Accounting for partnership

Concept of partnership

A sole trade

does business under certain limitations like limited capital, lack of expert

services, no enough skill and experience, division of labour, management

problems, etc. these limitations may induce a sole trader to enter into

partnership with others.

Partnership is

a form of business organization in which two or more than two person can carry

business family. It is an association of two or more persons who have agreed to

combine their labour, property and skill or some or all of them, for the

purpose of engaging in lawful business and sharing profits and losses between

them. Thus, it is a combination of such persons who have different qualities

and abilities. It is a business on which two or more person contributes financial

and human resources under an agreement for carrying legal business to earn and

share profits. The persons forming such an association and entering into partnership

are individually known as partner and collectively as firm. The home in which

the partnership is carried on is called firm home. The agreement between person

to form a partnership business is carried on is called firm home. The agreement

between persons to form a partnership business is called partnership deed.

According to L.H. Haney, "partnership is

relation existing between persons competent to make content to make contracts

who agree to carry on a lawful business in common with a view to private

gain."

In the word of

J.A. subin, "two or more

individuals may from a partnership by marking a written or oral agreement that

they will jointly assume full responsibility for the conduct of a

business."

According to

Nepal partnership Act, 2020 B.S., "partnership means any business registered

in the books of Nepal Government, which is carried on by some person under one

home for sharing the profit and with the agreement of participation in the

transactions by all partnership or a single partner acting for all."

Thus, form the

above definitions, it can be said that partnership is a relation between two or

more persons who have agreed to contribute their capitals, combine their labour

and skill to carry on some business which can be managed by all or any one of

them and profit or loss of such business is divided among them according to

their agreed rations.

1.2. Partnership Agreement

Partnership arise

not form status but form an agreement. Therefore, it is essential that they

must be some term and conditions agreed upon by all the partners. Such and

conditions may be either written or oral, because the law does not make it

compulsory to have a written agreement. However, in order to avoid all misunderstandings

and disputes, it is always the best course to have a written agreement.

Such written

agreement is called "Partnership Deed", it is better, if it is

written signed by the entire partner and registered.

The

partnership deed should contain the following points:

- 1. Name and address of the partnership firm.

- 2. Name of address of the partners.

- 3. The types and nature of the partnership business

- 4. The capital of the firm and contribution of individual partner

- 5. The profit sharing ratio among the partners.

- 6. Remuneration i.e. salaries, commission, etc, to the partners.

- 7. Amount of drawing to be allowed to draw.

- 8. Interest on capital and interest on drawing.

- 9. Nature of capital i.e. fixed capital or fluctuating capital.

- 10. The date and place of commencement of business.

- 11. Duration of partnership business.

- 12. Rights and duties of partners.

- 13. Method of valuation of goodwill in different situations like admission, retirement or death of a partner.

- 14. Accounting period of the firm.

- 15. Admission and retirement of partners.

1.3 Legal status of partner in the absence of

partnership Deed

If there is neither

partnership deed nor even verbal agreement or if the partnership deed is silent

(i.e. problem is silent). Nepal partnership Act 2020, provides the following

provision, which would become effective and applicable:

- 1. Profit or losses are to be shared equally among partners irrespective of their capital contributions.

- 2. No interest shall be allowed on partners' capital. No interest shall be charged on their drawings.

- 3. Partner shall not be allowed any salary or commission.

- 4. Maximum interest @ 10% p.a. shall be allowed on any loan advanced by any partner to the firm.

1.4 Accounting for partnership form

Accounts of

partnership firms are maintained in the same manner as those of sole proprietorship.

There is no statutory provision in the partnership Act for keeping books of

accounts as in the case of company Act for companies. But in the case of

partnership firm, the special; features related to the distribution of profit

and the maintained of capital accounts are applicable separately. Similarly, at

the time of admission, retirement and death of a partner, dissolution of firm

and amalgamation of firms, some special treatment are made.

Partner's Capital Account

In case o

partnership, capital accounts of partners are prepared using the same manner as

of capital account in sole proprietorship business. But there is only one capital

accounts in sole proprietorship and two or more capital accounts in partnership business.

Amounts contributed by the partners, where in cash or in the form of assets,

are credited to their respective capital accounts.

In other

words, in partnership accounts, separate capital accounts will be opened for

each partner on whom capital contributed by partnership will be credited to

their respective capital accounts. Thus, there will be as many capital accounts

as the number of partners.

The capital accounts

of different partners are maintained in two ways in the books of account of the

partnership business:

1. Fixed

capital accounts

2. Fluctuating

capital account

1. Fixed capital accounts

When the

amount of capital accounts is kept fixed form year to year, then such capital

account is called fixed capital account. Under this system, the capitals of

partners shall remain fixed unless same some additional capital is introduced

or some amount of capital is withdrawn by an agreement between the partners. Thus,

when fixed capital, system is adopted, all transactions relating partners such

as share of profit or loss, interest on capital, salary, commission, interest

on, drawing, etc. derived from to firm are transferred and recorded in a separate

account called partners current account. Under this system, two accounts for

each partner are to be maintained.

a. Capital account: this capital account is credited with the original amount of capital introduced by the partner. If there is any addition to capital, it is again credited. But in case of withdrawn, it is credited. All other transactions relating to a partner are recorded in current account, it is debited. All other transactions relating to a partner are recorded in current account of the respective partner. Therefore, the balance of this account will remain fixed year to year. Generally, this account show a credit balance which is transferred to liabilities side of the balance sheet.

b.

Current account: a partner's current account is

debited with drawings, interest on drawings, share of loss, etc. and is

credited with interest on capital, partner's salary, commission, share of

profit, etc. tow which the partner is entitled. The balance of this account

will fluctuate from year to liabilities side of the balance sheets, while debit

balance. Its credit balance goes to liabilities side of the balance sheets,

while debit balance goes to assets side.

In

the case of fixed capital, partner's capital and current account are prepared

as under:

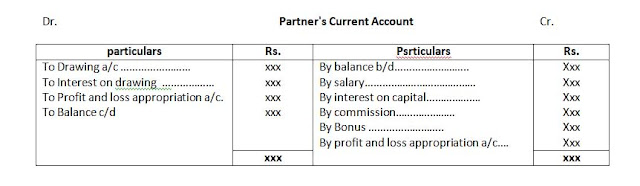

Partner's Current

Account Table:

Fluctuating Capital Account

When the

balance of capital account is allowed to fluctuate due to transactions of a

partner with the firm, the capital account is called fluctuating capital

account. Under this system, only one accounts i.e. capital account of each

partner is maintained, it records all transactions like additional capital

brought in: interest on capital account itself. As a result if these, the

balance in the capital account keeping on changing year to year. A capital

account under this system also shows either a debit balance or credit balance

which is transferred later on assets or liabilities side or the balance sheet.

In the case of

fluctuating capital, partner's capital account is maintained as under:

1.5 Accounting treatment for

partner's salary, Interest, Drawing and Commission

1. Partner's salary

In a partnership firm, te active

partner may be allowed salary for their work. But it should be clearly

mentioned in the partnership dead. In this situation the following two entries

are made:

2. Interest on capital

Interest on capital is to be

allowed to the partners, if it has been specifically provided in the

partnership deed. If interest on capital is to be allowed as per agreement, it

should be calculated with respect to the time, rate of interest and the amount

of capital.

Interest on capital is expenses

loss to the firm, but for a partner, it is income. It is show on the debit side

of profit and loss appropriation account and on the credit side of partners'

capital/current accounts. Generally, the following two entries are made in this

respect:

3. Drawings

Each partner can withdraw either

or good or both for his/her personal use according to partnership deed. For

recording it, a separate drawing account for each partner is maintained. It

records both cash and goods withdrawn by a partner and at the end of the year

its balance is transferred to the debit side of capital/current account of

respective partner. The following entries are passed in this situation:

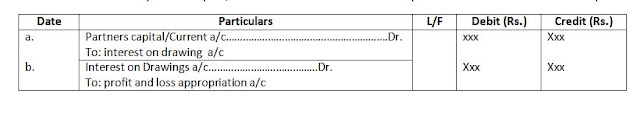

Similarly,

interest is also charged on drawings. Interest on drawing will be charged, if

it is specifically mentioned in the partnership agreement. Interest on drawing

is credited in profit and loss appropriation account as it is an item of income

for the firm and debit in partners capital/current account as it decrease the

capital two entries are made in this respect:

4. Sometimes, a partner is to be allowed commission on net profit,

in order to he or she may put his or her best in the performance of his/her

duties. It is a business expenses but for a partner, it is a gain. It is show on

the debit side of profit and loss appropriation account and on the credit side

of partners' capital or current account. For commission to partner, the

following two entries are made:

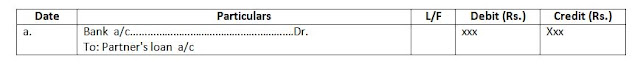

1.6 partners Loan Account

Sometimes, a partner provided

loan to the firm and it is called loan form a partner. Such amount of loan

received from a partner should be debited to bank account. The following entry

is made in this case:

1.7. Profit and Loss Appropriation Account

In case of

sole proprietorship, the net profits shown by the profit and loss account

belong to the sole trade. All net profit is transferred to his/her capital

account. However, in case of a partnership, the net profit after adjusting

partner's transaction such as interest in capital, partners' salary, commission,

drawings, interest on drawings, etc. is to be shared by all the partners in the

agreed profit sharing ratio. Thus, a separate account is prepared for

distribution of profit between the partners and it is known as profit and loss

appropriation account. In simple words, the account through which net profit or

net loss determined from profit and loss account is distributed among the

partners under different heads is called profit and loss appropriation account.

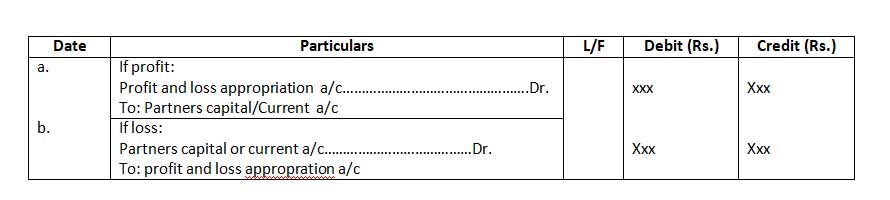

It is nominal account in nature and prepared just like profit and loss account.

It is debited with amount due to partner due from partner share of net profit,

partners' salary, commission , interest etc and credited with amount due from

partner such as interest on drawing etc. after that divisible profit or loss is

calculated from thee account. Such profit or loss is to be distributed among

the partner in there agreed profit sharing rations and their share of profit or

loss should be transferred to their capital or current account. Thus, profit

and loss appropriation account is an extension of profit and loss account,

which is used to show the balance of profit and loss account i.e. net profit or

loss is shared by the partners. The following format is used to prepare a

profit and loss appropriation account.

Profit and loss appropriation

account is prepared as under:

Note: in case of

fixed capital, amount of profit or loss shown by profit and loss appropriation

account is transferred to partners' current account. But in the case of

fluctuating capital, profit or loss should be transferred to partner's capital

account.

Define partnership in brief.

Partnership is

a form of business organization in which two or more than tow person can carry

business family. It is an association of two or more persons who have agreed to

combine their labor, property and skill or some or all of them, for the purpose

of engaging in lawful business and sharing profits and losses between who have

different qualities and abilities. It is a business on which two or more

persons contribute financial and human resources under an agreement for carrying

legal business to earn and share profit. The persons forming such an

association and entering into partnership are individually known as partner and

collectively as firm. The home in which the partnership is carried on is called

firm home. The agreement between persons to form a partnership business is

called partnership deed.

What do you mean by partnership agreement?

Partnership

arise not form status but form an agreement. Therefore, it is essential that

there must be some terms and conditions agreed upon by all the partners. Such

terms and conditions may be either written or oral, because the law does not

make it compulsory to have written agreement. However, in order to avoid all

misunderstandings and disputes, it is always the best course to have a written

agreement. Such written agreement is called "partnership deed." It is

better, if it is written signed by the entire partner and is registered.

Status of partners in the absence of partnership deed.

If there is

neither partnership deed nor even verbal agreement or if the partnership deed

is silent (i.e. problem is silent), Nepal partnership act, 2020, provides the

following provisions, which would become effective and applicable.

- 1. Profit or losses are to be shared equally among partners irrespective of their capital contribution.

- 2. No interest shall be allowed on partners' capital. No interest shall also be charged on their drawings.

- 3. Partners shall not be allowed any salary or commission.

- 4. Maximum interest @ 10% p.a. shall be allowed on any loan advanced by any partner to the firm.

Hi,

ReplyDeleteI have read your blog very carefully. The information you provide is very helpful. I also provide same services.

Thanks for sharing this useful blog.

Please visit MJS Accounting for more details

Thanks for sharing the concept of partnerhsip firm. Change of partnerhsip firm into a LLP is better on the grounds that a business will gain tax cuts and no review necessities underneath a specific capital. To know more, click here: partnership deed format

ReplyDeleteNow a days run a business as a single owner made life difficult!! So start a business put together is a way of sharing the risk. Visit Vakilsearch site to know about Partnership Deed Format

ReplyDeleteThanks for sharing, Reach Vakilsearch to know more about partnership deed format

ReplyDeleteThank you so much for this important post shared with us and if u need any info regarding GSTR and TAX regarding plz click on it SSI Registration Services in delhi and Corporate Tax Consultants in delhi

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteGreat piece of information, Thank you for sharing the Accounting for Partnership. Register now: Partnership deed registration

ReplyDeleteIf one of the partners dies or becomes incapacitated while working together as a team, then the other partner will have to take over his/her responsibilities and become responsible for managing his/her own affairs and finances. The law also allows partnerships to terminate if either party fails to perform their obligations under the contract (or any conditions) within three months after termination of their partnership firm registration.

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteCorporate Diwali Gifts is just around the corner and much preparation must be done. If you are searching for corporate Diwali gifts, finding the right present for your employees must be challenging. The big festival is celebrated annually with lights, devotion, peace, and amusement. Undoubtedly, Diwali is one of the most significant festivals in Indian Corporate Diwali Gifts.

ReplyDeleteIf you are searching for Walmart Thanksgiving Hours, know that the stores throughout the United States will remain closed on Thanksgiving 2023, November 23.

ReplyDeleteWhat Are Walmart Thanksgiving Hours

Hydraulic Torque Wrench are impressive! They offer precise torque control, making heavy-duty fastening tasks easier and more reliable. The build quality is robust, ensuring durability and long-term use. These wrenches are a must-have for any professional looking for efficiency and accuracy in industrial applications. Highly recommended!

ReplyDeleteThank you for the info! Did you know online partnership firm registration is super easy and safe? It is also very affordable!

ReplyDeleteModular Kitchen Manufacturers in Lucknow combines the best of tradition and innovation, offering high-quality, customizable, and affordable solutions. Whether you’re renovating your home, setting up a new office, or simply upgrading your decor, Lucknow’s furniture manufacturers provide endless possibilities to bring your vision to life. Invest in furniture from Lucknow to experience the perfect blend of style, comfort, and craftsmanship.

ReplyDeletePartnership Firm Registration is a crucial step for businesses seeking to establish a reliable and legally recognized entity. It ensures compliance with local laws, fosters trust among partners, and provides a structured framework for operations. By completing this registration, businesses can confidently pursue their goals, knowing they have a solid legal foundation.

ReplyDelete