Retirement of partner

Concept

A new partner

is admitted in the firm when such a need arises, the same way, a partner may

like to retire after giving due notice, in other words, a partner may wish to

withdraw from a firm for various reasons like old age, change in business

interest, on health grounds, mutual disputed, etc. such a situation, in a

partnership firm is called retirement of a partner means to leave the firm by a

partner due to certain reasons like old

age, ill health, etc. after the retirement of a partner existing partnership

comes to an end a new partnership comes into existence between the remaining

partners and it continues. A partner who leaves partnership firm is called a

retiring or outgoing partner.

A retiring

partner is entitle to claim his/her share of goodwill, share in the gain on

revaluation of assets and liabilities, share of undistributed profit, etc. the

total amount payable to a retiring partner is either paid out to him/her in

case or the same is transferred to a loan account in his/her name. it is also

possible that a part of the sum due to a retiring partner is paid in cash and

the balance is transferred to his/her loan account.

Adjustment at the time of retirement of Partner

Thus, on the

retirement of a partner various accounting adjustment became necessary to

calculate the current amount payable to retiring partners. These adjustments

are as under:

1. Calculation of new profit sharing ratio and gaining ratio

2. Revaluation of assets and liabilities

3. Adjustment regarding undistributed profit

4. Adjustment regarding goodwill after retirement

5. Adjustment regarding capital after retirement

6. Ascertainment of the due amount to the outgoing partner.

7. Mode of payment of retiring partner capital

8. Balance sheet of a new partnership firm

Calculation of new profit sharing ratio

When a partner

retires remaining partner continue the firm. In this situation, it is needed to

calculate new ratio of the remaining partners in the firm, which is called

"calculation of new profit sharing ratio". Generally, after the

retirement of a partner, the new profit sharing rations of remaining partners

exceed their old profit sharing ratios, and such increment in called

"Gaining ratio". In other words, gain in the new ratio as compared to

old ratio of remaining partners after the retirement of a partner is called

'gaining ratio'. The gaining ratio can be calculated by deducting old ratio of

remaining partners from the new one.

The following

situation can be found in the case of new profit sharing ratio:

- If new profit sharing ratio is not given

c. If new profit sharing ratio is given

a.

If new

profit sharing ration is not given: in this situation, it is assumed that

the remaining partners continue to share profit and losses in the old ratio

(i.e. no change is in the old ratio of remaining partners). In other words, the

new ratio of the remaining partners is called by striking out the share of the

retiring partners.

b.

If

gaining or benefit ratio is given: sometimes, remaining partners take over

the share of retiring partner in some specified proportions. In such case, the

share taken by the is added to their old share and the new ratio is calculated.

c.

If new

profit sharing ratio is given: in this situation, gaining ration is

calculated by deducting old ration from new rations.

Revaluation of assets and Liabilities

According to

the terms of the partnership deed, the value of all assets and liabilities are

revalued on the retirement of a partner. For this, a revaluation account or

profit and loss adjustment account is prepared in the same way as it is

prepared in case of admission of a new partner. The only difference is that in

case of retirement any profit or loss due to revaluation of assets and

liabilities is divided among all partners including the retiring one, while in

case of admission of new partner, such a new partner does not share profit or

loss on revalued assets and liabilities are shown in the new balance sheet of the

remaining partners. In this situation, the following entries are made:

Adjustment regarding undistributed profit

and loss

At the time of

retirement of a partner, if there is any undistributed profit such as any

reserve, credit balance of profit and loss account or any loss such as debit

balance of profit and loss account, then such undistributed profit or loss

should be distributed among all partner including retiring partner such

undistributed profit or loss should be distributed among all partners including

retiring partner on the basis of their new profit new sharing ratio. Generally,

two situations can be found regarding this:

a. By transferring total undistributed profits

or losses to all partner's capital account including retiring partners: in

this situation, such undistributed profit or losses are distributed among all

partners including retiring. Such undistributed profit or losses are

distributed among all partners including retiring one in their profit sharing

ratio and these are not shown again in the new balance sheet. The following

entries are made for this:

a. By transferring only he share of retiring

partner: in the situation, only the share of undistributed profit or losses

is transferred to retiring partner's capital account and the remaining balance

is continued in the new balance sheet. So far as the accounting treatment is

concerned, the following journal entries are passed in the books:

Adjustment regarding goodwill after

Retirement

When a partner

retires from the firm, he/she is entitled to his/her share of goodwill along

with share in the profit or losses. This necessitates the valuation of goodwill

at the time of retirement of a partner. Goodwill is valued in the same manner

as in the case of admission of a partner. As regards the accounting treatment

of goodwill, it shall depend upon whether goodwill account already exists in

the book or not. Thus, there may be two situations:

a. When goodwill does not appear in the books:

if the goodwill account does not exist in the books of account or balance

sheet of the firm at the time of retirement, then there will be following

possibilities.

- · Raising goodwill at its full value.

- · Raising goodwill and its immediate writing off.

- · Raising retiring partner's share of goodwill only.

- · Raising retiring partner's share of goodwill and its writing off.

- · Giving amount of goodwill to retiring partners without raising or recording in the books.

Raising goodwill at its full value: under

this possibility, the amount of goodwill is raised at its full value and

credited to all partners' capital accounts, including the retiring partner in

their old ratio. In the situation, the following entry is made:

Raising goodwill and its

immediate writing off: when goodwill is first raised to its full value and

then written off, then first of all, raised amount of goodwill is credited to

all partners' capital accounts including retiring partners in their old profit

sharing ratio. After that, raised value of goodwill is written off by debating

remaining partners' capital accounts and crediting goodwill account in their

account in their new profit sharing ratio. In this situation, the following two

entries are made:

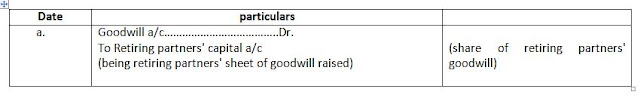

Raising retiring partner's share

of goodwill only: when goodwill account is raised with the retiring

partners' share only. Then such amount of goodwill is credited to that retiring

partner's capital account only. In this situation, that amount of goodwill is

again shown on the assets side of the new balance sheet.

Raising retiring partner's share

of goodwill and its writing off: under this, the share of goodwill of

retiring partner is determined and then credited to his/her capital account.

After that, remains partners decide to write goodwill and debited to their

capital accounts on the basis of their gaining ratio. In such a case, the

following two entries are made:

Giving amount of goodwill to

retiring partners without raising or recording in the books: when amount of

goodwill is paid to retiring partner without raising or recording it in the

books, then the remaining partners' capital account is debited in their gaining

ratio and the capital account of retiring partner is credited by share of value

amount of goodwill of retiring partner. In this situation, the following entry

is made:

When goodwill is shown in the

last balance sheet: sometimes, amount of goodwill appears in the balances

sheet at the time retirement of a partner. In this situation, amount of

goodwill is revalued and one of the following three situations can be seen:

a.

Increase in the value of goodwill

b.

Decrease in the value of goodwill

c.

No change in the value of goodwill

a. Increase in the value of goodwill: if

the agreed value of goodwill is more than the book value or given value of

goodwill, then the difference amount will be credited to all partners' capital

accounts in their old profit sharing ratio by debiting goodwill account. In

this situation, agreed value of goodwill is shown on the assets side of the new

balance sheet. In such a case, the following journal entry is recorded:

b. Decrease in the value of goodwill: when

the value of decrease i.e. agreed value of goodwill is less than the book

value, the capital accounts of all partners including retiring one are debited

with the difference in their profit sharing ratio by crediting amount. In this

situation, the following journal entry is made:

No change in the value of goodwill: if

the book value of goodwill is equal to the agreed value, then any entry will be

required in this situation.

Adjustment regarding capital after

retirement

After

retirement of a partner, remaining partners may adjust their capital. In this

situation, total capital of the firm can be fixed adjusting capital of

remaining partners after retirement of a partner. Such fixed total capital

should be divided among the remaining partners with their new profit sharing

ratio. After this, capital should be added or withdrawn accordingly. In this

situation, the following entries are made to add or withdraw the amount of

capital.

Ascertainment of the due amount to the

outgoing partner

The following

point should be considered while ascertaining the amount due to the retiring

patterns:

a.

Opening balance of capital and current account

of outgoing partner

b.

Share of profit or loss revaluation of assets

and liabilities

c.

Share of undistributed profit and loss

d.

Share of goodwill of the firm

e.

Share of profit earned by the firm on related

accounting period till the date of retirement

f.

Salary and interest on capital due to the

retiring partner till the date of his retirement

g.

The drawing from firm and interest thereon, of

the retiring partner

Mode of payment to the outgoing partners

On retirement of the partner, his/her capital account should be

adjusted by adjusting his/her share of goodwill, share on revaluation of assets

and liabilities and share on undistributed profits or losses. After that, the

amount payable to retiring partner is determined and procedure of payment is

following. For this, two modes of payment can be used:

a.

Lump sum payment

b.

Payment in installment

a. Lump sum payment: if the amount payable

to retiring partner is small, them lump sum payment is made to him/her. For

lump sum payment, form may use its cash or bank balance or additional capital

or loan can be taken from remaining partners. In this situation, the following

entries are made:

Installments payment: in most of the

cases, if may not be possible to repay the amount payable to retiring partner

immediately form the firm's recourse and also it may not be possible for

remaining partners to bring in cash as additional capital or loan. In this

situation, the amount due to retiring partner is transferred to his/her loan

account and repayment will be made in installment over a period of time with

fixed rate of interest. For this, the following entries are made:

Balance sheet of a new partnership firm

After retirement of a partner, remaining partners continue the

partnership business. Therefore, a new balance sheet of the firm is prepared by

considering the following points:

a.

After, adjusting goodwill, profit or loan on

revaluation, undistributed profit or loss, additional capital and repayment of

capital of retiring partner, only the capital accounts of remaining partner are

shown on the liabilities side of the new balance sheet.

b.

If retiring partners' capital account is

transferred to loan account, then such loan account will be shown on the

liabilities side of the new balance sheet.

c.

In the new balance sheet, revalued assets and

liabilities are shown.

d.

If a new assets or liability is created, then

such assets or liability will also be included in new balance sheet.

e.

New or adjusted goodwill is also shown on the

assets side of the balance sheet.

f.

Adjusted cash or bank balance is also shown on

the assets side of the new balance sheet.

Review of

Theoretical concept

Different ways in which a partner can

retire from the partnership firm.

A new partner

is admitted in the firm when such a need arises, the same way, a partner may

like to retire after giving due notice. In other words, a partner may which

wish to withdraw from a firm for various reasons like old age, change in

business interest, on health grounds, mutual disputes, etc. such a situation,

in a partnership firm is called retirement of a partner. Retirement of a

partner means to leave the firm by a partner due to certain reasons like old

ag, ill health etc.

Explain the made of payment of retiring

partners' capital.

On retirement

of the partner, his/her capital account should be adjusted by adjusting his/her

share of goodwill, share on revaluation of assets and liabilities and share on

undistributed profit or losses. After that the amount payable to retiring

partner is determined and procedure of payment is followed. For this tow modes

of payment can be used:

Lump sum payment: if the amount payable

to retiring partner is small, them lump sum payment is made to him/her. For

lump sum payment, form may use its cash or bank balance or additional capital

or loan can be taken from remaining partners. In this situation, the following

entries are made:

Installments payment: in most of the

cases, if may not be possible to repay the amount payable to retiring partner

immediately form the firm's recourse and also it may not be possible for

remaining partners to bring in cash as additional capital or loan. In this

situation, the amount due to retiring partner is transferred to his/her loan

account and repayment will be made in installment over a period of time with

fixed rate of interest. For this, the following entries are made:

0 comments:

Post a Comment