Accounting for

Professional person

Concept

Any type of job that needs

special training or a particular skill, such as being a doctor or lawyer or

character accountant, but not work in business or industry is called

"profession". But it is something a little more than a job. Actually,

it is a vocation founded upon specialized high.

Similarly, a person who is

competent or skilled in a particular activity as well as formally certified by

a professional body of belong we to a specific profession, is called

'professional person."

The professional person i.e.

doctors, engineers, lawyers, chartered account IT professional, etc. are

engaged in income generation activities, therefore, they have to maintain their

books of account properly adopting double entry systems. On the basis of their

books of account, surplus from their professional income can be determined for

income tax purpose, because professional persons should pay income tax on their

net income. Accounting for professional person is needed for income tax

purposes.

Techniques in General Account for profession

The professional services

field is a broad one. It includes doctors, lawyers, architects, engineers and

consultants. Their services have some unique challenges with multiple clients

and various different ways of billing keeping track of income and expense can

be hard.

Accounts of a profession are

prepared using cash basis of account not the accrual basis of accounting; cash

basis of accounting does not recognize income receivable because it is

uncertain. It does not treat receivable as income. Generally, financial

statements of a profession is prepared to ascertain surplus or deficiency

(profit or loss), and closing balance of cash. Accounts of a profession

include:

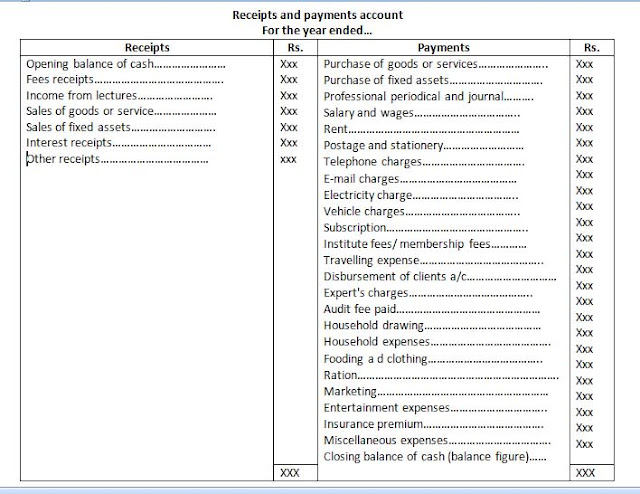

Receipts and payments account

Receipt and payments account

is the summary of cash receipts and cash payments of a profession for a certain

period. It is prepared at the end of accounting period. All cash receipts are recorded

on the debit side and all cash payments are recorded are recorded on the credit

side of this account. Therefore receipt and payment account is kind of cash

book on which credit and outstanding transactions are not and payment account

is a kind of cash book on which credit and outstanding transactions are not

recorded.

The following are the main

feature of receipt and payment account:

- It is a real account.

- It starts with opening balance of cash and bank on its debit side.

- It is just like a cash book.

- All cash receipts are shown on its debit side.

- All cash payments are shown on its credit side.

- It includes all capital and revenue cash receipts and cash payments.

- It includes all cash receipts and cash payments last year and next year in additions to currents year.

- It does not included outstanding expenses and accrued incomes.

- It does not include on cash expenses such as depreciation, provision for bad debts, etc.

- The balancing figure of this account on credit side is called closing balance of cash.

The following format is used

to prepare this account:

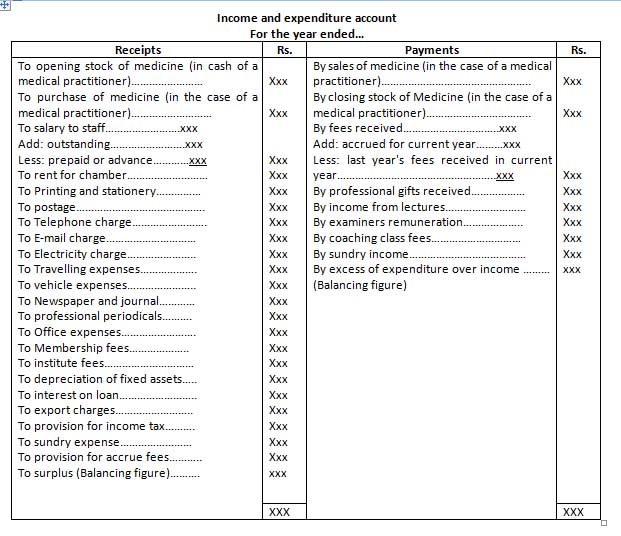

Income and expenditure account

Income and expenditure

account of profession is prepared in place of profit and loss account to known

the position of surplus or deficit. This account shows all revenue income and

losses on its debit side. Similarly, all revenue expenditures and gains are shown

on its credit side. If the total of credit side is ore, the balancing figure on

debit side is called surplus or excess of income over expenditure. It's just

opposite, if the total of debit side is more than its credit side, the

balancing figure on credit side is called deficit or excess of expenditure over

income. This account does not include capital income and expenditures.

Outstanding expenses of the current year are added to concerned expenses and

are shown on debit of this account; similarly, accrued incomes of this year are

added to concerned incomes and are shown on credit of this account. This account

showed only the income and expenses of the current year.

The following are the

features of this account.

- It is a nominal account.

- It is just a profit and losses Account.

- Revenue expenditure and losses are shown on its debit side.

- Revenue incomes and gains on its credit side.

- It included only the incomes and expenditure of current year.

- It does not include income and expenditures of last year and next year.

- It shows paid and unpaid both expenditures of the current year on its debit side.

- It shows both received and not received incomes of current year on its credit side. But due to the uncertainly of accrued income in profession, such accrued incomes should also be shown on debit side as provision for accrued income.

- It does not include capital incomes and expenditures.

- Non cash expenditures like depreciation, provision for bad debts, etc. are shown on its debit side.

- It credit side is more, the balancing figure on debit side is called 'surplus' or 'excess of income over expenditures'. But If debit side is heavy, the balancing figures on credit side is called 'deficit' or 'excess of expenditure over income'.

A professional person can

prepare income and expenditure account of his/her profession including all his

professional incomes and expenditures. Similarly, he/she can also prepare

household income and expenditure account including all household incomes and

expenditures.

Profit and loss account

Profit and loss account of

profession is prepared using the same rules of its income and expenditures

account. This account shows all revenue incomes and gains of profession on its

credit side. Similarly, this account shows all revenue expenditures and losses

of profession on its debit side. If credit side of this account is more, the

balancing figure on debit side is called net profit. But if debit side of this

account is more, the balancing figure on credit is called net loss. It does not

include capital incomes and expenditures. Only current year revenue items are

shown in profit and loss account. It does not include revenue items of next

year and year. In other words, it is prepared as a substitute of income and

expenditure account. A professional person prepares this account to depict net

profit or net loss from profession. The main features of profit and lossaccount of profession are as follows:

- It is a nominal account.

- All the revenues expenses and losses are shown on the debit side of profit and loss account.

- All the revenue incomes and gains are shown on the credit side.

- The income and expenses pertaining to only current year are recorded in it.

- All the items of income and expenditures which are pertaining to previous years and feature years are not recorded in it.

- The outstanding expenses for the year are added to related items and debited to profit and loss account.

- The accrued income for the year are added to related items and credited to profit and loss account.

- The accrued income for the profession may be receivable or not in future. So provision for accrued incomes for the profession is debited to profit and loss account.

- The items of capital income and expenditures are not included on it.

- All the non-cash items (i.e. depreciation, bad debts, provision for doubtful debts, etc.) are taken into account.

- It is prepared on an accrued basis.

- The closing the debit side, there is net profit. On the other hand, if the debit side exceeds the credit side, there it net loss.

The specimen of profit and

loss account is as follows:

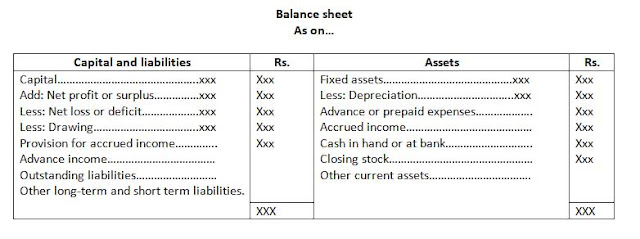

Balance sheet

Balance sheet is prepared to

exhibit the financial position of the profession at the end of the accounting

period capital and liabilities are shown on its left side while assets are

shown on its right side. In the balance sheet of profession, net as per profit

loss account or surpluses as per income and expenditure account is added to

capital and shown on the capital and liabilities side. But if there is net loss

in profit and loss account or defect in income and expenditure account that

will be deducted from capital.

The main features of

professional balance sheet are follows:

- Balance sheet columns are headed by liabilities and assets.

- It shows the true picture of professional financial position.

- It is statement showing closing balance of real and personal position.

- It prepared after the preparation of revenue account (i.e. income and expenditure account or profit and loss account)

- The two side of the balance sheet must always equal.

- All the fixed assets (depreciated value), current assets, fictitious assets and wasting assets are shown on right hand side of the balance sheet.

- All the capital, reserve and surplus, net profit long-term and liabilities, current liabilities, and contingent of liabilities are shown on the left hand side of the balance sheet.

The specimen of professional

balance sheet is as follows:

Household cash statement

Household cash statement is

also known as household receipt and payment account or household cash book. It

included household cash incomes and household cash expenses only. It shows all

the items of household cash incomes on its sources or left side. The amount

expended from professional income for household expenses should also be shown

on this side. Similarly, all the household cash expenses are shown on used or

right side. Then after, total amount of household sources of cash and household

uses of cash are determined the difference of these two source and uses is

called household closing balance of cash.

Review of

Theoretical concepts

What is mean

by profession?

Any types of job that needs special training or a

particular skill, such as being a doctor or lawyer or chartered accountant, but

not work in business or industry, is called 'profession'. But it is a vocation

founded upon specialized high.

Similarly, a person who is competent or skilled in a

particular activity as well as formally certified by a professional body of

before we to a specific profession, is called 'professional person.

Explain any

five feature of receipts and payments account.

The following are the main features of receipt and

payment account:

- It is a real account.

- It starts with opening balance of cash and bank on its debit side.

- It is just like a cash book.

- All cash receipts are shown on its debit side.

- All cash payments are shown on its credit side.

Explain the

feature of income and expenditure account:

The following are the features of this account.

- It is a nominal account.

- It is just a profit and losses Account.

- Revenue expenditure and losses are shown on its debit side.

- Revenue incomes and gains on its credit side.

- It included only the incomes and expenditure of current year.

Thanks it is very helpful

ReplyDeleteGood post, for professional accounting and bookkeeping service, I recommend NR Doshi and Partners

ReplyDeleteIt is great and good post abd also, it is quite useful

ReplyDelete