What is Accounting for non- trading concern?

What is Accounting for Non- Trading Concern and Feature of Non-Trading Concerns

Meaning of non-trading concern

The concerns whose main objectives are not to earn profit but render valuable services to its member and to the society are known as non-trading concerns. Those concerns or organizations are involved in promoting commerce, art, science, religion, charity or any kind of welfare.

Such concerns are not established to earn profit. Rather their charters prohibit the payment of provision of dividend. Even if there is incidentally some income the same is utilized to promote its objectives’ the example of such concerns are sports clubs, social clubs, libraries, hospital, religious, temples, churches, mosques and gurudwares etc.

Features/characteristics of non-trading concerns

• The main objective of such concern is not to earn profit but render services to its members and society.

• It depends on donation.

• A non-profit concern is government by elected member in the same way a business corporation is overmanned by a board of directors.

• A non-profit organization employs the same accrual basis of accounting used by business enterprises.

• They prepared income and expenditures account.

Accounting procedures of non-trading concerns

Non-trading organizations keep their accounting records under single entry system and double entry system. The small sizes of organizations are followed single entry and the large size of organizations prepared at the year end, the following three statements:

a. Receipt and payment account

b. Income and expenditure account

c. Balance sheet

Receipt and payment account

It is real account. It is consolidated summary of cash book. It is prepared at the end of the accounting period. All cash receipts are records on the debit side and all payments are recorded on the credit side. Cash book consisting of entries of receipt and payment in a chronological order while the receipts and payment is a summary of total cash receipts and payments. Ti start with opening balance of cash and banks and ends with closing balance of cash and bank, it doesn't consider into account outstanding amount of receipts and payments. Receipts and payments. Receipts and payments may be of capital and revenue nature. They may relate to the current or last or next year, so long, as they are actually receipts or paid, they must appear in this account.

Characteristics/features of receipts and payment account

The features of receipts and payments accounts are as follows:

• It is a summary of cash book like a cash book receipts are shows in debit side and payments are shown in the credit side.

• It includes cash and banking transactions whether they are related with payment, previous and subsequent.

• It records all receipts and payment whether are related with capital and revenue nature.

• It starts with opening balance of cash in hand and cash at bank.

• It ends with closing balance of cash in hand cash at bank.

• It does not include non-cash item (e.g. depreciation)

• It is not based on account basis of accounting.

Limitations of receipts and payment account

The limitations of receipts and payments are follows:

• It does not find surplus and deficit of the organizations.

• It does not income and expenses on accrual basis.

• It fails to differentiate capital and revenue receipts and payments.

• It does not record non-cash items such as depreciation.

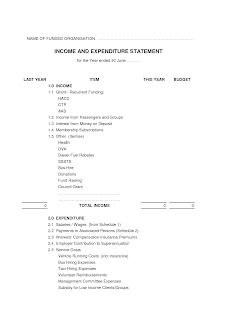

Income and expenditure account

Income and expenditure account is a nominal account. It is just like a profit and loss account. It is prepared to find out the amount of surplus or deficit made during and accounting period by non-trading concerns. It recorded all losses and expenses on the debit side and all income and gains on credit side. It includes only revenue nature of expenditure and income. It shows only current year incomes and

expenditure whether they are received or not. It excluded last year and next year income and expenditures. In other words, incomes and expenditures have to be adjusted both outstanding and prepayments.

According to F.G. Williams, ' an income and expenditure account is prepared to show all the revenue income for the period whether actually received or accrued and all the revenue expenditures for the period whether actually paid or accrued and not yet paid.'

Characteristic/ features of income and expenditure account

• It records only revenue nature of expenses and incomes.

• It records incomes, expenses and losses which related to current accounting year.

• It records all the expenses and losses in the debit sides and all the incomes and gains in the credit side.

• Both cash and non cash items such as depreciation are taken into consideration.

• It is prepared on the basis of accrual concept.

Terminologies related to non-trading concern

Subscriptions

Subscriptions are the amounts paid by the members of such concerns to maintain their membership. They are main source of revenue of the concerns. They are paid periodically i.e. annually. However, they are also paid monthly, quarterly or half yearly.

The actual amount received during the year is shown receipts side of receipts and payment account. The amount of subscriptions which relates to the current year either receipt or due is traded as income.

Donations

Donation is the amount received from person, firm, organization or any other body as a gift. It is show on the receipts side of receipt and payment account. Donation can be divided into tow types:

a. General donation

b. Specific donation

General donation

The donation which is not received for specific purposed. It can be used for any purpose. General donation is treated as revenue receipts and credited to income and expenditure account. Whether the donation is a capital or revenue receipts, it depends upon the rules and regulation of the organization and treated accordingly. In case of large amount of general donation, it is to be

treated as capital receipt and shown on the liability side of balance sheet and in case of small amount of general donation, it is to be treated as revenue receipts and shown in the credit side of income and expenditure account.

Specific donation

The donations which is received for specific purpose is known as specific donations such as donation for building, pavilion, furniture, medical equipment, educational equipment and laboratory, specific donation is treated as capital receipts and shown in the liability side of balance sheet.

Legacy

It is also a specific donation. The amount which is left to the organization by the will of deceased person is called legacy. In other words, it refers to the amount that is donated under a will on the death of donor. Legacy is generally treated as capital receipt and shown in the liability side of balance sheet.

Life member fees

Generally, the members are required to make the payment in a lump sum only one which enables them to the member for whole of the life. Life member are not required to pay the annual membership fees. Life membership fees is a capital receipts and shown in the liability side of balance sheet.

Entrance fees/ admission fees

The fee which is collected from the new member at the time of their admission is known as entrance/admission fees. The entrance fees are generally treated as revenue receipts and credit to the income and expenditure account.

Admission fees are paid by members only one at time of becoming a member. Hence, it is treated as a capital receipt by some organizations. Whether the entrance fees are to be treated as capital or revenue receipt, they are decided by the rules and regulations of the organizations.

Grants

The financial assistance received from public government, other organizations and countries is known as grant. It may be received for specific or general purposes. Therefore, general grants are treated as revenues receipts and shown on credit side of income and expenditure account. However specific grants must be treated as capital a receipt which is shown in the liability side of balance sheet.

Honorarium

Honorarium refers to the remuneration to be paid to outside (not an employee) for their specific services like guest lecturer, special trainer ad showing stage performance and concern etc.

Endowment fund

The fund which arises from a gift. It is relatively large amount of money advanced to the concern and placed in fixed deposits or invested in securities he endowment fund is a capital receipt and shown on the liability side of balance sheet.

Sale of newspapers, magazines and sports materials

The amount receipts from sale of newspapers, magazines and sport material is treated as revenue receipts and credit to income and expenditure account.

Sale of old assets

Amount received from sale of old assets is capital receipts. The book value of the assets sold is deducted from the relevant assets in the balance sheet. Profit on sale of old assets credited to income and expenditure account and loss on sale of old asset debited to income and expenditure account.

Special fund

Specific fund like prize distribution fund, tournament fund and development fund are known as special fund. The special find is capital receipts and shown on liability side of balance sheet.

Capital fund

Capital fund denotes excess of total assets over total outside liabilities. Surplus of income and expenditures account is added and deficit of income and expenditures account deducted to capital fund. Capital fund is usually made up by special donations. Legacies, capitalization of admission fees and life membership fees etc.

Preparation of income and expenditure account from receipt and payment account

Following steps are considered for preparing income and expenditures account:

a. Ignore opening and closing balance of cash in hand and cash at bank.

b. Ignore all capital receipts and capital payment.

c. Calculate the revenue receipt for the current year and credited to the income and expenditures account.

• The revenue with no adjustments directly credited to income and expenditure account.

• The revenue receipts with adjustment, then calculated revenue income (receipt) for the current year as follows:

d. To ascertain the revenue payment:

• Debit the revenue payments in which adjustment are to be made directly to the expenditure side (debit side) of the income and expenditure account.

• If revenue payment with adjustment then current year expenditure calculated as follows:

e. To ascertain surplus or deficit from income and expenditure account, if total credit side exceeds total debit side the excess is known as surplus or excess of income and expenditure. If the total debit side exceeds total credit side, the excess is known as deficit or excess of expenditure over income. The surplus is added on capital fund and deficit is deducted on capital fund on liability side of balance sheet.

Balance sheet

Balance sheet is the statement of assets and liabilities. It is prepared at a particular date to show the financial position of non-trading concerns. It is prepared at the end of accounting period after the income and expenditure account.

Opening balance sheet

Opening balance sheet is prepared for calculating opening capital fund. It is prepared from the information available from receipts and payment account and additional information. All the assets and liabilities of last year are taken into account in the preparation of opening balance sheet. Opening capital fund is the different amount amount of assets and liabilities.

Additional information or adjustments

Adjustments are unrecorded events or transactions of non-trading concern. Since every transaction have two sides effect according to principles of double entry system of book keeping every adjustment, therefore, has two sides effect in final account of non-trading concerns e.i. income and expenditures account and balance sheet:

a. Outstanding expenses

b. Prepaid expenses

c. Accrued income/outstanding incomes

d. Advance incomes

e. Last year's expenses

i. Outstanding expenses

ii. Prepaid expenses

f. Last year's incomes

i. Pre-received incomes

ii. Accrued incomes

g. Revenue and capital expenditure

h. Loss on sale of assets

i. Profit on sale of fixed assets

j. Depreciation on fixed assets

Outstanding expenses

The expenses which are incurred but not paid during the accounting period are called outstanding expenses. These are the expenses from which services or goods have been received but amount is not yet paid.

Prepaid expenses

The expenses which paid in advance receiving goods or services. In other words, prepaid expenses related to future accounting period, the entry and affected of adjustment are as follows:

Accrued incomes/outstanding incomes

The income earned but not amount received is known as accrued incomes. The entry and adjustment of outstanding incomes are as follows:

Advance income/ unearned incomes

The income which is not earned but received in advanced is known as advance income. For example: subscription received in advance.

Last year expenses

1. Outstanding expenses

The expenses which incurred but not paid in last year such expenses should be paid during the current year.

2. Last year prepaid expenses: the expenses which was not incurred last year but paid as an advance in last year. The accounting treatment is as follows:

Last year income

1. Accrued income: the income earned in the last year but not received, such income would be received during the current year. The entry and its effect are shown below:

2. Advance income of last year: the income which was received but not earned in last year is known as advance income of last year. The entry and effected of advance of last year is as follow:

Capitalization of revenue incomes

Sometimes the revenue income like entrance fees, general donation etc. may be transferred to capital fund partially or fully. For example

Loss on sale of fixed assets

If selling price of fixed assets less than the book value of fixed assets then less amount is known as loss on sale of fixed assets. The entry and effected of loss on sale of fixed assets is as follows:

Profit on sale of fixed assets

If selling price OS more than the book value then the excess amount is known as profit on sales of fixed assets'. The entry and effect of profit on sale of fixed assets is as follows:

Depreciation

The reduction value of fixed assets due to its use, wear and tear etc. the journal entry and effect of depreciation is as follows:

The features of receipts and payments accounts are as follows:

• It is a summary of cash book like a cash book receipts are shows in debit side and payments are shown in the credit side.

• It includes cash and banking transactions whether they are related with payment, previous and subsequent.

• It records all receipts and payment whether are related with capital and revenue nature.

• It starts with opening balance of cash in hand and cash at bank.

• It ends with closing balance of cash in hand cash at bank.

• It does not include non-cash item (e.g. depreciation)

• It is not based on account basis of accounting.

Limitations of receipts and payment account

The limitations of receipts and payments are follows:

• It does not find surplus and deficit of the organizations.

• It does not income and expenses on accrual basis.

• It fails to differentiate capital and revenue receipts and payments.

• It does not record non-cash items such as depreciation.

Income and expenditure account

Income and expenditure account is a nominal account. It is just like a profit and loss account. It is prepared to find out the amount of surplus or deficit made during and accounting period by non-trading concerns. It recorded all losses and expenses on the debit side and all income and gains on credit side. It includes only revenue nature of expenditure and income. It shows only current year incomes and

expenditure whether they are received or not. It excluded last year and next year income and expenditures. In other words, incomes and expenditures have to be adjusted both outstanding and prepayments.

According to F.G. Williams, ' an income and expenditure account is prepared to show all the revenue income for the period whether actually received or accrued and all the revenue expenditures for the period whether actually paid or accrued and not yet paid.'

Characteristic/ features of income and expenditure account

• It records only revenue nature of expenses and incomes.

• It records incomes, expenses and losses which related to current accounting year.

• It records all the expenses and losses in the debit sides and all the incomes and gains in the credit side.

• Both cash and non cash items such as depreciation are taken into consideration.

• It is prepared on the basis of accrual concept.

Terminologies related to non-trading concern

Subscriptions

Subscriptions are the amounts paid by the members of such concerns to maintain their membership. They are main source of revenue of the concerns. They are paid periodically i.e. annually. However, they are also paid monthly, quarterly or half yearly.

The actual amount received during the year is shown receipts side of receipts and payment account. The amount of subscriptions which relates to the current year either receipt or due is traded as income.

Donations

Donation is the amount received from person, firm, organization or any other body as a gift. It is show on the receipts side of receipt and payment account. Donation can be divided into tow types:

a. General donation

b. Specific donation

General donation

The donation which is not received for specific purposed. It can be used for any purpose. General donation is treated as revenue receipts and credited to income and expenditure account. Whether the donation is a capital or revenue receipts, it depends upon the rules and regulation of the organization and treated accordingly. In case of large amount of general donation, it is to be

treated as capital receipt and shown on the liability side of balance sheet and in case of small amount of general donation, it is to be treated as revenue receipts and shown in the credit side of income and expenditure account.

Specific donation

The donations which is received for specific purpose is known as specific donations such as donation for building, pavilion, furniture, medical equipment, educational equipment and laboratory, specific donation is treated as capital receipts and shown in the liability side of balance sheet.

Legacy

It is also a specific donation. The amount which is left to the organization by the will of deceased person is called legacy. In other words, it refers to the amount that is donated under a will on the death of donor. Legacy is generally treated as capital receipt and shown in the liability side of balance sheet.

Life member fees

Generally, the members are required to make the payment in a lump sum only one which enables them to the member for whole of the life. Life member are not required to pay the annual membership fees. Life membership fees is a capital receipts and shown in the liability side of balance sheet.

Entrance fees/ admission fees

The fee which is collected from the new member at the time of their admission is known as entrance/admission fees. The entrance fees are generally treated as revenue receipts and credit to the income and expenditure account.

Admission fees are paid by members only one at time of becoming a member. Hence, it is treated as a capital receipt by some organizations. Whether the entrance fees are to be treated as capital or revenue receipt, they are decided by the rules and regulations of the organizations.

Grants

The financial assistance received from public government, other organizations and countries is known as grant. It may be received for specific or general purposes. Therefore, general grants are treated as revenues receipts and shown on credit side of income and expenditure account. However specific grants must be treated as capital a receipt which is shown in the liability side of balance sheet.

Honorarium

Honorarium refers to the remuneration to be paid to outside (not an employee) for their specific services like guest lecturer, special trainer ad showing stage performance and concern etc.

Endowment fund

The fund which arises from a gift. It is relatively large amount of money advanced to the concern and placed in fixed deposits or invested in securities he endowment fund is a capital receipt and shown on the liability side of balance sheet.

Sale of newspapers, magazines and sports materials

The amount receipts from sale of newspapers, magazines and sport material is treated as revenue receipts and credit to income and expenditure account.

Sale of old assets

Amount received from sale of old assets is capital receipts. The book value of the assets sold is deducted from the relevant assets in the balance sheet. Profit on sale of old assets credited to income and expenditure account and loss on sale of old asset debited to income and expenditure account.

Special fund

Specific fund like prize distribution fund, tournament fund and development fund are known as special fund. The special find is capital receipts and shown on liability side of balance sheet.

Capital fund

Capital fund denotes excess of total assets over total outside liabilities. Surplus of income and expenditures account is added and deficit of income and expenditures account deducted to capital fund. Capital fund is usually made up by special donations. Legacies, capitalization of admission fees and life membership fees etc.

Preparation of income and expenditure account from receipt and payment account

Following steps are considered for preparing income and expenditures account:

a. Ignore opening and closing balance of cash in hand and cash at bank.

b. Ignore all capital receipts and capital payment.

c. Calculate the revenue receipt for the current year and credited to the income and expenditures account.

• The revenue with no adjustments directly credited to income and expenditure account.

• The revenue receipts with adjustment, then calculated revenue income (receipt) for the current year as follows:

d. To ascertain the revenue payment:

• Debit the revenue payments in which adjustment are to be made directly to the expenditure side (debit side) of the income and expenditure account.

• If revenue payment with adjustment then current year expenditure calculated as follows:

e. To ascertain surplus or deficit from income and expenditure account, if total credit side exceeds total debit side the excess is known as surplus or excess of income and expenditure. If the total debit side exceeds total credit side, the excess is known as deficit or excess of expenditure over income. The surplus is added on capital fund and deficit is deducted on capital fund on liability side of balance sheet.

Balance sheet

Balance sheet is the statement of assets and liabilities. It is prepared at a particular date to show the financial position of non-trading concerns. It is prepared at the end of accounting period after the income and expenditure account.

Opening balance sheet

Opening balance sheet is prepared for calculating opening capital fund. It is prepared from the information available from receipts and payment account and additional information. All the assets and liabilities of last year are taken into account in the preparation of opening balance sheet. Opening capital fund is the different amount amount of assets and liabilities.

Additional information or adjustments

Adjustments are unrecorded events or transactions of non-trading concern. Since every transaction have two sides effect according to principles of double entry system of book keeping every adjustment, therefore, has two sides effect in final account of non-trading concerns e.i. income and expenditures account and balance sheet:

a. Outstanding expenses

b. Prepaid expenses

c. Accrued income/outstanding incomes

d. Advance incomes

e. Last year's expenses

i. Outstanding expenses

ii. Prepaid expenses

f. Last year's incomes

i. Pre-received incomes

ii. Accrued incomes

g. Revenue and capital expenditure

h. Loss on sale of assets

i. Profit on sale of fixed assets

j. Depreciation on fixed assets

Outstanding expenses

The expenses which are incurred but not paid during the accounting period are called outstanding expenses. These are the expenses from which services or goods have been received but amount is not yet paid.

Prepaid expenses

The expenses which paid in advance receiving goods or services. In other words, prepaid expenses related to future accounting period, the entry and affected of adjustment are as follows:

Accrued incomes/outstanding incomes

The income earned but not amount received is known as accrued incomes. The entry and adjustment of outstanding incomes are as follows:

Advance income/ unearned incomes

The income which is not earned but received in advanced is known as advance income. For example: subscription received in advance.

Last year expenses

1. Outstanding expenses

The expenses which incurred but not paid in last year such expenses should be paid during the current year.

2. Last year prepaid expenses: the expenses which was not incurred last year but paid as an advance in last year. The accounting treatment is as follows:

Last year income

1. Accrued income: the income earned in the last year but not received, such income would be received during the current year. The entry and its effect are shown below:

2. Advance income of last year: the income which was received but not earned in last year is known as advance income of last year. The entry and effected of advance of last year is as follow:

Capitalization of revenue incomes

Sometimes the revenue income like entrance fees, general donation etc. may be transferred to capital fund partially or fully. For example

Loss on sale of fixed assets

If selling price of fixed assets less than the book value of fixed assets then less amount is known as loss on sale of fixed assets. The entry and effected of loss on sale of fixed assets is as follows:

Profit on sale of fixed assets

If selling price OS more than the book value then the excess amount is known as profit on sales of fixed assets'. The entry and effect of profit on sale of fixed assets is as follows:

Depreciation

The reduction value of fixed assets due to its use, wear and tear etc. the journal entry and effect of depreciation is as follows:

This comment has been removed by the author.

ReplyDelete