What is a Bank Reconciliation Statement?importance of Bank Reconciliation statement

Bank Reconciliation statement

Concept

For conduction the business transaction or the activities through the bank, the business concern should open an account with the bank by depositing some amount of money. The business concern or the customer may deposit cash or cheque with the help of paying-in-slip or voucher and can withdraw money be means of a cheque. The bank provides information ot their customer through the bank statement (or the passbook) which contains deposit, payment and other chare for a certain period.

On the other hand, the concern keeps it own record related to the bank transaction through the cashbook with bank column. The bank column of the cashbook records all the of

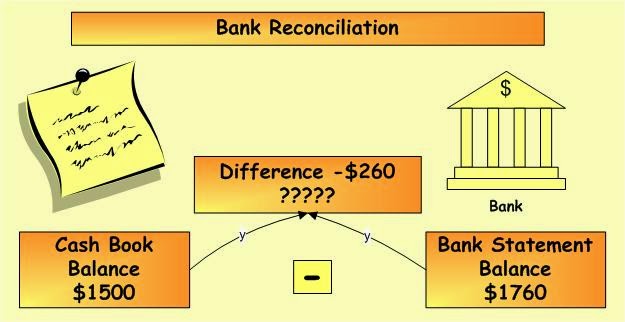

cheque are recorded on the credit side. It means, whatever the transactions recorded in cashbook, all of them are to be recorded in passbook also, but such system may not be exited in passbook. It is occurs, the items may be missed or wrongly presented either in cashbook or passbook. It it occurred; the balance of cashbook won't be agreed with the balance of passbook. In such suiation, the business of cashbook won't agree with the balance of passbook. In such suitable, the business concern is required to be agreed with the balance of passbook. In such suction, the business concern is required to find out the causes of disagreements between them and they are to be reconciled. For reconciliation, a statement is to be prepared which is known as bank reconciliation statement.

Need and importance of Bank Reconciliation statement

Bank reconciliation statement can be taken as a procedure to prove the cashbook balances. It contains a complete and satisfactory explanation of the different existed between cash and passbook balances. It is an importance tool of controlling cash receipts and disbursements. The necessities and importance tool of controlling cash receipts and disbursements. The necessities and importance of bank reconciliation statement can be presented with the help of the following points.

It assists to cause of differences between cash and passbook balances.

It assists to calculate the actual bank balances.

It assists to find out mistakes committed in cashbook and passbook.

It shows the transaction not recorded either by cash book or pass book.

It assists to maintain up to date record and tries to avid in collection and payment.

It assists to maintained up to date records and tries to avoid delay in collection and payment.

It assists to maintain healthy relation between banks its customers.

Reasons for disagreement between cashbook and passbook (bank statement)

The cashbook with the bank column prepared by the business enters the deposited amount, cheque draft and other receipts on the debit side of cashbook but not bank enters then into the credit side of passbook. Likewise, ll the payments or issuing of the cheque are to be entered on the debit side and deposit or collected amount re to be entered on the credit side of passbook, it some of the items are missed to enter in proper side within retain date or wrongly presented then, disagreement occurred. The way of presenting different transaction into cash and passbook can observed with the help of the following formats:

1. Cheque issued but not presented for payment

As soon the cheque is issued by the business, it is entered on the credit side of cashbook. Cheque issue reduces the cash balance is reduced but not the passbook until it is present for payment for payment. In such situation, the cashbook balance is reduced but the passbook balance remains the same and disagreement occurred; let's see the effect of such type of transactions into cash and passbook.

2. Cheques deposited ( or paid into the bank) but not yet collection by the bank

When a business receives cheque form customer and deposited then into bank, then the bank column of the cashbook is debited. Corresponding credit is given to customer's account form whom the cheque is received. In such situation, cashbook balance will increase. The bank may take some time in collecting the cheque , until the cheque is collection, the pass book balance would remain less than the cashbook balance.

3. Amount directly deposited into bank by debtors but not entered in cashbook

The debtor of a business may directly deposit the amount in the bank. If happens, the bank credits the deposited account. But the business will know about it after receiving information from bank. Until then, the bank balance as per passbook would show more than the balances as per the cashbook.

4. Cheque deposited into the bank but dishonored

The dishonor of cheque which was sent to the bank for collection affects the bank balances shown by cashbook and passbook since cashbook has been debited. The dishonor of cheque does not affect the balance of passbook. Therefore, disagreement of the two balances occurs.

5. Bank charges, commission and interest on overdraft, by the bank but not entered in cashbook

The bank can charge some amount for the services provides to the depositors, such charges or the commissions rre debited by the bank due to which the passbook balance decrease. But the amount holder makes not entry until the information is received. So, the disagreement will be created between the cash and passbook balances.

6. Interest credited by bank but not entered in cashbook

Bank allows interest to its customers by crediting his account. It increases bank balance. The customer may enter the amount of interest in cashbook after getting the information from the bank. If the information is not provided to the customer, interest allowed by the bank is not recorded in the bank column of the book. In such situation, the bank balance as per passbook would be more than the balance as per cashbook.

7. Expenses directly paid by bank on behalf of but not recorded in cash book (standing order)

It is instruction given to a bank by a customer to make a fixed payment regularly like rent, electricity, telephone charges on stated date to third party. After making such payment, the bank will be reduced. But, the business will not enter such amount in cashbook until the information is received.

8. Income directly collection by the bank on behalf of customer but not recorded in cash book

In case of collection of increase also. The bank may receive standing instruction from its customer's. the example of such incomes may be dividend on share, interest on investment, rent etc. if the bank directly collects such incomes as per the standing instruction, the amount of such incomes is immediately credited by the bank column of the cash book only when necessary information to the effect is received from the bank. If the entries in the cash book and pass book information. The case can be presented as follow:

9. Errors committed in the cash book & pass book

If errors are committed either in cash book or passbook or in both the books. That will create the different in the balance shown by the two books likewise, if any items is omitted to record in cashbook or pass book, the balance won't be matched each other.

10. Bank overdraft

If a person or concern draws more than the deposited amount. The overdrawn amount is knows as bank overdraft. The facility by which the deposited can draw the excess amount than the deposited is termed a overdraft. Such facility can be obtained after making ore-negotiation the deposited is termed as overdraft. The cash book showed the credit balance and the pass book shown the debtor balance. This facility is generally given to the business for a short period so it is taken as short term loan. On bank overdraft given to the business for a short period so it taken a short term loan. On bank overdraft, the charges certain amount of money as interest which is debited in the passbook.

Preparation of bank reconciliation statement

For the

preparation of bank reconciliation statement. The date at which the statement

is to be prepared should be presented at the top. Then, following procedures

are followed:

Compare cashbook

and passbook items.

Give sign to all

the items cashbook/passbook which are matched with each other.

Start to prepare

bank reconciliation statement taking any balance either from cash or passbook

as a basis.

Adjust the items

which cause the disagreement in the balance. Add the items which have decreased

the balance on the book with which reconciliation made. One the contrary

subtracts the amount of those items which have increased the balance.

The above stage

can be adopted if the extracts of cashbook and passbook are given. The cause of

differences or disagreement should be identified by comparing cashbook and

passbook. But if causes of differences are given, it is not necessary to follow

all the above procedure.

When the cause

of disagreement between cashbook and passbook balance are given, then pass

book. Bank reconciliation statement can be prepared either on the basic of

Bank balance

shown by cashbook

Bank overdraft

shown by cashbook

Bank balance

shown by passbook

Bank overdraft

shown by passbook

Bank balance shown by cashbook

In this

condition, we have to see whether a particular item increase or decrease the favorable

balance of pass book. Those items increase the pass book balance more than the

cash book balance are to be added. On the other hand those items which decrease

the pass book balance are to be added. On the other hand these items which

decrease the pass book balance are to be deducted. Those items can be presented

in the following format.

Extraordinary blog. you put Good stuff. All the themes were clarified briefly.CFA Audit | Visibility Audit | Fixed Assets Audit

ReplyDeleteInformative & useful post. Thanks for sharing that kind of blog. Keep in blogging.. Duplicate Payment Review | AP Vendor Helpdesk | Duplicate Payment Recovery

ReplyDeleteThanks for sharing that valuable post. I really enjoy your post.... Duplicate Payment Review

ReplyDeleteVendor Audit

Duplicate Payment Audit

Grammar, vocabulary, tenses, indirect speech, passive sentences must always be keep in mind while writing a blog. Everyone must read this blog. This is going to help everyone. sme lending

ReplyDelete