Accounting for

department of Activity

Concept

Today's modern life is very

mechanical and complex especially in big cities. In this situation, the

resident of such cities expects expect all the goods and services under a

single roof. The departmental stores are the example of large scale retail

selling just under a single roof. Different departments are involved for

different goods to be sold out. In other words, when business grows and sells

various kinds of goods or provides variety of activities under the same rood,

it needs to be split up into a number of departments. These departmentsgenerally found in business of almost all size. A department is usually, a unit

of the rest of the business and functions as a physical part of it. Each

department is considered a separate profit center though, geographically, each

department is an integral part of the rest of the departments.

To calculate the net result

of the whole organization, a full fledgling trading and profit and loss account

is to be prepared. But to evaluate individual department, it will be credit

worthy to prepare individual trading and profit and loss account. Such individual accounts will help to evaluate individual department, then such

accounting system is termed as department accounting.

Objectives of accounting for department of activity

Department accounting system

is used to calculate operating results i.e., profit or loss of individual

department as well as the net result of the whole organization. The main

objectives of departmental accounting are:

- To record income and expenditure of each department.

- To find out profit or loss of each department.

- To checkout interdepartmental performance on the basis of trading results.

- To evaluate the performance of the department with previous period result.

- To assist the management for making decision to drop an existing department or add a new department

- To assist management for cost control.

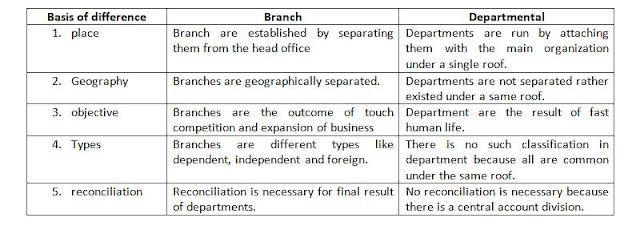

Difference between Branch and Department

Following are the main differences

in between branch and department:

Types of accounting Procedures of Departmental Accounting

Departmental accounting can

be prepared by using the following two methods:

- Separate unit method

- Analytical method

Analytical method: this method is known as columnar basis method. Under this method, each account constrains individual column for each department. Similarly, various subsidiary books are prepared containing individual column for each department and such subsidiary books make easy to prepare departmental trading and profit and loss account. In other words, under this method, it is convenient to prepare departmental trading and profit and loss account using columnar or analytical purchase day book and sales day book for recording credit purchase and credit sales of each department and so as other subsidiary books. This method is useful, if the numbers of departments are small.

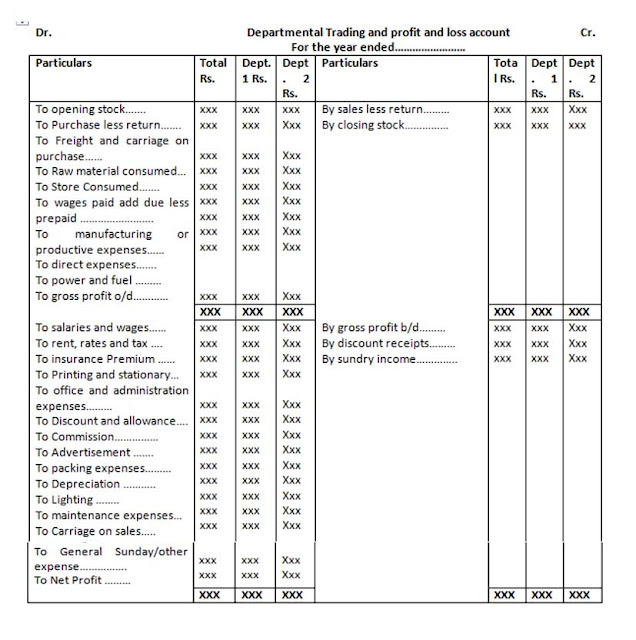

Departmental Trading and profit and loss account

At the end of accounting

period, departmental trading and profit and loss account is prepared including

individual column for each department on it. Such departmental trading and

profit and loss account is prepared by using the following format:

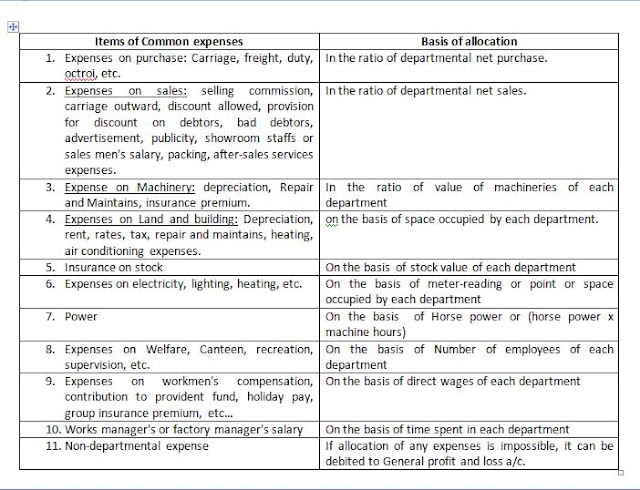

Allocation of Common expenses

Expenses directly related to

a particular department can be charged directly to that department. For

example, salary of employees of a particular department or bad debts from the

sale of a particular department can be charged to the concerned department directly.

Similarly, the expenses which have a direct bearing with the sales should be

apportioned on the basis of net sales. For example, advertisement expense

should be apportioned on the basis of departmental sales to outside customers.

But there are some other common or joint indirect expense, which should be

apportioned on the most logical basis. The nature of the expenses and nature of

the business will determine the basis for apportionment of expenses. The bases

for apportionment of some important expenses are given below:

Inter-department Transfer

When a department supplies

goods to another department, then it is called inter-department transfer. Since

each department is considered as a separate profit center, it is necessary to

have separate records for inter-departmental transfer. Generally, the following

journal entry is made in the case of such transfer:

Supplying department shows

such inter-department transfer on credit side of its Trading account treating

them as sales. Similarly, receiving department treats such transfer as purchase

and is shown on debit side of its trading account.

Transfer price can be cost

based or market based. They are discussed below:

- Inter-departmental transfersat cost price

Under cost-based transfer

pricing, the price may be based on actual cost, total cost or standard cost.

Marginal cost is also sometimes used as a basis of ascertaining transfer price.

Standard cost is preferred to actual cost since the inefficiency of one

department cannot be passed on to another department. While transferring goods

at cost price, no adjusting entry is needed.

- Inter-departmental transfers at selling or market price

When goods are transferred

from one department to another at a price higher than its cost price, then it

is called inter-departmental transfer at selling price. The accounting

treatment of such inter-departmental transfer at selling price is exactly the

same as stated above in the case of cost price except with regard to stock at

the beginning and at the end of such transferred goods. The amount of profit

included on these opening and closing stock is called unrealized profit and that

must be adjusted by passing the following some additional adjusting entries.

Adjusting entry for unrealized profit included in closing stock:

Adjusting entry for unrealized profit included in opening stock:

Review of Theoretical concept

Explain inter department transfer.

When a department suppliers

goods to another department, then it is called inter-department transfer. Since

each department is considered as a separate profit center, it is necessary to

have separate records for inter-departmental transfer. Generally, the following

journal entry is made in the case of such transfer:

Supplying department shows

such inter-department transfer on credit side of its trading account treating

them as sales similarly, receiving department treats such transfer as purchase

and is shown on debit side of its trading account transfer price can be cost

based or market based.

Difference between branch and department.

Following are the main

difference in between branch and department:

It was a very good post indeed. I thoroughly enjoyed reading it in my lunch time. Will surely come and visit this blog more often. Thanks for sharing.

ReplyDeleteAccounting services in Houston

Accounting firm in Chicago

Hybrid Accounting sitemap

CPA firm in Dallas

Accounting firm in Austin

Tax Preparation Services in Fort Worth

our enthusiasm leads you beyond the limits. When you feel yourself enthusiastic that’s the time you can cross any limit. You seek to get perfection by using the ability of work. Read such motivational article and definitely it will help you to know new facts. assetz

ReplyDelete