dmission of New Partner

2.1 Concept

Sometimes, a

new partner is admitted in a running partnership business. It may due to the

requirement of more capital or may be to take advantages of his/her experiences

and skill. But a new partner can be admitted only with the consent of all the

existing partners uncles otherwise agreed upon.

When a person

is admitted as a partner into an existing partnership business, then that

person is known as incoming is a new partner and the process of admission in

called 'Admission of a new partner."

On the

admission of a new partner, the existing partnership agreement comes to an end

a new agreement comes into effect. In other words, a new firm is reconstituted

under a fresh agreement. The capital to be contributed by the new partner, the

shares of profit and loss given to him/her and other conditions are agreed

upon. The new partner becomes liable for the liabilities of the firm on joining

it.

2.3 impact of admission in the profit sharing ration of thee firm

The rations in

which all partners including new partner share the future profits and losses

are known as new profit sharing rations. When a new partner is admitted, he/she

acquires his/her share of profits from old or existing partners. This reduces

the old or existing partners' share in profits. Hence, it is necessary to

calculated new profit sharing ratio.

The

calculation of new profit sharing ratio will depend on the agreement between

the old partners and new partners' generally; the following cases may arise

while calculating the new profit sharing ratio.

- 1. When the share of the new partner is given and information about sacrifice of the old partners is not given

When only the

ratio of new partner is given and the question is silent regarding the ratio of

existing partner, them it means there is no agreement in this regard. In this

situation, it is presumed that the existing or old partners will share the

remaining profits (after allocation to new partners) in the same ratio in which

they were sharing before the admission of the new partner i.e. in their old

ratio.

- 2. When new partner acquired his share from any one old partner

Sometimes, a

new partner acquires share of profit only from one partner. In this situation,

that acquired ratio will be the ratio of new partner. The new ratio of the

sacrificing partner should be calculated by deducting that portion from his/her

old profit sharing ratio and the ratio of remaining partners will be the same,

because it does not affect their existing rations.

- 3. When old partners may sacrifice their share of profit for the new partner in their old profit sharing ratio

Sometimes, the

old partners surrender a particular fraction of their share in favors of new

partner according to their old profit sharing ratio. In this situation, old

partner's new profit sharing ratio calculated by deducting the surrendered

profit sharing ratios from their old rations.

4.

When new partner's share of profit is out of

agreed portion of all old partners

In this case,

the new partner's profit sharing ratio is calculated by adding the surrendered

portion of share by all old partners. Similarly, all old partners' profit

sharing ratio is calculated by deducting the surrendered profit sharing ratio

their old rations.

- 5. When new partner's share of profit is out of the profit of all old partners in equal ratio

Sometimes, new

partners purchase his/her share from the old partners equally. In such a case,

the new profit sharing rations of the old partner's will be ascertained by

deducting equal sacrifice ratio made by them from their existing profit sharing

ratio.

- 6. When old partners may contribute their share of profit for the new partner in the certain ratio

In this

situation, new profit sharing rations of old partner will be calculated by

deducting their sacrificing rations from their old rations.

2.3 sacrificingratio

At the time of

admission of new partner, old partner have to sacrifice some of their old

shares in favor of the new partner. The rations which are sacrificed by the old

partners in favor of new partner are called sacrificing rations. In other

words, decrease ratios of old partners' share of profit due to admission of new

partner are known as sacrificing rations. Actually, a sacrificing ratio is the

difference of old ratio and new ratio of an old partner at the time of

admission of new partner. It is calculation as under:

Sacrificing ratio= old ratio – New ratio

2.4 Guarantee of profit

Sometimes, a

new partner is guaranteed that he/she shall get a certain minimum amount of

profits of them firm. Such a guarantee may be given either by (a) any one of

the old partner or (b) by all old partners in a particular ratio. When the

profits of the firm are not adequate them the excess paid to the new partner

should be changed to the partner who has given the guarantee.

2.5 impact of admission in Revaluation of

assets and liabilities

At this time

of admission of a new partner, it is necessary to assess the assets and liabilities

of the firm. In order words, the assets and liabilities of the firm should be

revalued on admission of a partner because with the gap of time, the value of

some assets and liabilities might have increased while the value of some assets

and liabilities might have decreased. Thus the proper value of various assets

and liabilities may be different form the value mentioned in the balance-sheet.

New partner should not suffer because of decrease in the value of assets or

increase in the value of liabilities. Similarly, he/she should not be benefited

by increase in value of assets or decrease in value of liabilities. Thus, any

profit or loss arising on account of such revaluation must be adjusted in the

old partners' capital accounts in their old profit sharing ratio.

There are two

accounting methods to recede revaluation of assets and liabilities.

- When assets and liabilities are revaluation of assets and liabilities.

- When assets and liabilities are revalued and received are not to be shown in the books of account.

-

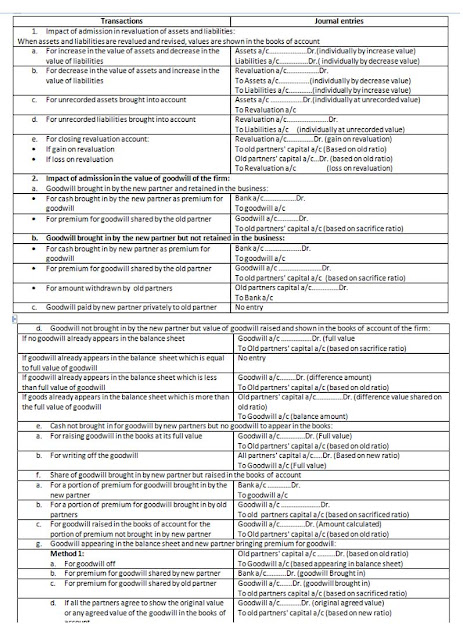

1. When assets and liabilities are revalued and revised values are shown in the books of accountUnder this method, the adjustment on account of revaluation of assets and liabilities is done thought and account called "Revaluation Account or Profit and Loss Adjustment Account". Revaluation account is a normal account. Thus, it is debited with decrease in the value of assets, increase in the amount of liabilities and unadvised liabilities. Similarly, it is credited with any increase in the value of assets, decrease in the amount of liabilities and unrecorded assets, at the time of balancing of this account, if total of credit side exceeds debit side. It is a gain and if total of debit side exceeds credit side, it is a loss. Such profit or loss on revaluation is transferred is transferred to old partners' capital accounts in their old profit sharing ratio. Similarly, revised value of assets and liabilities are shown in the new balance-sheet of the firm. The following journal entries and passed on revaluation of assets and liabilities.

12. When assets and liabilities are revalued and

revised values are not be shown in the books of account

I if all the

partners including new partner agree that asset and liabilities of the firm

will be shown at their old values, not at their revised, them a separate

account is opened called "Memorandum Revaluation Account". This

account is divided into two parts. In the first part, like the revaluation

account. The entries for all increase and decrease in the value of assets and

liabilities are made, if the values of assets are increased, the same credited

in this account and if the values of assets are decrease, they are debited in

this account. Similarly, if the values of Liabilities are increased, they are

debited and when the values of liabilities are decreased, they are credited

profit or loss shown by this part is transferred to capital accounts of old partners

in their old profit sharing ratio.

I in the second

part of memorandum Revaluation Account, the entries are reversed. Those entries

which were earlier debited in the first part are now credited and those which

were earlier credited in the 1st part are now debited. The profit or

loss of this part is transferred to the capital account of all partners

including the new one in the profit sharing ratio.

After

preparing this memorandum revaluation account all assets and liabilities except

bank and cash account are shown at their original value in the new balance

sheet. The following journal entries are made:

1.6

impact of admission in the value of goodwill of

the firm

When a new

partner is admitted, the old partners have to sacrifice some of their interest

in the business. The new partner as to give something in compensation of the

sacrifice. For acquiring the right of becoming the owner of a part of firm's

asset, the new partner contribution towards capital and for having a right to

share in failure profit he/she pays something's which is called goodwill.

Generally, it is provided in the partnership deed as to how will the goodwill

be valued at the time of admission of new partner. There may be various

situations related to treatment of goodwill at the time of admission of a new

partner:

1.

goodwill brought in by the new partner and

retained in the business

i if the new

partner brigs in his/her share goodwill in case and this amount is retained in

the business, it is distributed among the old partners and credited to their

capital account in their sacrificing ratio. In other words, such amount of

goodwill is not withdrawn by old partners. For this purpose, the following two entries

are passed:

1.

Goodwill brought in by the new partner but not

retained in the business

Sometimes, the

amount of goodwill brought in by the new partner is withdrawn by old partners.

In this case, the following three journal entries are required to be passed:

In this

situation, again the amount of goodwill brought in the business is not shown on

the assets side of the new balance-sheet. Similarly it does not affect the cash

balance of the firm and old partners' capital. But if old partners' withdraw

the less amount of goodwill, then it does affect the cash balance of the new

balance sheet and their capital.

- 1. Goodwill paid privately to old partners

When the

amount of goodwill is paid to the old partners privately or directly or outside

the business by the new partner, no journal entry is required in the books of

the firm, because the amount of goodwill is not paid through the firm.

- 2. Value of goodwill raised and shown in the books of account of the Firm

S sometimes, a

new partner does not bring any cash for his/her share of goodwill. In this

situation, goodwill account is raised and opened in the books of accounts of

the firm. Such raised amount of goodwill is distributed among old partners

according to their old profit sharing ratio by crediting their capital

accounts. Generally, the following situations can be found in this context.

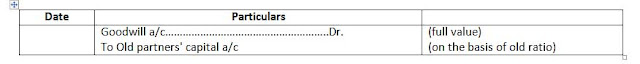

- a. Rising of goodwill at its full value, if there is not goodwill in balance-sheet: under this, a goodwill account is opened in the books of accounts by raising full value of goodwill. Thereafter, such amount of full value raised goodwill should be distributed among old partners according to their old profit sharing ration by passing the following entry:

- a. Already appearing full value of goodwill in the balance sheet: if agreed value of goodwill (i.e. full value) is equal to the amount of goodwill already appearing in the balance-sheet of the firm, the no entry will be required in the books and the same amount will be shown again in new balance-sheet.

- b. Less amount of goodwill appearing in the balance sheet than the agreed value of goodwill: if the agreed value of goodwill is more than the value already appearing in the books, then goodwill account will be raised with the difference amount only. In this situation, such difference amount is distributed amount old partners' capital account according to their old profit sharing ratio and agreed value is shown on the assets side of new balance-sheet.

- a. Less agreed value of goodwill than the amount of goodwill already appearing in the balance-sheet:

I if the value

of goodwill already appearing in the balance-sheet is more than the agreed

value of goodwill, then the difference amount will be writer off form the

capital accounts of old partners in their old profit sharing ratio. In this

situation, agreed value of goodwill will be shown on the assets side of the new

balance –sheet.

- Cash not brought in for goodwill by new partners but not goodwill to appear in the books

When new

partner does not bring cash for goodwill, at that time goodwill account is

raised in the books, but it is written off again. In this situation, first of

all, raised amount of goodwill is distributed among old partners in their old

profit sharing ratios. Then after, raised amount of goodwill is written off by

all partners including new partner according to their new partner sharing

rations.

1.

A part of share of goodwill in cash by new

partner and raising of goodwill in the books of account

S sometimes, a

new partner brings only a part of his/her share of goodwill in cash. In this

situation, such amount of goodwill brought in by new partner should be

distributed among old partners according to their sacrificing rations. Then

after, amount of goodwill to be raised is calculated on the basis of remaining

amount not brought in by new partner. For this, the following formula is used:

- 1 Appearing goodwill in the balance sheet and bringing premium for goodwill by new partner

S Sometimes, balance sheet of the

firm shows the amount of goodwill and new partner also brings in his/her share

of goodwill in the business. In this situation, two methods can be applied:

- a. Method

1: under this method, first of all, goodwill in the balance sheet is written

off from the capital accounts of old partners in their old profit sharing

ration. Then after amount of goodwill brought in by new partners is distributed

among old partners in their sacrificing rations. If all partners decide to show

original or agreed value of goodwill in the new balance-sheet, them that agreed

or original value of goodwill will be distributed again among all partners in

their new profit sharing ratio and will be shown again on the assets side of

new balance-sheet. Under this method, the following journal entries are made:

a Method

2: under this method, first of all, value of goodwill is fixed on the basis of

amount of premium of goodwill brought in by new partner in the business. If

such valued amount of goodwill is more or less than the goodwill appearing in

the balance-sheet, the difference amount of goodwill should be distributed

among old partners in their old profit sharing rations. Under this method,

amount of goodwill brought in by new partner is not distributed among old

partners. But, if less amount of goodwill is shown than the valued amount of

goodwill, them the difference ratio. The following entries are made in this situation.

-

1.6

Re-arrangement of reserve and surplus and

accumulated losses of the firm

Whenever a new

partner is admitted, a firm may have undistributed profits or loss such as

general Reserve, Reserve Fund, Credit or debit balance or profit or loss a/c,

etc. the new partner is not entitle to any share in such undistributed profit

or loss as there are earned or suffered by the old partners. Hence, these

undistributed profit or loss should be credited or debited to the capital

account old partners in their old sharing ratio. For this, the following

journal entries are made:

But, if all

partner including new once agree to keep amount of general reserve in new

balance sheet, the first of all general reserve will be distributed among old

partners in their old profit sharing ratio and after that, the amount of

general reserve will be credited by all partners including new one from their

new profit sharing ratio.

1.7 Re-adjustment of Partners Capital Giving

Due influence of New Admission

For example, if newly admitted partner bring

Rs. 1,00,000 as capital for 1/5 share then total capital of the firm will be

Rs. 5,00,000 (i.e. Rs. 1,00,000 x 5/1) and this total capital should be

distributed among all partners in their new profit sharing ratio.

If the existing

capital of an old partner, is found short then the new capital then he/she has

to bring the required amount in cash or his/her current account is debited with

this amount. Similarly, if the existing capital of an old partner is found

excess, them the surplus amount is either refunded or transferred to the credit

of his/her capital or current account. In this situation, the following entries

are made:

2.9 admission of a partner during an accounting

Year

A new partner

can be admitted at any time of accounting period i.e. either the beginning of

the accounting period or end of the accounting period or at the mid of the

accounting period. In this situation, the following points should be considered

systematically:

a.

Accounting period should be divided into parts

at the time of admission of a new partner i.e. period before admission and

period after admission.

b.

Income should also be divided as pre-admission

and admission.

c.

Similarly, all expenses should be divided as

pre-admission and post admission.

d.

After dividing incomes and expenditures as

pre-admission and post admission, profit and loss should also be determined as

pre-admission and post admission. Such pre-admission profit or loss should be

divided be divided among old partner according to their sharing rations. But

post admission profit should be divided among all partners including new one

according to their new profit sharing rations.

e.

Such profit or loss should be transferred to

capital or current accounts of all partners.

All the records of above mentioned transaction are explained in the

following table:

1.6

Re-arrangement of reserve and surplus and

accumulated losses of the firm

Whenever a new

partner is admitted, a firm may have undistributed profits or loss such as

general Reserve, Reserve Fund, Credit or debit balance or profit or loss a/c,

etc. the new partner is not entitle to any share in such undistributed profit

or loss as there are earned or suffered by the old partners. Hence, these

undistributed profit or loss should be credited or debited to the capital

account old partners in their old sharing ratio. For this, the following

journal entries are made:

But, if all

partner including new once agree to keep amount of general reserve in new

balance sheet, the first of all general reserve will be distributed among old

partners in their old profit sharing ratio and after that, the amount of

general reserve will be credited by all partners including new one from their

new profit sharing ratio.

1.7 Re-adjustment of Partners Capital Giving

Due influence of New Admission

It is sometimes

agreed that on the admission of a new partner, the capital of the partner

should also be adjusted in profit sharing ratio, in such a case, adjustment for

capital may be any of the following two partners:

a.

The combined capital of old partners is assumed

to be based capital.

b.

The new partner's capital is assumed to be based

capital.

a.

The

combined capital of old partners is assumed to be based capital

Sometimes, the

capital to be brought by the new partner is not given in the questions. In such

a case, the total capital of existing or old partners in ascertained after

making all the necessary adjustments such as revaluation, goodwill,

undistributed profit or loosed, etc. balance is considered as equal to the

total new capital of the firm except new partners' capital. The total capital

of the new firm is determined on the basis of this old partners' capital. Te

total capital of the new firm is determined on the basis of this old partners'

capital and from this total capital, the share of capital of the new partner is

determined. For example, the total capital of the partner after making all

adjustment is Rs. 4, 00,000. They admit the new partner for 1/5 share. In this

situation, combined share of profit of old partners will be 4/5 (i.e. 1-1/5)

and the total capital of the firm will be Rs. 4, 00,000 x 5/4 = Rs. 5,00,0000.

On the basis of this, the new partner brings in Rs. 1, 00,000 (i.e., Rs. 5,

00,000 x 1/5) as his/her share of capital.

b.

The

new partner's capital is assumed to be based capital

If the capital

of a new partner is given, the same can be used as a base for calculating the

new capital of the old partners. In such situation, first of all, the total

capital of the new firm should be determined on the basis of new partner's

capital and them the total capital is divided among all partners including new

one in their new profit sharing ratio.

For example, if newly admitted partner bring

Rs. 1,00,000 as capital for 1/5 share then total capital of the firm will be

Rs. 5,00,000 (i.e. Rs. 1,00,000 x 5/1) and this total capital should be

distributed among all partners in their new profit sharing ratio.

If the existing

capital of an old partner, is found short then the new capital then he/she has

to bring the required amount in cash or his/her current account is debited with

this amount. Similarly, if the existing capital of an old partner is found

excess, them the surplus amount is either refunded or transferred to the credit

of his/her capital or current account. In this situation, the following entries

are made:

2.9 admission of a partner during an accounting

Year

A new partner

can be admitted at any time of accounting period i.e. either the beginning of

the accounting period or end of the accounting period or at the mid of the

accounting period. In this situation, the following points should be considered

systematically:

a.

Accounting period should be divided into parts

at the time of admission of a new partner i.e. period before admission and

period after admission.

b.

Income should also be divided as pre-admission

and admission.

c.

Similarly, all expenses should be divided as

pre-admission and post admission.

d.

After dividing incomes and expenditures as

pre-admission and post admission, profit and loss should also be determined as

pre-admission and post admission. Such pre-admission profit or loss should be

divided be divided among old partner according to their sharing rations. But

post admission profit should be divided among all partners including new one

according to their new profit sharing rations.

e.

Such profit or loss should be transferred to

capital or current accounts of all partners.

-

admission of a partner during an accounting Year_journal entry continuum:

1.6

opening

balance sheet

After adjustment all, a new

balance sheet is prepared by taking adjusted capital of all partners, revalued

assets and liabilities and showing goodwill, if necessary. Such a new balance

sheet is called "opening balance sheet" of the firm.

Review of Theoretical concept

Why is new profit sharing ratio determined

after a new partner is admitted?

The ratios in which all partners

including new partner share the feature profit and losses are known as new

profit sharing rations. When a new partner is admitted, he/she acquires his/her

share of profit from old or existing partners. This reduces the old or existing

partners' share in profit. Hence, it is necessary to calculated new profit

sharing ratio.

Why assets and liabilities are revalued at

the time of admission of a new partner?

At this time of admission of a

new partner, it is necessary to assess the assets and liabilities of the firm.

In other words, the assets and liabilities of the firm should be revalued on

admission of a partner because with the gap of time, the value of some assets

and liabilities might have increased while the value of some assets and

liabilities might have decreased. Thus, the proper value of various assets and

liabilities may be different from the values mentioned in the balance –sheet.

New partner should not suffer because of decrease in the value of assets or

increase in the value of liabilities similarly; he/she should not be benefited

by increase in value of assets or decrease in value of liabilities. Thus, any

profit must be adjusted in the old partners' capital accounts in their old

profit sharing ratio.

Why goodwill is valued whenever a new

partner is admitted in partnership firm?

When a new partner is admitted,

the old partners have to sacrifice some of their interest in the business. The new

partner has to give acquiring the right of becoming the sacrifice. For

acquiring towards capital and for having a right to share in failure profit

he/she pays something's which is called goodwill. Generally, it is provided in

the partnership deed as to how will be goodwill is valued at the time of

admission of a new partner.

Good Article Post About Accounting Courses In Chandigarh Keep share more

ReplyDeleteThank you for sharing