains Account' is prepared to

record such packages or containers. This account shows opening stock of

packages or containers and purchases of packages or containers on its debit

side. Similarly, its credit side shows amount receivable from containers and

closing stock of packages or containers account should be transferred to profit

and loss account. Generally, the following format is used to prepare a

containers account:

Discus the nature of the containers stock account,

container trading account and container reserve account.

Containers stock Account: this account shows units, rate and amount of

containers. All records are maintained on the basis of cost price or minimum

value of given stock. Its debit side shows opening stock I hand and with

customers as well as purchase of containers. Its credit side shows cost of

containers retained by customers, depreciation of containers, and cost of containers

scrapped cost of destroyed or lost containers as well as closing stock of

containers in hand and with customers.

Containers trading account: containers trading account to depict profit or loss

from returnable containers. This account begins with containers stock account

(cost of containers retained by customers) on debit side. Similarly

depreciation of containers, cost of containers scrapped and repair and

maintenance of containers are shown on it debit side. Its credit side shows

hire charge on containers, retaining f returnable price of containers, scrap

sold, etc. the balancing figure of this account either on debit or on credit is

called profit or loss and should be transferred to profit and loss account.

Containers Reserve Account: the credit side of this account shows opening stock

of containers with customers and containers sent to customers. It shows

retaining of side also shows returnable price of containers returned by

costumers and returnable price of closing stock with customers.

0 comments:

Post a Comment