ANALYSIS AND PRESENTATION OF DATA

4.1 Introduction

This

chapter deals with the presentation, analysis and interpretation of relevant

data of Nepal Bank Limited in order to fulfill the objectives of this study.

The purpose of this chapter is to introduce the mechanics of data analysis and

interpretation. Calculated financial ratios are

analyzed and evaluated after their interpretation is made. The calculated

secondary data have analyzed and presented in table form. For this purpose. analysis

and interpretation are categorized into two headings. They are analysis of

financial and statistical tools.

4.2 Analysis of Financial Tools

Under this topic various financial ratios are calculated to

evaluate and analyze the performance of Nepal [lank Limited, Study of all types

of ratios is not done. Only those ratios that are important from the point of

view of the fund mobilization and investment are calculated. the important

ratios that are studied for this purpose arc given below.

4.2.1 Ratio Analysis

Ratio Analysis enables the business owner/manager to spot

trends in a business and to compare its performance and condition with the average

performance of similar business in the same industry. To do this compare own

ratio with the average of business similar to owns and compare own ratios for

several successive years. watching especially for any unfavorable trends that

may be starting. Ratio analysis may provide the all important early warning

indications that allow us to solve business problems before our business is destroyed

by them.

A. Liquidity Ratios

These ratios indicate the ease of turning assets into cash.

Liquidity refers to the ability of a firm to meet its short term or current

obligations. So liquidity ratios are used to measure the ability of a firm to

meet its short term obligations In the worst case, inadequate Liquidity can

lead to the liquidity can lead to the liquidity insolvency of the institution.

To find out the ability of the bank, to

meet their short term obligations which are likely to mature in the short

period, the following ratios are developed under the liquidity ratios to

identify the liquidity position.

i.) Current Ratio

Table 4.1 is presented in figure also to show the bar

diagram of current ratio.

The main question current ratio address is “Do your business

have enough current assets to meet the payment schedule of current debts with a

margin of safety for possible in current assets, such as inventory shrinkage or

collectable accounts ?"

Table 4.1 and Figure 4.1 shows that the exhibit the current

ratio of Nepal Hank Limited for the study period of 2067/68 to 2071/72. The

average ratio of five year period is 0.284. The ratios were 0.31. 0.34, 0.33,

0.23 and 0.21 respectively. Comparing to five years average, only in the fiscal

year 2067/68, 2068/69 and 2069/70 the ratio is more than the average i.e. 0.31,

0.34 & 0.33 and less than average 0.23 & 0.21 in the year 2069/70 and 207

1/72. The trend of current liabilities is increasing one where as current

assets is in fluctuating trend. The standard value for the current ratio is 2

to 1 but in case of Nepal Rastra Bank, it is not meeting the standard all

ratios are less than the standard.

Source: Annual Reports of NBL (Appendix-IV)

Source: Table 4.8

Table 4.8 and Figure shows that the non performing assets to

total loan and advances ratio of Nepal Bank Limited in the above table, the ratios

are 0.58, 0.53, 0.50, 0.18 and 0.14 for fiscal year 2067/68 to 2071/72

respectively. The bank has 38.6%. For all years of the study period except

fiscal years 2070/71 and 2071/72, the ratio is higher than the average.

Theperformance and efficiency of the bank is better if this ratio is low. One

to four or fice percent non perforing assets are fined but when it exceeds that

limit, it's really worrisome. NRB has directed to all commercial banks that the

ratio of non-performing assets to total loan and advance should be about 5%.

But the ratio maintained by NBL. seems to be very much higher than the standard

directed by Nepal Rastra Bank. But the ratio has gone down in the later the

study period in contrast with the beginning which is a sign of progress in term

of total loan and advance.

vii.) Provision for Pass Loan to Total Pass Loan Ratio

Table 4.9 is presented in figure also to show the bar

diagram of current ratio.

Source: Table 4.9

Table 4.9 and Figure 4.9 shows that the comparative analysis

of the provision for pass loan to total pass loan of Nepal Bank Limited for the

study period 2067/68 to 2071/72. The average ratio for the five year is 0.04

that means the bank has maintained a provision for pass loan at 4% of total

pass loan in the study period. As per the Nepal Rastra Bank directives, the

provision for pass loan should be 1% of total pass loan. For the first three

years, the bank has maintained it quite strictly as per the directives. But the

ratio has been increasing almost by one percent in the 2069/70 and 2071/72 and

then two percent in 2068/69 and 2071/72.

viii) Provision for Doubtful Debt to Total Doubtful Debt

Ratio

Table 4.10

Provision for Doubtful Debt and

Total Doubtful Debt

(Rs. in million)

Source: Table 4.10

Table 4.10 and Figure 4.10 shows that the provision for

doubtful debt to total doubtful debt of Nepal Bank Limited for the study period

of 2067/68 to 2071/72. By observing the above table, it can be concluded that

the bank has failed to maintain the given standard in 2066/67 but above the

standard in 2068/69, 2069/70 & 2070/71. The standard for the provision for

doubtful debt to total debt by NRB is at about 50%. The high amount of doubtful

debt and its provision is not good for the bank's performance. The bank has

maintained a provision for doubtful debt at 55% on an average over the study

period. And the trend of both the doubtful debt and doubtful debt provision are

clearly of decreasing. In the fiscal year 2069/70 the bank has minimum doubtful

debt and doubtful debt provision whose ratio is exact 50%, which is under NRB

standard.

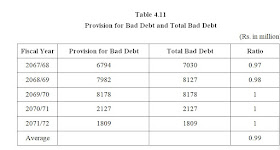

ix.) Provision for Bad Debt (Loss) to Total Bad Debt Ratio

Source: Annual Reports of NBL (Appendix – IV)

Table 4.11 is presented in figure also to show the bar

diagram of current ratio.

The ratio of provision for bad debt to total bad debt ratio

of Nepal Bank Limited for the study period of 2067/68 to 2071/72 are 0.97,

0.98, 1, 1 and 1 respectively. The average ratio for the study period is 0.99.

It means that only 99% of total debt has been kept for its provision on

average. As per the NRB directives, the provision for bad debt should be 100%

of total bad debt. The bank is not able to maintain that ratio of 100% in the

first two years. But from the fiscal year 2069/70, it has been able to maintain

the ratio as per NRB directives. Increase in the bad debt can be subjected to

the new classification of loan according to the NRB directives and increase in

provision can be subjected to the compliance of standard by making additional

provision in the succeeding years.

3. Profitability Ratios

A company should earn profit to survive and to grow over a

long period of time. It is the difference between revenues and expenses over a

period of time. It shows the overall efficiency of the business concern. The

following ratios are calculated under the profitability ratios:

i.) Interest Income to Loan and Advances and Investment

Ratio

Table 4.12 is presented in figure also to show the bar

diagram of current ratio.

Source: Table 4.12

The average ratio of interest income on loan in subject to

loan and advance and investment of NBL is 8.8%. It means that the bank is

earning the interest in credit and investment on average of 8.8% in five years

period. The year wise income for the study period of 2067/68 to 2071/72 is

0.11, 0.09, 0.09, 0.08 and 0.07 respectively. Viewing above ratios, the earning

ratio is higher in the initial years of study period than in the following

years. From fiscal year 2070/71, it is in decreasing trend. To have the high

profitability position of bank, there should be high interest income ratio.

ii.) Interest Expenses to Total Expenses Ratio

Table 4.13 is presented in figure also to show the bar

diagram of current ratio.

Higher

the ratio of interest expenses to total expenses, the more interest bearing

deposit that the bank has. Reviewing interest expenses to total expenses ratio

table of Nepal Bank Limited for the study period of 2067/68 to 2071/72, average

ratio for five years is 0.34 which means on an average NBL is maintaining the

level of interest expenses to 34%. The rations of NBL are in decreasing order

in the study period. From fiscal year 2068/69, the ratio is in constant and

position. The ratios are substantially lower than the average in the last three

years. This clearly means that the efforts by the bank are towards reducing the

interest bearing deposit.

iii) Interest Expenses to Interest Income Ratio

Source: Table 4.9

Table 4.9 and Figure 4.9 shows that the comparative analysis

of the provision for pass loan to total pass loan of Nepal Bank Limited for the

study period 2067/68 to 2071/72. The average ratio for the five year is 0.04

that means the bank has maintained a provision for pass loan at 4% of total

pass loan in the study period. As per the Nepal Rastra Bank directives, the

provision for pass loan should be 1% of total pass loan. For the first three

years, the bank has maintained it quite strictly as per the directives. But the

ratio has been increasing almost by one percent in the 2069/70 and 2071/72 and

then two percent in 2068/69 and 2071/72.

viii) Provision for Doubtful Debt to Total Doubtful Debt

Ratio

Table 4.5 is presented in figure also to show the bar

diagram of current ratio.

Higher

ratio between the performing assets to non performing assets better the banks

efficiency would be. The ratio of performing to non-performing assets of Nepal

Bank Limited is 0.67, 0.87, 1.02, 4.50 and 6.41 in the financial year 2067/68

to 2071/72 respectively. The average ratio

is 2.694 times more than the non-performing assets in the study period.

The ratio in the fiscal year 2070/71 and 2071/72 is much larger than the

average ratio. This shows that the bad loan is slowly being recovered and in

the fiscal year 2071/72, it has been recovered more. This is the very positive

indication. The management of NBL is focusing on revocery of loan so

non-performing assets is decreasing much to the relief.

Table

4.6 is presented in figure also to show the bar diagram of current ratio.

Source: Table 4.6

The non-performing assets to total assets ratio of NBL for

five years were 0.27, 0.22, 0.18, 0.06 and 0.05 respectively throughout the

study period. The average ratio is 0.156 meaning that the non-performing assets

are 15.6% of total assets. Analyzing this ratio, Nepal Bank Limited was not

able to maintain the non-performing assets to total deposit ratio in initial

stage of research period because Nepal Rastra Bank has directed all the

commercial banks to have non-performing assets not to exceed 10% of total

assets. Higher non-performing assets to total assets show the low performance

of bank. Up to fiscal year 2069/70 of study period, the ratio is higher than

the average ratio. In 2071/72 and 2071/72, it seems to be good position because

the ratios are 0.06 and 0.05 respectively which are under the standard of NRB

directives. It is because of recovery of some of the non-performing loan

through new rules and regulations.

v.) Loan Loss provision to Total Loan and Advances Ratio

Table 4.17 is presented in figure also to show the bar

diagram of current ratio.

Source: Table 4.7

Loan loss provision to total loan and advance ratio of Nepal

Bank Limited for the study period of 2067/68 to 2071/72 is 1.17, 0.99, 1.00,

0.28 and 0.25 respectively. The trend of the total loan and advances is of

increasing one and the trend of loan loss provision to total loan indicates

that the bank has decreasing trend of non-performing loans. The average ratio

shows that in an average 73.8% of the total loan amount are provisioned against

it. The ratio in the study period is raised by NRB from 67% to 100%. The ratio

is higher than the average ratio in fiscal year 2067/68 to 2069/70 and in

fiscal year 2070/71 and 2071/72, the ratios are too much lower than average

ratio i.e. 0.28 and 0.25 respectively. According to the general standards. the

banks should make higher percentage of provision for the non-performing loan so

that the unnecessary burden of non-performing assets in the future is overcome.

Even though the total loan has decreased, the loan loss provision has increased

in the fiscal year 2067/68. Now in the recent years, the bank has been very

careful in sanctioning in the loan and advances with new rules and regulations,

so it may be he reasons behind decreasing the loan loss provision.

vi.) Non-Performing Assets to Total Loan & Advances

Ratio

Table 4.8

Non-Performing Assets and Total Loan

& Advances

Table 4.8 is presented in figure also to show the bar

diagram of current ratio.

Source: Table 4.8

Table 4.8 and Figure shows that the non performing assets to

total loan and advances ratio of Nepal Bank Limited in the above table, the ratios

are 0.58, 0.53, 0.50, 0.18 and 0.14 for fiscal year 2067/68 to 2071/72

respectively. The bank has 38.6%. For all years of the study period except

fiscal years 2070/71 and 2071/72, the ratio is higher than the average.

Theperformance and efficiency of the bank is better if this ratio is low. One

to four or fice percent non perforing assets are fined but when it exceeds that

limit, it's really worrisome. NRB has directed to all commercial banks that the

ratio of non-performing assets to total loan and advance should be about 5%.

But the ratio maintained by NBL. seems to be very much higher than the standard

directed by Nepal Rastra Bank. But the ratio has gone down in the later the

study period in contrast with the beginning which is a sign of progress in term

of total loan and advance.

vii.) Provision for Pass Loan to Total Pass Loan Ratio

Source: Annual Reports of NBL (Appendix – IV)

Table 4.9 is presented in figure also to show the bar

diagram of current ratio.

Source: Table 4.9

Table 4.9 and Figure 4.9 shows that the comparative analysis

of the provision for pass loan to total pass loan of Nepal Bank Limited for the

study period 2067/68 to 2071/72. The average ratio for the five year is 0.04

that means the bank has maintained a provision for pass loan at 4% of total

pass loan in the study period. As per the Nepal Rastra Bank directives, the

provision for pass loan should be 1% of total pass loan. For the first three

years, the bank has maintained it quite strictly as per the directives. But the

ratio has been increasing almost by one percent in the 2069/70 and 2071/72 and

then two percent in 2068/69 and 2071/72.

viii) Provision for Doubtful Debt to Total Doubtful Debt

Ratio

Table

4.10 is presented in figure also to show the bar diagram of current ratio.

Source: Table 4.10

Table 4.10 and Figure 4.10 shows that the provision for

doubtful debt to total doubtful debt of Nepal Bank Limited for the study period

of 2067/68 to 2071/72. By observing the above table, it can be concluded that

the bank has failed to maintain the given standard in 2066/67 but above the

standard in 2068/69, 2069/70 & 2070/71. The standard for the provision for

doubtful debt to total debt by NRB is at about 50%. The high amount of doubtful

debt and its provision is not good for the bank's performance. The bank has

maintained a provision for doubtful debt at 55% on an average over the study

period. And the trend of both the doubtful debt and doubtful debt provision are

clearly of decreasing. In the fiscal year 2069/70 the bank has minimum doubtful

debt and doubtful debt provision whose ratio is exact 50%, which is under NRB

standard.

ix.) Provision for Bad Debt (Loss) to Total Bad Debt Ratio

Source: Annual Reports of NBL (Appendix – IV)

Table 4.9 is presented in figure also to show the bar

diagram of current ratio.

Source: Table 4.9

Table 4.9 and Figure 4.9 shows that the comparative analysis

of the provision for pass loan to total pass loan of Nepal Bank Limited for the

study period 2067/68 to 2071/72. The average ratio for the five year is 0.04

that means the bank has maintained a provision for pass loan at 4% of total

pass loan in the study period. As per the Nepal Rastra Bank directives, the

provision for pass loan should be 1% of total pass loan. For the first three

years, the bank has maintained it quite strictly as per the directives. But the

ratio has been increasing almost by one percent in the 2069/70 and 2071/72 and

then two percent in 2068/69 and 2071/72.

viii) Provision for Doubtful Debt to Total Doubtful Debt

Ratio

Table 4.10 is presented in figure also to show the bar

diagram of current ratio.

Table 4.10 and Figure 4.10 shows that the provision for

doubtful debt to total doubtful debt of Nepal Bank Limited for the study period

of 2067/68 to 2071/72. By observing the above table, it can be concluded that

the bank has failed to maintain the given standard in 2066/67 but above the

standard in 2068/69, 2069/70 & 2070/71. The standard for the provision for

doubtful debt to total debt by NRB is at about 50%. The high amount of doubtful

debt and its provision is not good for the bank's performance. The bank has

maintained a provision for doubtful debt at 55% on an average over the study

period. And the trend of both the doubtful debt and doubtful debt provision are

clearly of decreasing. In the fiscal year 2069/70 the bank has minimum doubtful

debt and doubtful debt provision whose ratio is exact 50%, which is under NRB

standard.

ix.) Provision for Bad Debt (Loss) to Total Bad Debt Ratio

Table 4.11 is presented in figure also to show the bar

diagram of current ratio.

Table 4.11

Provision for Bad Debt and Total Bad

Debt

The ratio of provision for bad debt to total bad debt ratio

of Nepal Bank Limited for the study period of 2067/68 to 2071/72 are 0.97,

0.98, 1, 1 and 1 respectively. The average ratio for the study period is 0.99.

It means that only 99% of total debt has been kept for its provision on

average. As per the NRB directives, the provision for bad debt should be 100%

of total bad debt. The bank is not able to maintain that ratio of 100% in the

first two years. But from the fiscal year 2069/70, it has been able to maintain

the ratio as per NRB directives. Increase in the bad debt can be subjected to

the new classification of loan according to the NRB directives and increase in

provision can be subjected to the compliance of standard by making additional

provision in the succeeding years.

3. Profitability Ratios

A company should earn profit to survive and to grow over a

long period of time. It is the difference between revenues and expenses over a

period of time. It shows the overall efficiency of the business concern. The

following ratios are calculated under the profitability ratios:

i.) Interest Income to Loan and Advances and Investment

Ratio

Table 4.12

Table 4.12 is presented in figure also to show the bar

diagram of current ratio.

Figure 4.12

Source: Table 4.12

The average ratio of interest income on loan in subject to

loan and advance and investment of NBL is 8.8%. It means that the bank is

earning the interest in credit and investment on average of 8.8% in five years

period. The year wise income for the study period of 2067/68 to 2071/72 is

0.11, 0.09, 0.09, 0.08 and 0.07 respectively. Viewing above ratios, the earning

ratio is higher in the initial years of study period than in the following

years. From fiscal year 2070/71, it is in decreasing trend. To have the high

profitability position of bank, there should be high interest income ratio.

ii.) Interest Expenses to Total Expenses Ratio

Table 4.13 is presented in figure also to show the bar

diagram of current ratio.

Table: 4.13

Higher

the ratio of interest expenses to total expenses, the more interest bearing

deposit that the bank has. Reviewing interest expenses to total expenses ratio

table of Nepal Bank Limited for the study period of 2067/68 to 2071/72, average

ratio for five years is 0.34 which means on an average NBL is maintaining the

level of interest expenses to 34%. The rations of NBL are in decreasing order

in the study period. From fiscal year 2068/69, the ratio is in constant and

position. The ratios are substantially lower than the average in the last three

years. This clearly means that the efforts by the bank are towards reducing the

interest bearing deposit.

iii) Interest Expenses to Interest Income Ratio

Source: Table 4.14

Analyzing

the above table and figure, the ratio of interest expenses to interest income

of Nepal Bank Limited are 0.70, 0.60, 0.40 and 0.40 respectively for the study

period of 2067/68 to 2071/72. The average ratio is 0.50 meaning that out of

total interest income, 50% is taken by interest expenses. High level of this

ratio shows that bank has to bear high interest expenses out of interest income.

In the first two years of study period, the bank has bared h igh amount of

interest expenses. In the fiscal year 2067/68 interest expenses is more than

interest income whose ratio is 170%. But after fiscal year 2067/68, it is in

decreasing trend and remained constant from the year 2069/70S.

iv.) Return of Equity Ratio

Table

4.15 and figure 4.15 shows that the ratio of net profit after tax and net worth

as return on equity of Nepal Bank Limited, for the financial year 2067/68 to

2071/72 shows that the situation of return on equity s poorer. The ratio was

positive in first years of study period. But both net profit after tax amount

and Net worth amount are in negative value. The amount of net profit after tax

has been reduced hugely in the year 2071/72 which has made its ratio -0.15. The

average ratio is -0.23 that means loss is higher in the fiscal year 2068/69 to

2070/71.

v.) Return on Total Assets Ratio

Table

4.16 is presented in figure also to show the bar diagram of current ratio.

Figure 4.16

Source:

Table 4.16

Nepal

Bank has very poor performance in term of profitability viewing the return on

total assets ratios for the study period 2067/68 to 2071/72. Return on total

assets ratio s negative in first years. That means loss is higher in the fiscal

year 2067/68. But during the later of the study period, the bank is able to

earn some little profit through and so that the ratio s in positive trend. The

average ratio of return on total assets for the study period is 0.006 meaning

that the bank is in profit of 0.6% on average. This indicates that the bank is

not being able to manage the assets in efficient way. The reduction of total

assets in 2069/70 has risen in the fiscal year 2070/71.

vi.) Return on Net Loan and Advance

Table

4.17 is presented in figure also to show the bar diagram of current ratio.

Return

on Net Loan and Advance of Nepal Bank Limited are -0.32, 0.08, 0.21, 0.14 and

0.02 respectively for the study period of 2067/68 to 2071/72. The average ratio

for the study period is 0.03. That means the bank's return on net loan and

advance is positive with 3% in the five years period. The trend of net loan and

advance is decreasing in the 2069/70 but increasing remaining year. The higher

the positive ratio. the better bank's profitability is. After analyzing this

table, we can conclude that NBL has low performance in terms of return on loan

and advance except fiscal year 2066/67 and 2071/72.

vii.) Earning per Share

Figure 4.18

Earning Per Shares

Source:

Table 4.18

Table

and Figure 4.18 shows that the earning per share of Nepal Bank Limited for the

study period is Rs. 211.4. EPS in the first year of study period is zero. The

ratio is higher than the average in fiscal year 2069/70 and 2070/71. But in

fiscal years 2071/72, the net profit has declined so much so the earning per

share has also reduced highly. This indicates that the bank is not being able

to raise capital through the issuance of equity share. At present, the shares

of Nepal Bank Limited are not listed in stock exchange. NRB has restricted the

listing of shares in stock market as it has negative net worth presently.

Despite all these drawbacks; the positive earning per share can be regarded as

an indication of good performance.

4.3 Statistical Analysis

4.3.1 Coefficient of Correlation Analysis

The

statistical tool, coefficient of correlation has been studied to find out

whether the two available variables are inter-correlated or not. If the result

falls with in the correlated point, the two variables are inter-correlated

otherwise not. Now to find out the correlation coefficient between total

lending and total assets, the widely used method of Karl Pearson's Coefficient

of Correlation has been adopted.

Where,

N

= Number of pairs of X and Y observed

X

= Values of first type of variable

Y

= Value of second type of variable

r

= Karl Pearson's Coefficient of Correlation

i.) Computation of Correlation Coefficient of Non Performing

Assets and Total Loan

Here,

Non Performing Assets = X1

Total Loan = X2

Table 4.19

Correlation Coefficient of Non Performing Assets and Total

Loan

The correlation coefficient and probable error between

non-performing assets and total loan in NBL remained 0.99 and 0.006

respectively. Since R is more than +0.5, but less than 6 times of probable

error i.e. 0.99<6×0.006. It indicates that there was negative correlation

between non performing assets and total loan. This means there is not much

decreasing of non-performing assets with respect to the decrease in the total

loan.

ii.)

Computation of Correlation Coefficient of Total Loan and Total Assets

Here,

Total Loan = X1

Total Assets X2

Table

4.20

Correlation

Coefficient to Total Loan and Total Assets

The

correlation coefficient and probable error between total loan and total assets

in Nepal Bank Limited remained 0.69 and 0.16 respectively. Since r is more than

+0.5, and more than 6 time of probable error i.e. 0.69 < 6 × 0.16. It

indicates that there was significant correlation between total loan and total

assets. In other words, the total loan and total assets of Nepal Bank Limited

in the study period of 2066/67 to 2070/71 are significantly correlated.

4.4 Major Findings of the Study

·

At the time of financial

reengineering process of Nepal Bank Limited, Loan investment policy has been

brought. New policy of lending focuses on cash flow lending by passing out

collateral based lending.

·

The Credit Information Bureau was

established in 1989 AD. Nepal Rastra Bank started to control the financial

institutions with strengthening the supervision and monitoring system.

·

Liquidity position of Nepal Bank

Limited seems strong. It is obvious that in the present situation of the

country, investment potential is not favorable, so the liquidity is sufficient in

the bank.

·

Under the structural Adjustment Programmed,

of the IMF, the financial sector was further liberalized in 1987. The focus of

Nepal Rastra l3ank was placed on indirect monetary control.

·

Most of the banks of Nepal now days

are focusing on consumer lending. Nepal Bank Limited is also falls on the same

category. This is because of load shading. Industrial development in Nepal is

not good due to load shading at this time. So it has directly affected the

lending policy of commercial banks.

·

Nepal Bank Limited has invested

money in growing credit and advances hut the recovery Process of the bank is slow.

Efficiency in the management is not satisfactory.

·

Most of the credit customers of

Nepal Bank Limited are satisfied with the banks. Customers said that the main

strength of Nepal Bank Limited is its lending interest rate In the comparison

of other banks, the lending rate of Nepal Bank Limited is found low Due to

Which customers are interested to borrow loan from Nepal Bank Limited.

·

The non performing assets with

respect to total assets of Nepal Bank Limit with high volume i.e. 0.156.

·

The EPS of Nepal Bank Limited was

negative as it has huge loss in fiscal year 2067/68. From fiscal Year 2068/69,

the EPS is positive which is on the average of Rs. 211.

·

At the time of re-engineering

process, the bank was able to make large amount of profit as management got

foçus on recovery of bad loans. The bank incurred loss for the first three

fiscal years of the study period. From fiscal year 2068/69, it has started to

make profit and made high profit in 2067/68 and 2069/70 with Rs.8127 m. and

Rs.8178 m. in 207 1/72, the profit was limited to Rs. 1809 m. only.

·

The trend of deposit utilization of

Nepal Bank Limited is found very poor. During the study period, loan, advance

& investment to total deposit ratios of Nepal Bank Limited was 62.4%.

·

Nepal Bank Limited operates as full

fledged commercial bank. The bank is providing services to clients such as

credit and advances, consortium finance, working capital credit, term credit,

demand credit, trade finance, hire purchase credit, letter of credit, bills purchase,

bank guarantee and others.

·

The bank is in the phase of

computerization. About 50% of branches have been already computerized and rest

branches arc in the process of computerization. The bank has already started

Web Remit, Any Branch Banking etc. and is preparing for the installation of

Automatic Teller Machine.

·

By analyzing the market demand and

trend. Nepal Bank Limited has brought retail banking facilities like Home Loan,

Margin 1.ending whose market performance at present seems satisfactory.

·

For effective liquidity management

and Customer’s Service, Nepal Rank Limited has been making great effort for the

development and empowerment of employees by conducting various training related

w liquidity management and customer service so that they could provide the best

services to the customers as well as credit risk could be reduce.

Nice one

ReplyDeletegood

ReplyDeleteGood work

ReplyDelete