Accounting for debentures

Introduction

Thought share capital is a main source of finance of a joint stock company, the company need additional amount of money for meeting the long-term financial requirement. For this, it can raise loan from the public. The amount of loan can be divided into units of small denominations and the company can sell them to the public. Each unit is called a 'debenture' and holder of such units is called debenture holder. The amount so raised is loan for the company.

Meaning of debentures

A debenture is a written instrument that acknowledges a debt. It contains provisions as regard the repayment of principle along with a fixed rate of interest. It is issued under the seal of the company. It bears the public. The amount of loan can be divided into units of small denominations and the company can sell them the public. Each unit is called a 'debenture' and holder of such units is called debentures holder. The amount so raised is loan for the company.

Nepal company act, 2063 defines debentures as "the instrument issued by a company against mortgage or without mortgage of property."

Thus, debenture is a part of total capital of a company and debenture holders are the creditors. The rate of interest is pre-determined and stated in the certificate. The interest is payable irrespective of the printability.

Characteristics of debentures

Following are some of the notable characteristics of debentures.

Written promise: a debenture is a written promise in the form of certificate issued to the lender that states the payment of the value of loan along with the interest in a specified period of time.

Face value: A debenture has a fixed face value. It is generally Rs100 or Rs 1,000.

Fixed rate of interest: the rate of interest is fixed and paid every year. Hence, debenture is also known as fixed cost bearing capital.

Maturity period: debentures has specified period of time for redemption which is called maturity period.

Long term: it is form of long-term borrowed capital.

Common seal: it is issued against certain collateral as land, building equipment etc. however; it does not apply with unsecured debentures.

No voting right: the debenture holders do not bear voting right in the general meeting of a company.

Preference: the debentures get the first priority for the payment on liquidation or winding up of the company.

Importance of debentures

Issue of debentures is very importance in long-term financial planning and decision-making. In modern competitive business era, every company needs funds for business opportunity. Such need can be fulfilled only by issuing owner's capital and debt capital. The issue of debentures, in one side creates the obligation for the payment of interest at a fixed rate and in another side, it causes and increases in 'earning per share' due to decrease in number of share the following point's further highlight is importance:

i. Debenture serves as long term source of financing for a company.

ii. It is a low cost source of financing sine the interest to be paid to the debentures holderss is generally less than the dividend.

iii. The interest is subtracted from the taxable income. Hence, it reduces the tax burden.

iv. It provides way to leverage the capital structure of a company.

Difference between shares and debentures

The differences between shares and debentures are presented below:

Types of debentures

The major types of debentures are presented in the following figures.

On the basis of records

Registered debentures: these are the debentures that are registered with the company. The amount of such debentures is payable only to those debenture holders whose name appears in the register of the company.

Bearer debentures: these are the debentures which are not recorded in a register of the company. Such debentures are transferable merely by delivery. Holder of these debentures is entitled to get the interest.

On the basis of security

Secured or mortgage debentures: these are the debentures that they are secured by a charge on the assets of the company. These are also called mortgage debentures the holders of secured debentures have the right to record their principle amount with the unpaid amount amount of interest on such debentures out of the assets mortgaged by the company. In India, debentures must be secured. Secured debentures can be of two types:

Non-redeemable debentures: these are the debentures which are not redeemed in the life time of the company. Such debentures are paid back only when the company goes into liquidation.

On the basis of convertibility

Convertible debentures: these are the debentures that can be converted into shares of the company on the expiry of the pre-decided period. The term and conditions of conversion are generally announced at the time of issue of debentures.

Non-convertible debentures: ht debenture holder of such debentures cannot convert their debentures into shares of the company.

On the basis of priority

First debentures: these debentures are redeemed before other debentures.

Second debentures: these debentures are redeemed after the redemption of first debentures.

Accounting for issue of debentures

The procedure and accounting entries for issues of debentures are very much similar to that of shares. A prospectus is issued to the public for inviting applications. The money on debentures may be payable in full at a time along with application or by installments on application, allotment and various calls.

There are no legal restrictions on the price for which debentures are issued. Thus, a debenture may be issued at par, at premium or at a discount. They can be issued for cash, for consideration other these cash and as collated security as well as issue of debentures with redeemable conditions.

The different situations for debentures are as follows:

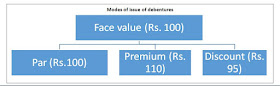

Modes of issue of debentures

There are three modes of issue of debentures. They have been mentioned below:

Issue of debentures at par: when a debenture is issued at its face value, it is called issue of debentures at par. If a debenture of Rs. 100 Is issued at Rs. 100, it is called the issue of debentures at par.

Issue of debentures at premium: A debenture is said to be issued at premium when the issue price exceeds the par value. If a debentures of Rs. 100 each is issued at Rs.110, then it is called issue of debentures at premium. The excess amount of Rs. 10 (Rs. 110- Rs. 100) is debentures premium.

Issue of debentures at discount: when a debenture is issued at an amount less than its face value, it is said to be issued at discount. If a debenture of Rs. 100 is issued at Rs. 95, it is said to have been issued at a discount of Rs.5.

Issue of debentures for cash

While issuing debentures for cash, the amount may be collected on lump sum basis or in total as shown below:

Issue of debentures at lump sum

If the total amount of debentures is collected in a single installment, it is said to be the issue of debentures at lump sum basis. The entries for the issue of debentures on lump.

Issue of debentures in installments

If the total amount of debentures is collected in different installment as application, allotment and calls, it is called issue in installments. The discount or premium on debenture issue in normally adjusted with the allotment. Hence, in the absence of specific information, they should be adjusted with allotment.

Issue of debentures for consideration other than cash

Sometimes debentures are issued for consideration other than cash. Normally, such issues are made for the purchase of assets or business form the vendor. Such issue is called as 'issue of debentures for consideration other than cash.'

Issue of debentures as collateral security

Collateral security means security given in addition to the principle security. It is a subsidiary or secondary insecurity. Whenever a company takes loan from bank or any financial institution it may issue its debentures as secondary security which is in addition to the principle security. Such an issue of debentures is known as 'issue of debenture as collateral security.' The lender will have a right over such debentures only when company fails to pay the loan amount and the principle security is exhausted. In case the need to exercise the right does not arise debentures will be returned back to the company. No interest is paid on the debentures issued as collateral security because company pays interest on loan.

Accounting treatment

In the accounting books of the company issue of debentures as collateral security can be credited in two ways.

First method: No journal entry to be made in the books of accounting of the company: debentures are issued as collateral security. A note of this fact is given on the liability side of the balance sheet under the heading security loans and advances.

Second method: Entry to be made in the books of account of the company: a journal entry is made on the issue of debentures of debentures as a collateral security. Debentures suspense account is debited because no cash is received for such issue.

Redemption of debentures

Debentures are the loan for a company. It is a liability and has to be paid at maturity period. Redemption of debentures of debentures means repayment of the amount of the debentures. Generally, it is discharged or paid at the expiry of the period, for which, it is originally issued. Normally, the time and period and mode of repayment are indicated in the prospectuses at the time of issue of debentures by a company.

Lump sum cash payment method

As mentioned above, debentures are generally issued for a specified period of time. After expiry of the period, the whole amount of debentures is paid back to the debentures holders at once in lump sum which is called redemption. It is also called redemption on maturity. The debentures may be redeemed at par, at a premium or at a discount, as previously.

Redemption by conversion

Conversion of debentures into shares will take place only in case of convertible debentures. Non-convertible debentures cannot be converted into shares as per the prescribed by the controller of capital issue. The conversion into shares may be optional or compulsory depending upon the terms at which convertible debentures has been issued. While converting the told debentures into shares or new debentures, the shares may be issued at par, at a premium or at discount.

No. of shares to be issued= amount payable to debenture holders/ net issued price per share= ……shares

No. of debentures to be issued= amount payable to debentures holders/ net issued price per debenture = …..Debentures

Redemption in installments

Under this method, the company redeems its debentures by payment each year of certain installment amount. The debentures may be selecting lottery system and this procedure is called redemption in installment or 'drawing by lot' method.

Redemption by purchase in the open market

The company can also redeem its debentures by purchasing own debentures in the open market. It can be done if the article of association of the company permits so. The company usually purchases its own debentures from the market when they are available in the market at a price, which is less than its par value and earns the amount of profit. The profit armed on cancellation of old debentures is transferred to 'capital reserve account.'

Interest on debentures and income tax

The company pays interest to the debentures hodlers. It is debentures to profit and loss account since it is expenditures of the company. Tax is charged against such interest. According to the tax act, the tax on interest has to be deducted at source i.e. the tax is deducted from the interest before paying to the debenture holders. Letter, the tax deducted is transferred to the revenue account of the government.

Define debentures is brief?

A debenture is a document issued under the seal of the company to acknledge the loan received. It bears the date of redemption and rate and mode payment of interest. Whole a company intends to raise the loan amount from the public, it issues debentures holder who is the creditor of the company.

Mention any five characteristics of debentures.

Following are some of the notable characteristics of debentures.

Written promise: A debenture is a written promise in the form of certificated issued to the lender that states the payment of the value of loan along with the interest in a specific period of time.

Face value: a debenture has a fixed face value. It is generally Rs. 100, or Rs. 1,000.

Rate of interest: the rate of interest is fixed and paid every year. So, it is also known as "fixed cost bearing capital."

Maturity period: debenture has specific period of time for redemption which is called maturity period.

Long term: it is a form of long-term borrowed capital.

Write any five different between shares and debentures.

The different between shares and debentures are presented below:

The share of a company provides ownership to the shareholder whereas the debentures are creditors of a company.

The person holding a share is knows as shareholder whereas the owner of debentures is known as debentures holders.

Shares can't be converted into debentures but debentures can be converted into shares.

Shareholders have the right to participate and vote in company's meeting which the debentures holders do not possess.

There is no certainly of returns on shares. However the rate of interest on debentures is fixed and is too paid even if there is no.

Classified the debentures on the basis of redemption.

On the basis of redemption, debentures can be classified into the following two groups as mentioned below.

Redeemable debentures: these debentures are issued for a fixed period. The principle amount of such debentures is paid off to the debenture holders on the expiry of such period.

Non-redeemable debentures: these are the debentures which are not redeemed in the life time of the company. Such debentures are paid back only when the company goes into liquidation.

Classified the debentures on the basis of convertibility.

On the basis of convertibility, denatures can be classified into the following two types.

Convertible debentures: these debentures can be converted into shares on the expiry of precised period. The term and condition of conversion are generally fixed at the time of issue of debentures.

Non-convertible debentures: the debentures holder of such debentures cannot convert their debentures into shares of the company.

What is a redeemable debenture? What are the different options to redeem debentures?

The debentures which are issued for a fixed period are called redeemable debentures. The principle amount of such debentures is paid off to the debentures holders on the expiry of such period. There are a number of options available for redemption of debentures. These are as follows:

Lump sum cash payment method: if the amount of debentures is paid back to the debentures holders at once in lump-sum, it is also called lump sum cash payment method.

Redemption by conversion: the debentures may be redeemed by converting them into new debentures or shares.

Redemption installments: under the method, the company redeemed its debentures by payment each year of a certain installment amount.

Redemption out of profit: this is a method of redemption of debentures from profit.

Redemption out of capital: under this method. The debentures are redeemed out of capital.

No comments:

Post a Comment