Accounting for Branch

Concept of Branch

As a business

flourishes, it become necessary to open up branches in various other towns,

cities and districts in other to market its services/products which results in

the increase of its profits. A branch is generally defined as a section of an

enterprise that is geographically separated from the rest of the business. The

activities of the branch are controlled by a head office and usually it carries

on the same functions as of the enterprise. In other words, when the business

grows in size due to increased production or sale, the large organization

generally set up local retail shop known as branches which are part of the

central office, called to head office that controls al the branch. Head

officers, therefore, a place from which the branches are controlled. The idea

behind opening a branch is to eliminate firms which by going as nearer to the unlimited

customers as possible. Well known example of business firms which operate

through branch are: Golchha organization, IEIIT Group, Best job search center,

various commercial bank, etc.

It should be

mentioned that a branch is not a separate legal entity; it is simply a segment

of a business. From an accounting standpoint, a branch is a clearly identifiable

profit center. In other to exercise greater control over the branch, it is

necessary to ascertain profit or loss made by such branches separately. Apart

from this, specialization accounting techniques have to be adopted for

controlling various branch activities and for their smooth running, both at the

head office level. The system of

accounting varies among different enterprise in accordance with their type of

activities, methods of operation and the preference of their managements.

Types of branch

Generally, in

order to study accounting systems adopted for various branch, it is necessary

to classify branches in the following categories:

- Dependent Branch

- Independent Branch

- Foreign Branch

1. Dependent Branch

When the

policies and administration of a branch are totally control by the head

officer, then such branch is called a dependent branch. It does not maintain

its accounts. Head office maintains accounts of all the transactions of such

branch. This type of branch depends with head office for all its transactions.

This branch received goods from head office and makes cash and credit sales.

All sales proceeds are sent to head office and head office sends amount

separately for its expenses. Generally, petty cash fund to maintained fort the

petty expense there are two types of dependent branch:

- Services branch: this branch executes or books orders on behalf of the head office. After receiving order from this branch, head office supplies goods directly to the customers according to the orders received from the branch.

- Retail selling branch: this branch directly sells goods received from head office to customers.

1. Independent Branch

When the size of the branches is

very large, their functions will become complex. In such a situation, it is

desirable or practicable for each branch to establish its own double entry

book-keeping system quite separate from those of head office. Under this

system, the branches are treated as separate independent units.

As independent branch Is given

more freedom as action with the manager acquiring more responsibility. Apart

from receiving goods form the head office, these branches are allowed to

purchase goods from the open market locally. From the amount received from cash

sales or debtors, they can incur expenses and can operate the bank account in their

own name. The only link and independent branch with the head office is that

they are owned by the head office, because the latter provides and process the

premises and other physical assets which a branch needs before it can become

operational, and the profit or loss of the branch unitedly belong to the

head office.

2.

Foreign

Branch

When a branch is established in

another country, it is called a foreign branch. The accounting arrangements for a

foreign branch are exactly the same as for any independent, up to the trial

balance. In order to incorporate the Trial Balance of forging branch in the

books of the head office, it must be converted into the currency of the head

office.

Accounting Records of Dependent branch in the Books of Head Office

Head office may send goods to

branch either at 'cost price' or 'selling price' (also called invoice price).

The accounting procedures in these two cases are slightly different; therefore,

these are discussed separately as:

- Goods send at cost price

- Goods send at market price

Goods sent at cost price

Under this method at the

beginning of the year, the branch account is debited with the opening balance

of assets such as stock, debtors, petty cash, furniture, prepaid expenses

accrued income, etc, lying with the branch. Similarly it is credited with the

opening balance of liabilities of branch such as, creditors, outstanding,

salaries, rent, etc.

The branch account is then

debited with the amount of goods sent to the branch and other amounts remitted

to meet various expenses such as, salaries, rent and taxes, etc. likewise, the

Branch account is credited with the return of by the branch, and receipts from

debtors and cash sales. At the end of the year, branch account is debited with

the closing values of liabilities and credited with the closing value of

assets. The difference between two sides represents profit or loss for the

branch for a particular period:

The above journal entries are

posted in the branch account. The specimen of branch account as following:

Under this

method head office does not include the following items while preparing branch

account.

- Normal Loss

- Credit sales made by branch

- Collection from debtors

- Bills receivable from debtors to branch

- Bills receivable from debtors to branch dishonouured

- Bad debts of branch

- Discount, allowances and commission allowed to customers by branch

- Goods returned by customers to branch

- Expenses paid by branch

- Depreciation on fixed assets

- Profit or loss on sales of fixed assets

If head office wants to know

opening and closing debtors more amounts received from debtors or credit sales,

then it prepares Branch Debtors Account as under:

1.

Goods

sent at market price

Sometimes,

head office may prefer to send goods to the branch at a higher price than the

cost. When head office does so, then it is termed as 'goods sent at invoice

price or market price'. Method of sending goods at invoice price is excellent

from the point of view of stock control. As the goods are invoice at selling

price, the head office can dictate pricing policy to its branches, as well as

save work at the branch, because price have already been decided. Invoicing at

selling price is generally done, where goods are of standard type pre-packed

and likely to fluctuate in price. Where head office has little control over

selling price (as for example, with perishable goods like fruits, fish, milk,

etc.), the most suitable method is that margin of profit a secret from the

branch manager.

The method of

preparation of branch account is the same as in the cost price method,

excepting that all journal entries relating to the goods (opening stock, goods

sent to branch, goods returned to head office and closing stock) are made at

invoice price and proper adjustments for loading (difference between cost price

and invoice price) are made at the end of the accounting period by passing some

following additional entries.

Accounting Records of Independent Branch in

the Books of Head office

In the case of

independent branch, the accounting arrangements are quite simple. Each branch

maintains a "Head Office Account" in its Ledger, whilst the head

office maintains an account in the name of each branch, just as if individual

branch were customers of its. All transactions between the two are passed

thought these account, which, if book-keeping is up to date and accurate, will

have equal and opposite balances.

A head office

account in the branch office books may have the following entries:

Accounting Entries for incorporation Branch

Transaction in the Books of Head Office and Consolidated balance sheet

At the end of

each financial or accounting period, a branch both sends its trail balance to

head office for preparation of Trading and profit and loss account and Balances

sheet or prepares its own final accounts (head office being shown as a debtor

or a creditor as appropriate). In either case, the net profit made by a branch

is credited to head office account, net loss, on the hand, is debited to that

account in the branch books. In this connection, it should be noted that the

profit or loss made by each branch is transferred to head office (by passing

the above entry), instead of being distributed in the normal way as with a

single entry enterprise.

After

receiving branch Trial balance by the head office, it keeps all the records of

the branch Trial Balance on its own books which is called incorporation of

branch Trial Balance. Generally, such incorporation is done in the following

two ways:

- Incorporation of all the items in Trial Balance

- Incorporation of net profit or loss, assets and liabilities of branch

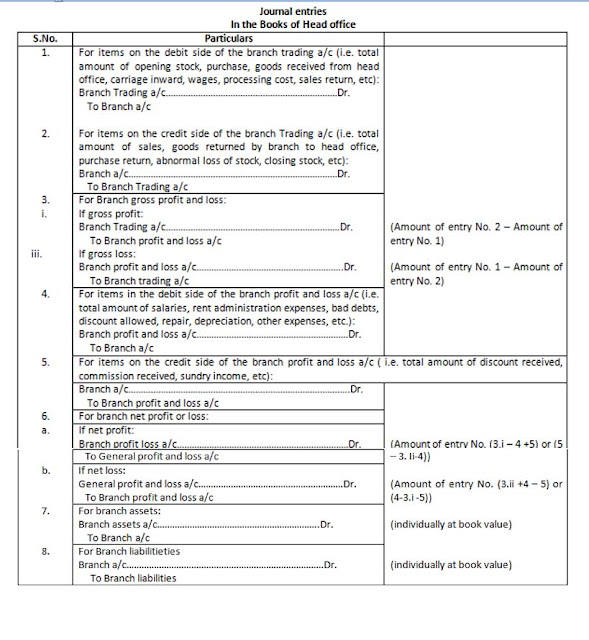

INCORPORATION OF ALL THE ITEMS IN TRIAL BALANCE

While

incorporating all the items in Trial Balance, the following journal entries are

made in the books of head office:

Head office

can also prepare a consolidated balance sheet incorporating all assets and

liabilities of it on and its branch.

Accounting Treatment of some important

Adjustments

- Normal loss: when goods are lost or damaged due to normally expected but unavoidable cause such as leakage of oil or ghee, evaporation, shortage of coal, flours or vegetable due to ladling and weighing, drying, etc., it is called normal loss. Such normal loss increase amount of cost of goods sold of the product and it is not needed to keep its record separately

- Abnormal Loss: loss of goods due to the accident or negligence is called abnormal loss. It is unexpected and beyond the control of the businessman e.g., loss of goods due to fire. Flood, earthquakes, war, soil in-crusts or by theft, etc. such type of loss can be avoided by efficient management. If there is abnormal loss of goods sent by head office, the valuation of such abnormal loss should be done and recorded.

- Goods in transit: it is quite common that the head office and the branch send goods to each other very frequently. Head office sends goods to the branch at regular intervals as per the requirement of the branch and branch aslso returns to the head office which it cannot sell at a profit. When the head office sends goods to the branch, it immediately debits the branch account in its books and credit the goods sent to branch account. But the branch will pass entry (in respect of this transaction) only when it receives the goods. Similarly, when branch sends or return some goods to the head office, it immediately debits head office account and credit goods suppliers by head office account. But the head office will pass entry (in respect of this transaction), only when it receives the goods. These goods, which are on the way to branch or head office, are called goods-in-transit.

- Cash-in-transit: branch may send cash to head office at regular intervals. At the end of the accounting period, if there is any cash-in-transit it should be adjusted just like goods-in-transit. In this situation, again adjustment entries are made either in the head office books or in the branch books.

- Inter branch transactions: it is quite possible that one branch may send goods (or cash) to another branch directly, with of course, the consent of the head office. The usual procedure, In such a case is that the head office, in its books, should debit the receiving branch and credit the sending branch. But in the books of the branch, it regard the transactions as returning the goods to the head office and thereafter sending the goods to another branch. For example, a company's head office at Kathmandu operates two branches; one of these in Lahan, Siraha and another one is in Mid-Baneshwor. Some of the goods are sent to Mid-Baneshwor branch by Lahan, siraha Branch.

Incorporation of net profit or loss, assets

and liabilities of Branch

Under this

method, all the items or Trial Balance of Branch are not incorporated by head

office, but it incorporates only the net profit or loss and items of assets and

liabilities in its books.

Review of Theoretical Concept:

Write the meaning of branch:

When the

business grows in size due to increased production or sales, the large

organizations generally set up local retail shop known as branches which are

part of the central office, called the head office that controls all the

branches. Head office, therefore, a place from which the branches are controlled

he idea behind opening a branch is to climate customers as nearer to the

ultimate customers as possible. Well known examples of business firms which

operate through branches are IEIIT Organization, Best job search center, sales

various commercial banks etc.

Describe the type of branch.

There are

three types of branch:

- Dependent branch: when the polices and administration of a branch are totally controlled by the head office, then such branch is called a dependent branch. It does not maintain its accounts. Head office maintains accounts of all the transactions of such branch. This type of branch depends with head office for all its transactions. This branch received goods from head office and makes cash and credit sales. All sales proceeds re sent to head office and head office sends amount separately for its expenses. Generally, petty cash fund is maintained for the petty expenses.

- Independent Branch

When the size of the branches is very large,

their functions will become complex. In such a situation, it is desirable or

practicable for each branch to establish its own double entry book-keeping

system quite separate from those of head office. Under this system, the

branches are treated as separate independent units.

An independent branch is given

more freedom as action with the manager acquiring more responsibility. Apart

from receiving goods form the head office, these branches are allowed to

purchase goods from the open market locally. From the amount received from cash

sales or debtors, they can incur expenses and can operate the bank account in

their own name.

- Foreign Branch

When a branch is established in

another country, it is called a foreign branch. The accounting arrangements for

a foreign branch are exactly the same as for any independent, up to the trial

balance. In order to incorporate the Trial Balance of forging branch in the

books of the head office, it must be converted into the currency of the head

office.

Hello! It looks like the writer of this blog is really very professional because I never read such kind of writing before. The way of writing and the way of using right words on right place shows some expert skills thincats

ReplyDeleteYah u r ryt

DeleteAmazing blog of Accounting. The method of preparation of branch account is very easy in your blog. Such a useful information share in your blog. Nice post. i am also using a blog branches of accounting. Visit our website at branches of accounting

ReplyDelete