What is Process costing?Advantages & Disadvantages of process costing

Process costing

Concept and process costing

Concept and meaning of process costing

Process is a set of sequential steps followed to complete a certain activity. The way of maintaining the costing records of each process is called costing. It refers to the method of cost accounting under which cost are accumulated for every process which are interrelated to each other. Process costing is used in manufacturing concerns where the raw materials are converted to finished goods after passing through a number of processes. For example; in case of cotton textiles, the first process may be spinning, second process may be weaving and the final process may be finished.

Characters institute of management accountants (CIMA), London defines "process costing is that form of operating costing where standardized goods are produced."

Likewise, according to Charles T. Hangmen, "process costing deals with the mass production of like units that usually pass in continuous fashion through a series of production steps called operation of process."

Process costing is mostly used in manufacturing concerns. T determines the cost of a product at each stage of manufacturing or process. This method of costing is adopted by industries involved in the manufacturing of textiles, biscuits, cement, paper, oil refining, etc. the output of first process becomes the input of the second process and so on as shown in following figure.

Features of process costing

The major features of process costing are as follows:

a. Each process is treated as a cost center and the costs like material, labour and overhead are incurred in each process separately.

b. Production is in continuous flow and the output of one process becomes the input of sub sequences process and so until the finished production is obtained.

c. The costs also flow with the production process i.e. costs incurred in one process is transferred to the next process along with output.

d. Costs are ascertained for each process at the end of costing period.

e. Units of production are uniform and homogenous. As a result, unit cost of each process is obtained by averaging the total cost in each process.

f. Total cost of the process Is adjusted with normal loss, abnormal loss, abnormal gain and scrap of the process.

g. The output from each process may be categorized as main production and by products. The main product generally involves high cost whereas the byproducts involved low cost.

Advantages of process costing

The following are the advantages of process costing:

a. It is simple and less expensive to find out the cost of each process.

b. It is easy to allocate the expense to process in order to have accurate costs.

c. Production activity in process costing is standardized. Hence, managerial control and supervision become easier.

d. In process costing, the products are homogeneous. As a result, costs per unit can be easily computed by averaging the total cost and price quotations become easier.

e. It is possible to determine process costs periodically at short integrals.

Disadvantages of process costing

The following are the disadvantages of process costing:

a. The cost obtained at the end of the accounting period is historical in nature and is of little use for effective's managerial control.

b. Since process cost is average cost, it may not be accurate for analysis, evaluation and control the performance of various departments.

c. Once an error is committed in one process, it is carried to the subsequent processes.

d. Process costing does not evaluate the efficiency of individual workers or supervisor.

e. The computation of average cost is difficult in those cases where more than one type of product is manufactured.

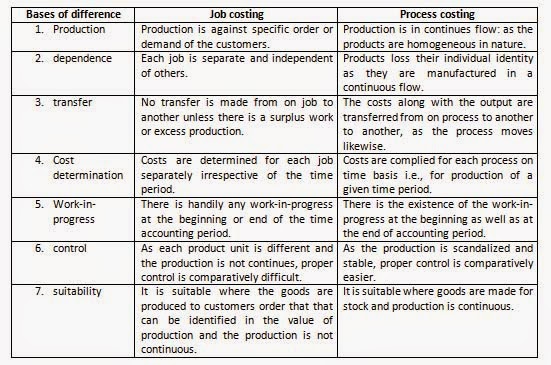

Differences between job costing and process costing

The differences between job costing and process costing are as follow:

Elements of production cost

The following are the main elements of productions cost in process costing:

a. Direct materials: materials are used for manufacturing products. The materials required for production are issued to the first process. The output of first process is passed to the next process and so on. Hence, the output of first process becomes the input of second process and so on, sometimes; new materials may be introduced in the second and subsequent processes.

b. Direct labour: payment madden to the manpower involved in process work against their work is called labour cost. Generally, employees are engaged in one process and wages paid to them is debited in the concerned process account. But if the employs are engaged in more than one process, the total wages paid to them are apportioned among the process on equitable basis.

c. Direct expenses: cost of electricity, hire charges of machine, depreciation of machine are the cost that are directly attributable to a particular process. The process account is debited by such direct costs.

d. Production overhead: the overhead covers a significant portion of the total process cost. Great attention should be paid to ensure that each process is charged with a reasonable share of production overhead like store service, cafeteria services, services etc. are allocated on the basis of absorption rate. The overheads are debited to the process account.

Under process costing, a separate account is maintained for each process. The account is debited with the value of materials, labour, direct expenses and overhead relating to the process. The value of by-products and scrap, if any, is credited to this account. The balance of this account, representing the cost of partially worked out product, is passed on to the next process and so on until the product is completed. Thus the finished product of one process becomes the raw material of the next process.

The following situations arise while preparing process accounts.

a. Process costing having no process loss and stock

All the costs like materials, direct, labour expenses and production overhead relating to the particular process are debited to the process accounts. Since there is no process loss, the output of a process is equal to the unit of input introduced in the process. The total cost of the process is transferred to the next process. The format of the process account having no process loss and stock is given below:

b. Process costing having process loss

It is rare that the output of a process is equal to its input. In most of the cases, the output of a process is less than the input. The difference between the input and output and output is called process loss. The process loss may be in the form of loss in weight, scrapes or wastes. These process losses may be classified into.

Normal loss

Normal loss or uncontrollable loss means the less of materials, which is inherent in the processing operations or in the nature of material. Normal loss includes loss of leakage and normal scrap. Normal loss is considered to be an integral part of process cost. It is unavoidable but efficient workers can reduce it to some extent. The accounting treatment of normal loss is as follows:

Abnormal loss

Any loss caused by unexpected or abnormal condition such as accident, carelessness, etc. is called abnormal loss. It is the excess of over the normal loss. For example, if 1,000 units of raw material are introduced in a process subject to wastage of 10 percent, i.e. the output of the process should be 900 units. But the actual output is 830 units; the extra losses of 70 units are abnormal loss. In other words, the excess loss of 70 units over the normal loss of 100 units is the abnormal loss.

Calculation of the unit and of abnormal loss:

Normal output/yield= inputs – normal loss/ scrap unit

Total normal cost = total cost of input – scrap value of normal loss

Abnormal loss unit = normal output unit – actual output unit

Normal cost per unit = total normal cost/ normal yield

Accounting for process costing

Process accountsUnder process costing, a separate account is maintained for each process. The account is debited with the value of materials, labour, direct expenses and overhead relating to the process. The value of by-products and scrap, if any, is credited to this account. The balance of this account, representing the cost of partially worked out product, is passed on to the next process and so on until the product is completed. Thus the finished product of one process becomes the raw material of the next process.

The following situations arise while preparing process accounts.

a. Process costing having no process loss and stock

All the costs like materials, direct, labour expenses and production overhead relating to the particular process are debited to the process accounts. Since there is no process loss, the output of a process is equal to the unit of input introduced in the process. The total cost of the process is transferred to the next process. The format of the process account having no process loss and stock is given below:

b. Process costing having process loss

It is rare that the output of a process is equal to its input. In most of the cases, the output of a process is less than the input. The difference between the input and output and output is called process loss. The process loss may be in the form of loss in weight, scrapes or wastes. These process losses may be classified into.

Normal loss

Normal loss or uncontrollable loss means the less of materials, which is inherent in the processing operations or in the nature of material. Normal loss includes loss of leakage and normal scrap. Normal loss is considered to be an integral part of process cost. It is unavoidable but efficient workers can reduce it to some extent. The accounting treatment of normal loss is as follows:

Abnormal loss

Any loss caused by unexpected or abnormal condition such as accident, carelessness, etc. is called abnormal loss. It is the excess of over the normal loss. For example, if 1,000 units of raw material are introduced in a process subject to wastage of 10 percent, i.e. the output of the process should be 900 units. But the actual output is 830 units; the extra losses of 70 units are abnormal loss. In other words, the excess loss of 70 units over the normal loss of 100 units is the abnormal loss.

Calculation of the unit and of abnormal loss:

Normal output/yield= inputs – normal loss/ scrap unit

Total normal cost = total cost of input – scrap value of normal loss

Abnormal loss unit = normal output unit – actual output unit

Normal cost per unit = total normal cost/ normal yield

Difference between normal loss and abnormal loss

The differences between the normal loss and abnormal loss are given below:

c. Process costing having abnormal gain

We know that margin allowed for normal loss is just an estimate and slight differences are bound to occur between the actual and anticipated output of a process. These differences do not always represent increased loss may be less than the expected. Thus, when actual loss in a increased loss, on occasions the actual loss may be less than the expected. Thus, when actual loss in a increased loss, in a process is lower than the expected, an abnormal gain results. The value of the gain is calculated in a similar manner to an abnormal loss.

Abnormal gain being the result of actual loss being less than the normal, the scrap realization shown against normal loss gets reduced by the scrap value of abnormal gain. Consequently, there is an apartment loss by way of reduction in the scrap realization attributable to abnormal gain. The loss is set off against abnormal gain by debiting this account. The balance of this account becomes abnormal gain and is transferred to costing profit and loss account. The balance of this account becomes abnormal gain normal yield or actual loss is less than normal loss.

Calculation of abnormal gain unit and value

Total normal cost= total cost of input – scrap value of normal loss

Normal output/ yield= input – normal loss/ scrap unit

Normal cost per unit = total normal cost/ normal yield

Sales account and income statement

Income statement is prepared to find out profit and loss. Income statement is based on sales account, if sales is recorded in related process account. Incomes statement is also prepared on the basis of profit and loss of every process. If sales are not recorded in related procuress account, incomes statement is prepared on the basis of total sales. Incomes statement can be prepared as follows:

Interest process profit

The profit associated with the transfer of goods form one process to another is called inter process profit. Normally finished goods of one process are transferred to the immediate next process at cost of production basis. In some process industries, transfer of finished goods is made to the immediate next process by including some account of profit. The procedure is followed to demonstrate the department efficiency of concerned processes. It helps in recognizing the profit on each process of production. The profit so incorporated is called inter-process profit. The price fixed by adding nominal balance sheet for the transfer of the finished goods to the next process is called as transfer price. For balance sheet purpose, intern process profit cannot be included in stock, as a firm cannot make profit by trading itself. To avoid these complications a provision must be created to reduce the stock to actual cost price. This problem arises only in respect of stock on hand at the end of the period.

The following are the objectives of inter process profit.

• To assess the performance of process operation

• To assess whether the output can compete with the market.

• To decide whether the output can be sold without further processing.

Advantages of inters-process profit

• It shows whether the cost of production computers with the market price.

• By comparing the transfer prices with the corresponding market prices, the 'week' or strong' sports in the manufacturing activity can be located. As a result, measures can be adopted to improve the conditions wherever necessary.

• It makes each process stand on its own efficiency and economics.

Disadvantages of inter-process profit

• This system involves an unnecessary complication of the accounts.

• This systems shown unrealized profits in respect of unsold stocks on the closing date of the accounting period.

• In the balance sheet, stock is conventionally shown at 'cost or market price whichever is lower' to make it acceptable to auditors and tax authorities. Thus, the profit included in stocks has to be eliminated from the stock value before they are shown in final accounts and balance sheet.

Wastage, scrap, spoilage and diffractive unit

1. What is the meaning and features of process costing?

The activities related to each other are known as process. In order to produce sugar, oil, shoes and soap and chemical substances and drinks different stages should be passed. Recording cost in different stages is known as process costing. Recording cost in different stages is known as process costing. The main features of process costing are as follows:

a. The product and process are standardized.

b. Unit of production is uniform and homogeneous. As a result, there is confirmation in the production.

c. Products are produced for stocks. They are not produced according to the demand of customers.

d. The output of one process becomes the input of next process. Cost of production is determined in average value.

2. What is scrap? How is it treated?

Scrap is defined as the incidental material residue. For a certain types of manufacturing, it has got some disposal values which are usually small. This type of loss is visible. Scrap may occur because of faulty operation, bad supervision, wrong tool setting and defective process. Scrap is recorded in the credit side of process account and debit side of profit and loss account.

3. What is wastage and how is it treated?

Wastage is defined as the portion of material which is lost during the production which has no reuse value. It is a complete loss. It may be visible or non-visible. Raw dust if furniture industry, as in a coke industry, send in construction, and evaporation in oil refinery etc. are the example of wastages. Normal wastage is not recorded in a separate account rather per unit cost of production increase due to this. But abnormal wastage is recorded in the credit side of process account and wastage is recorded in the credit side of process account and debit side of profit and loss account.

4. What is spoilage? How is it treated?

Spoilage is defined as the demand goods in the course of manufacturing process which are taken out of process and disposed off in some manner without further processing. This occurs due to some defects in material, fault in operation, defective machines and faulty tool setting. Normal spoilage is recorded in cost of production but abnormal spoilage is recorded in the debit side of profit and loss account.

5. What is defective production? How is it treated?

Defective products are defined as the imperfect products which are not up to the standard quality or do not meet prescribed specification. It can be rectified and turned into normal units by the application of extra material, labour and overhead. It is recorded in related department which is raised due to normal cases or detrimental activities. When it can't be separate, it is recorded in total overhead costs.

6. Write about the efferent type of process losses and explain their accounting treatments.

Normal loss: normal loss or uncontrollable loss means the loss of materials, which is inherent in the processing operation or in the loss nature of material. Normal loss including loss of weight leakage and normal scrap. Normal loss is considered to be an internal part of a process cost. It is unavoidable but efficient workers can reduce it to some extent.

Abnormal loss: any loss caused by unexpected or normal condition such as accidents carelessness, etc. is called abnormal loss. It is the excess of loss over the normal loss.

Abnormal gain: we know that margin allowed for normal loss is just an estimate and slight differences are bound to occur between the actual and anticipated output of a process. These different do not always represent incurred loss, on occasions do not always represent incurred loss, on when actual loss may be less than the expected. Thus, abnormal gain results.

List of formula

Normal output/yield = inputs – normal loss/ scrap unit

Total normal cost = total cost of input –scrap value of normal loss

Normal cost per unit = total normal cost/ normal yield

Abnormal loss (unit) = normal output unit –actual output unit/ normal output unit – actual output unit

Abnormal loss (Rs.) = abnormal loss unit x normal cost per unit

Abnormal gain (units) = actual loss unit – actual loss unit

Abnormal gain (RS.) =abnormal gain unit x normal cost per unit

Inter process:

Cost of losing stock = given closing stock x total amount of cost column/ total amount of total column

Unrealized profit on closing stock = given closing stock – cost of closing stock

Calculation of inter process profit:

a. It percentage of item process is given on processing cost, then

Inter process profit = total cost x %profit

a. If percentage of inter process profit is given on transfer price , then

Inter process profit =total cost x %profit / 100- %profit

Actual released profit = gross profit + unrealized profit on opening stock – unrealized profit on closing stock