Cash flow statement

IntroductionBusiness organization engages in difference activities such as operating activities, financing activities and investing activities. In other words, operating, financing and investing activities are the major business activities that result in either a net cash inflow or net cash outflow. Cash flow statement depicts the cash inflow and cash outflow associated with these activities of the firm. The cash flow statement shows the net increase or decrease in cash during a particular time period and explain the causes for the changes in the cash balance.

Meaning of cash flow statement

Cash flow statement is one of the components of financial statement which provides the information about the changes in cash balance shown in the two consecutive balance sheets. The cash flow statement reports the firm's cash flow during the period, outlining where cash generated from and where it was spent. In other words, cash flow statement is an indicator of the amount of cash receipts and the amount of cash payment or disbursements Suring a specified period.

The concept of cash flow statement has been development to overcome the limitations of other financial statements such as income statement, balance sheet and funds flow statement. A balance sheet reports the cash balance at the end of period. By examining two consecutive balance sheets, we can tell whether cash is increased or decreased during a particular period. However, the balance sheet and not indicate why the cash balance changed. The income statement reports revenues, expenses and net income. These items provided information about the resolve generating capacity and profitability, but income statement itself cannot tell why cash increased or decreased. Similarly, funds statement cannot explain about the cash inflow and cash outflows associated with operating, financing and investing activities of a firm. Cash flow statement is prepared for providing information related with operating, financing and investing activities.

In this way, cash flow statement has been involved as fourth component of the financial statements. Cash flow statements are closely linked with the balance sheet and income statement and play an importance role in providing financial insights into a firm.

Cash flow statement is one of the components of financial statement which provides the information about the changes in cash balance shown in the two consecutive balance sheets. The cash flow statement reports the firm's cash flow during the period, outlining where cash generated from and where it was spent. In other words, cash flow statement is an indicator of the amount of cash receipts and the amount of cash payment or disbursements Suring a specified period.

The concept of cash flow statement has been development to overcome the limitations of other financial statements such as income statement, balance sheet and funds flow statement. A balance sheet reports the cash balance at the end of period. By examining two consecutive balance sheets, we can tell whether cash is increased or decreased during a particular period. However, the balance sheet and not indicate why the cash balance changed. The income statement reports revenues, expenses and net income. These items provided information about the resolve generating capacity and profitability, but income statement itself cannot tell why cash increased or decreased. Similarly, funds statement cannot explain about the cash inflow and cash outflows associated with operating, financing and investing activities of a firm. Cash flow statement is prepared for providing information related with operating, financing and investing activities.

In this way, cash flow statement has been involved as fourth component of the financial statements. Cash flow statements are closely linked with the balance sheet and income statement and play an importance role in providing financial insights into a firm.

Objective of cash flow statement

The purposes of cash flow statement are as below:

i. To provide information about the cash inflows and cash outflows from operating financing and investing activities of the firm.

ii. To show the impact of the operating, financing and investing activities on cash resources

iii. To tell how much cash came in during the period, how much cash went out and what the net cash flow was during the period.

iv. To explain the causes for changes in the cash balance.

v. To identify the financial needs and help in focusing future cash flows

Importance of cash flow statement

The importance of cash flow statement is presented as below:

i. Cash flow statement furnishes the importance cash activities of an enterprise and summaries the performance on cash basis. Income statement is prepared on accrual basis; therefore, cash flow statement is considered a better indicator of future cash inflows and outflow than income statement.

ii. Cash flow statement discloses the movement of internal related with operating activities of an enterprise. Therefore, this statement is more appropriate for internal financial planning controlling and decision-making.

iii. Cash flow statement is a disclose to company's investors and creditors. Company's investment and creditors focus on cash flow from operation rather than net income because they can about the company's ability to pay bills rather than profit earned.

iv. Cash flow statement provides various groups of users a valuable starting point for evaluating the company's financial health. These groups pay special attention to the cash flow adequacy ratio and cash flow per share, which are based on net cash generated by a firm during a particular period of time.

v. Cash flow statement is useful in making internal as well as external investment and financing decision such as project expansion, replacement of projects, repayment short term and long term debt etc.

The importance of cash flow statement is presented as below:

i. Cash flow statement furnishes the importance cash activities of an enterprise and summaries the performance on cash basis. Income statement is prepared on accrual basis; therefore, cash flow statement is considered a better indicator of future cash inflows and outflow than income statement.

ii. Cash flow statement discloses the movement of internal related with operating activities of an enterprise. Therefore, this statement is more appropriate for internal financial planning controlling and decision-making.

iii. Cash flow statement is a disclose to company's investors and creditors. Company's investment and creditors focus on cash flow from operation rather than net income because they can about the company's ability to pay bills rather than profit earned.

iv. Cash flow statement provides various groups of users a valuable starting point for evaluating the company's financial health. These groups pay special attention to the cash flow adequacy ratio and cash flow per share, which are based on net cash generated by a firm during a particular period of time.

v. Cash flow statement is useful in making internal as well as external investment and financing decision such as project expansion, replacement of projects, repayment short term and long term debt etc.

Distinction between funds flow and cash flow statement

The difference between funds flow statement and cash flow statement is presented as below:

Preparation of cash flow statement

Cash flow statement is prepared by combining the cash flow from operating activities, investing activities and financing activities. The main steps involved in the preparing of cash flow statement are presented in the following chart:

Cash flow statement is prepared by combining the cash flow from operating activities, investing activities and financing activities. The main steps involved in the preparing of cash flow statement are presented in the following chart:

Step I: determination of cash flow from operating activities

Meaning of operating activities

Operating activities is concerned with the day to day business operations. Cash flow from operating activities is any cash transaction related to the firm's ongoing business which is repressible for most of the profit earned or loss suffered. Operating activities usually involved producing and delivering goods and rendering services. Cost of purchase and cost of goods sold, payment of wages, salaries, rent, interest, tax and other expense are to major sector of cash outflow. Cash flow front operational is te major means of generating cash. Cash from operations shows the extent to which day-to-day operating activities have generated more cash which has been used.

Cash inflow and outflow from operating activities

According to the clause 03 and section 6 of Nepal according standard (NAS-03 sec-6), following items are the examples of cash flows relating to operating activities:

i. cash receipts from the sales of goods to operating activities:

ii. Cash received fee, commission, royalties and other revenues.

iii. Cash payment to suppliers for goods and providers of services.

iv. Cash paid to employers.

v. Cash received and cash payment of an insurance enterprise for premium and claims, annuities and other benefits

vi. Cash receipts or refund of income taxes unless they can be specially identified with financing and investing and

vii. Cash payment or refund of income taxes unless they can be specially identified with financing and investing and

viii. Cash receipts and payment from contracts held for dealing or trading purpose.

Cash and cash equivalents are not included in the cash flow operating activities. In other words, cash and cash equivalents are adjustment at the end of cash flow statement i.e. their opening balance are added with the net changes in cash balance to determine their ending balance.

The cash flow from operating activities is basically related with revenue, cash expenses and changes in current assets and current liabilities. The cash inflow and outflow from this activity has been presented in following table:

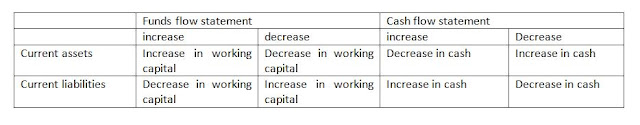

It is importance to note that current assets and current liabilities are treated difference under funds flow statement and cash flow statement. The changes in current assets and current liabilities and flow their treatment under funds flow statement and cash flow statement has been presented in the following table:

Cash and cash equivalents

Cash and equivalents include cash in hand, cash at bank at bank and any cash investment in short-term and highly liquid financial instruments. Generally, marketable securities such as treasury bulls, commercial paper and money market funds are the example of cash equivalents. Cash and cash equivalents are not included in the cash flow from operating activities. In other words, cash and cash equivalents are adjusted at the end of cash flow statement i.e. their opening balance are added with the net changes in cash balance to determine the ending cash balance.

Cash flow from operating activities

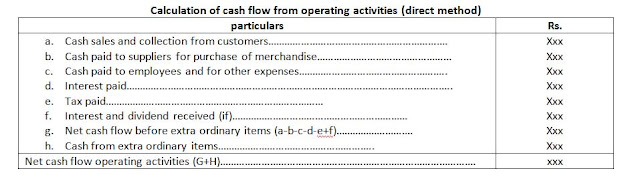

Net cash flows from operating activities can be ascertained either by using director indicters' method. Under direct method, cash from operating activities is determined by deducting all cash expenses from the revenue generated in cash. Under indirect, cash from operating activities is calculated on the basis of net income, non-operating and non-cash items and changes in current assets and current liabilities. Both methods and equally applicable, however, Nepal accounting standards emphasis direct method. According to the clause 03 and section of Nepal Accounting standard (NAS-03 Sec-19), "Enterprise is encouraged to reports cash flows from operating activities using the direct method".

1. Direct method

The cash flow from operating activities under direct method is ascertained as below:

Cash collection from customers: cash collection from customers' included the amount of cash sales and cash received from customers or credit sales. The sales reported by income statement are the combination of cash and credit sales. The cash generated through cash sales and cash collection from credited sales is determined with the help of changes in the customer's account shown in the assets side of balance sheet. The amount of cash received is also affected by the amount of bad debt written off, bad debt recovered and discount allowed to customers. Following points are important to note while calculating cash collection form customers:

• An increase in debtors/ account receivable/bills receivable account reduces increase in credit sales, which reduces cash collection.

• A decrease in debtors/ account receivable/ bills receivable account represents cash collection form customers.

• An increase in provision for doubtful debt and provision for discount on debtors increase cash inflow and decrease in these accounts represents cash outflow.

• Bad debt recovered is a source of cash and discount allowed to customers is an application of cash.

Cash paid to suppliers: the major area of cash outflow under operating activities is the purchase of merchandise or goods purchased for the purpose of selling or manufacturing finished goods. Merchandise can be purchase either on cash or on credit. Sundry creditors, bills payable, accounts payable, suppliers account etc. are the accounts which show the condition of credit purchase during a particular period of time. The purchase or cost of goods sold shown by increase statement representing both cash and credit purchase and paid to suppliers is determined with the help of cost of goods sold and changes in suppliers account and the position of inventory of merchandise.

• An increase in inventory represents purchase and decrease in inventory represents sales of merchandise.

• An increase in creditors/ accounts payable/ bills payable represents the credit purchase which decrease the cash outflow.

• A decrease in creditor/ accounts payable/bills payable account represents cash paid to suppliers which increase the cash outflow.

• Discount received from suppliers reduces the cash outflow

Cash paid to employees and for other operating expenses: wages, salaries, rent, general office expense, selling and distribution expense, depreciation are the examples of operating expense. Out of these expenses, depreciation in non-cash expense. Income statement includes difference types of operating and non-operating expenses, but, only cash operating expense are taken into account while determining cash paid to employers and for other expenses.

Interest payment: interest on difference types of loss is included either under operating activities or under financing activities. In the absence of any information, interest paid is considered as operating expenses and should be included under the operating section of cash flow statement. However, the provision regarding the treatment of interest paid under Nepal accounting standard (NAS-03 etc 31, 32, 33 and 34) are as below:

• Cash flow from interest and dividend should be disclosed separately. Each should be classified in a considered manner from period to period, operating investing or financing activities.

• The total amount of interest paid during a period is disclosed in the cash flow statement whether it has been recognized as an expense in the income statement or capitalized.

• Interest paid is usually unclassified as operating ash flow for a financial institution. However, there is no consensus on the classification for other enterprises. Interest paid may include under financing activities because interest paid is a cost of financing.

Tax payment: tax payment is treated as cash outflow from operating revenue. The amount of tax paid is determined on the basis of tax expenses of the current year and position of outstanding tax.

Interest and dividend received: the provision regarding the treatment of interest and dividend received has been explained in section 31, 32, 33 and 34 under Nepal Accounting standard (NAS-03). Cash flow from interest and dividend received should be disclosed separately. Each should be classified in a considered manner from period to period, operating, investing or financing activities. Interest and dividend received are usually classified as operating cash inflow because they enter into the determination of net income or loss. Interest and dividend received may included under investing activities because they are treated as return on investment on shares, debentures and other assets.

Cash from extra ordinary items: cash sales and cash collection from customers, cash purchases and cash paid to suppliers, cash paid to employers and for other expenses, interest and dividend received or paid and tax paid are the normal or ordinary items relating with the operating activities. Besides these ordinary items, there are some other items concerned with the operational cash flow of a business such as short term borrowing, compensation received from insurance companies etc. increase in the balance of extra ordinary items is treated as sources or cash inflow and decrease in their balance is considered as cash outflow.

2. Indirect method

Under indirect method, cash flow from operating activities is determined on the basis of the following information:

• Net income or loss

• Non-cash expenses and losses, non-operating expenses, losses and amortizations

• Non-operating incomes and gain

• Changes in current assets (except cash & equivalents)

• Changes in current liabilities

Step ii: determination of cash flow from investing activities

Cash flow from investing activities is the second part of cash flow statements. Investing activities are related with the purchases and sales of non-current assets such as plant and machinery, land and building, furniture and fixture etc. investing activities also included lending money and the purchase or sales of investments in security explain the changes in cash position between two balance sheet dates due to the buying or selling of non-current assets.

Step iii: determination of cash flow from financing activities

The financing activities section of the cash flow statement shows the sources of fund generated through owner's capital and borrowed capital. Financing activities also include the repayment of debt and payment of cash dividend to shareholders. The major financing activities of a firms and impact of these activities on cash flow statement.

Step IV: preparation of cash flow statement

a. Direct method

Combining the cash flows generated from operating investing and financing activities, cash flow statement is prepared to show the net change in cash balance during a particular period. T can be prepared according to the direct or indirect method.

b. Indirect method

Cash flow statement can be prepared by using indirect method also. The difference between direct method and indirect method is only cash flow operating activities. Cash flow from investing and financing activities are similar under direct and indirect methods. The format of cash flow statement.

Group cash flow statement

Group cash flow statement is prepared on the basis of combined or integrated financial statements. Comminuted financial statements are prepared when the consolidated financial statements of grouped company such as; holding company and subsidiary company are provided. Group cash flow statement is prepared by applying the general rules and format of cash flow statement described in previous section. In order words, the cash flow of grouped companies is also divided into operating, investing and financial activities.

Step I: determinations of preparing group cash flow operating activities.

Step II: determination of cash flow from investing activities.

Step III: determination of cash flow from investing activities.

The method of determining cash flow from operating and financing is similar to the method described above. However, net value of subsidiary purchases should be determined while calculating the cash flow from investing activities.

Net value of subsidiary purchase

Net value of subsidiary purchase is determined on the basis of following information.

1. Date of acquisition

2. Holding ratio of investment

3. Capital profit

4. Revenue profit

5. Minority interest

6. Cost of control (goodwill/ capital reserve)

ReplyDeletePayroll

AJ Accounting Solutions Pty Ltd offers a wide range of secure business activity statement (BAS) services to small business, also offer the best global payroll management system and software.

to get more - https://ajas.com.au/business-support/

This comment has been removed by the author.

ReplyDeleteThe Cash Flow Statement is a vital tool for financial analysis, providing a comprehensive view of a company's cash-generating activities and its overall financial health. It complements other financial statements, such as the income statement and balance sheet, to provide a holistic understanding of a company's performance and financial position.

ReplyDeleteMoolamore is an advanced accounting application that analyzes, manages, and projects real-time transaction data. Using our cash flow forecasting software and app, you can forecast and estimate your company's future financial position. Best Cash Flow Forecasting Software

Certainly! A web development company is a business that specializes in creating and maintaining websites for clients. These companies typically offer services such as website design, development, hosting, and ongoing support. They may work with a variety of technologies and platforms to create custom websites tailored to their clients' needs. Additionally, some web development companies may offer additional services such as digital marketing, search engine optimization (SEO), and e-commerce solutions.

ReplyDeleteweb development company in USA

This article provides a thorough and insightful exploration of the cash flow statement, a critical financial document for any business. It effectively outlines the various components and activities—operating, financing, and investing—that impact cash flow. The detailed explanation of the cash flow statement’s objectives, importance, and preparation methods, including both direct and indirect methods, is particularly useful. The comparison between funds flow and cash flow statements adds clarity, and the inclusion of group cash flow statements offers valuable guidance for more complex corporate structures. This comprehensive guide is an excellent resource for understanding and managing a company’s financial health.

ReplyDeletetax accountants for small business