Reconciliation of profit between cost and financial accounts

Meaning and concept

Financial accounting is a branch of accounting that is primarily concerned with recording the financial transaction with a view to ascertain the result of operation condition. Under it, trading and profit and loss accounts are prepared to ascertain the result of business operation i.e. profit earned or loss suffered during a particular period of time. On the other hand, cost accounting is concerned with recording classifying, analysis and control of cost with the view of finding out the total cost of production. Under it, cost sheet is prepared to ascertain the profit made or loss suffered during a specific period of time.

When an organization has maintained both of these accounts, the profit or loss shown by them may not tally to each other due to some specific assumptions under them. Hence, it is necessary to find out the reasons of difference and adjust them accordingly for which, a statement is prepared called a cost recondition statement. Under it, the profit or loss shown by an account is ascertained by using the profit or loss shown by another account after adjustmenting the reasons of differences.

According to Eric L. Kohler, "reconciliation is the determining of the items necessary to bring the balances of two or more related account or statement into agreement."

As discussed earlier, reconciliation is necessary when the cost and financial accounts are maintained separately. It is not necessary where an integrated accounting system has been followed.

Need and importance of cost reconciliation statement

A bank reconciliation statement is prepared due to the following reasons.

• It helps checking the arithmetical accuracy of both set of account.

• It helps in finding out the reasons for the differences in profit or losses as shown by the accounts.

• It promotes coordination between cost and financial accounting department.

• It helps in formulation of polices regarding overheads, depreciation and stock valuation.

• It assists the management in decision making.

Causes or reasons for differences in profit or loss

The main reason of difference in profit between cost and financial accounts are as follows:

Items shown only in financial accounts

There are some items which are shown in financial accounts only. These items cause the difference in profit between the financial and cost accounting. The following are the items which are shown in financial accounts only.

Items shown only in cost account

There are some items which are shown in cost account only. These items are not shown in financial account. They are:

Over and under absorption of overhead

If there are difference between the overhead shown by the financial account and cost account, there cause in the difference in profit as shown by these accounts. Factory expenses, administrative expenses selling and distributions expenses comprise the overhead cost.

The effect of over or under absorption of overhead to profit is show in the following way.

Difference in stock valuation

If there is difference in the method of stock valuation between the financial and cost accounting, it results in the difference in profit as well. Under cost accounting, the stock valuation is done according to the cost price whereas in financial accounting it is done in cost or market price whichever is less. The profit shown by their accounts may differ due to this.

The effect stock valuation on profit is shown in the following table.

Difference in method of charging depreciation

In cost accounts depreciation is calculated on the basis of production unit or machine hour's method. In financial accounts, depreciation is generally charged on the basis of straight-line method or written down value method. Such difference in the method of charging depreciation causes disagreement in profit between cost and financial accounts. Overhead of depreciation indicates high cost resulting in low profit and under charge of depreciation indicates low cost resulting in higher profit. This has been shown below:

Preparation of cost reconciliation statement

The following steps are to be followed in preparation of bank reconciliation statement.

Step 1: in the first stage, the profit or loss shown by either cost or financial account account should be motioned as:

• Net profit as per cost account

• Net profit as per financial account

• Net loss as per cost account

• Net loss as per financial account Net profit as per cost account

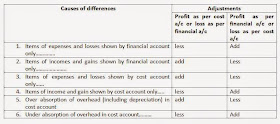

Step 2: in the stage, the reasons of difference between the profit as per cost and financial accounts should be ascertained. Some of the reason of difference and their effects on profit have been shown below:

1. What do you mean by cost reconciliation?

The process of preparations of a statement in funding profit-loss of one accounting (statement) method on the basis of another accounting (statement) method is known as cost reconciliation. It is also known as the reconciliation between the cost and financial account. Cost accounting is prepared by cost accounting department where as financial accounting is prepared by financial accounting department.

The profit and loss obtained form both accounts may be different not because of error in system but because of the difference in producers and principle followed by their accounts. Thus, it is necessary to reconcile the profit between these two accounts.

2. When any the objectives of preparing cost-reconciliation statement.

The main objectives of preparing cost reconciliation statement are:

a. To check arithmetical accuracy and reliability of both accounting.

b. To co-ordinate between cost and financial accounting department.

c. To help in formulation policy regarding overhead depreciation and stock valuation.

3. Write any three causes of difference in profit and loss shown by cost and financial account.

The causes of differences in profit and loss shown by cost and financial account are as follows:

a. Items shown only in financial account and cost accounts only.

b. Over absorption and under absorption of overheads

c. Difference in stock valuation and in the method of charging depreciation.

4. List out the points which are shown only in financial account?

there are certain items which are shown only in financial account:

a. Interest on investment

b. Income tax

c. Profit or loss sales assets.

The process of preparations of a statement in funding profit-loss of one accounting (statement) method on the basis of another accounting (statement) method is known as cost reconciliation. It is also known as the reconciliation between the cost and financial account. Cost accounting is prepared by cost accounting department where as financial accounting is prepared by financial accounting department.

The profit and loss obtained form both accounts may be different not because of error in system but because of the difference in producers and principle followed by their accounts. Thus, it is necessary to reconcile the profit between these two accounts.

2. When any the objectives of preparing cost-reconciliation statement.

The main objectives of preparing cost reconciliation statement are:

a. To check arithmetical accuracy and reliability of both accounting.

b. To co-ordinate between cost and financial accounting department.

c. To help in formulation policy regarding overhead depreciation and stock valuation.

3. Write any three causes of difference in profit and loss shown by cost and financial account.

The causes of differences in profit and loss shown by cost and financial account are as follows:

a. Items shown only in financial account and cost accounts only.

b. Over absorption and under absorption of overheads

c. Difference in stock valuation and in the method of charging depreciation.

4. List out the points which are shown only in financial account?

there are certain items which are shown only in financial account:

a. Interest on investment

b. Income tax

c. Profit or loss sales assets.

I might want congrats to all the victor for this incredible achivment. I can see the wide grin which is a major accomplishment for parents.So in exposition composing best and blunder free written work is fundamental necessity and i prefer to visit https://www.accountingassignmenthelp.net/professional-managerial-accounting-help-for-college-students/ that's good for all of us.

ReplyDelete